"A robust strategy is a simple and logical one that makes money in market conditions it is designed for and loses or breaks even in market conditions it's not."

Robust strategies perform well despite market changes because their simplicity prevents overfitting to historical data.

Backtesting Dangers

Beginners often make critical mistakes by stacking multiple indicators and optimizing parameters until achieving "perfect" backtests on lower timeframes. They continue 'improving' their strategy until they achieve a 100% win rate.

However, strategies exhibiting suspiciously perfect results typically fail in live trading. "When experienced traders encounter a backtest that is too good, they ask themselves what they've overfitted, whereas beginners wonder which Lamborghini they will order."

Core Robustness Criteria

The article identifies several indicators of strategy robustness:

- Can it be described in simple and logical terms?

- Can you answer why it makes money?

- Is it profitable across multiple coins?

- Does it have a wide range of profitable parameters?

- Is it profitable on various timeframes?

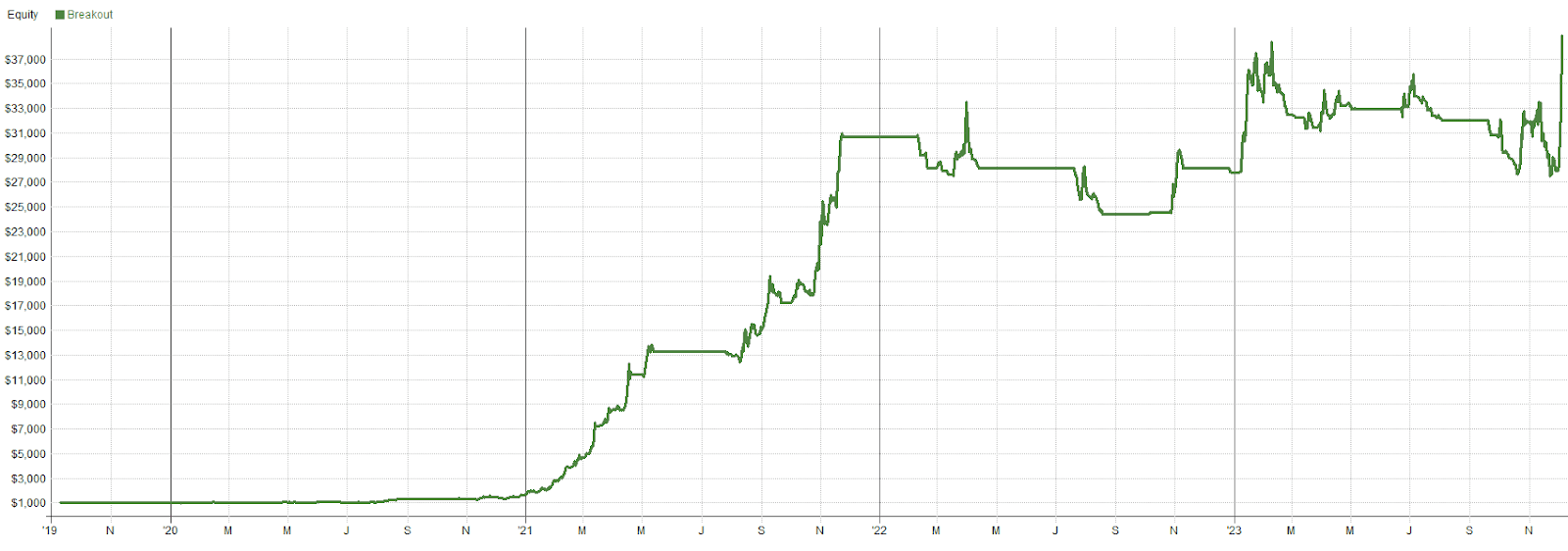

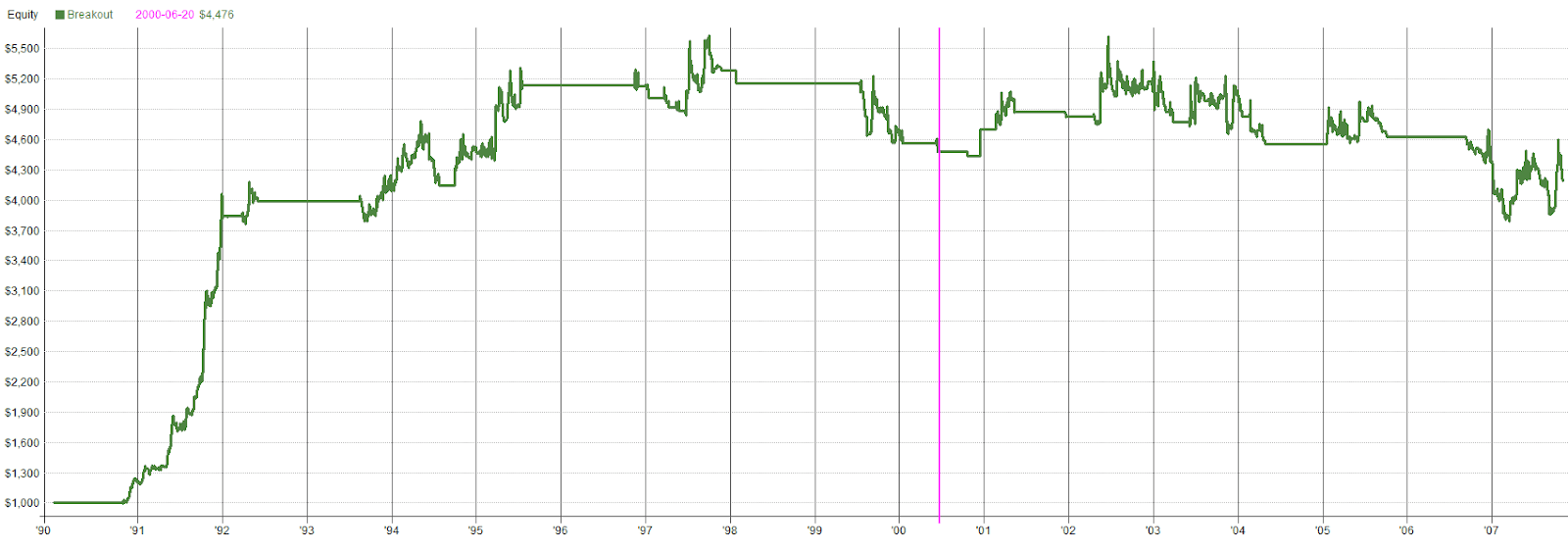

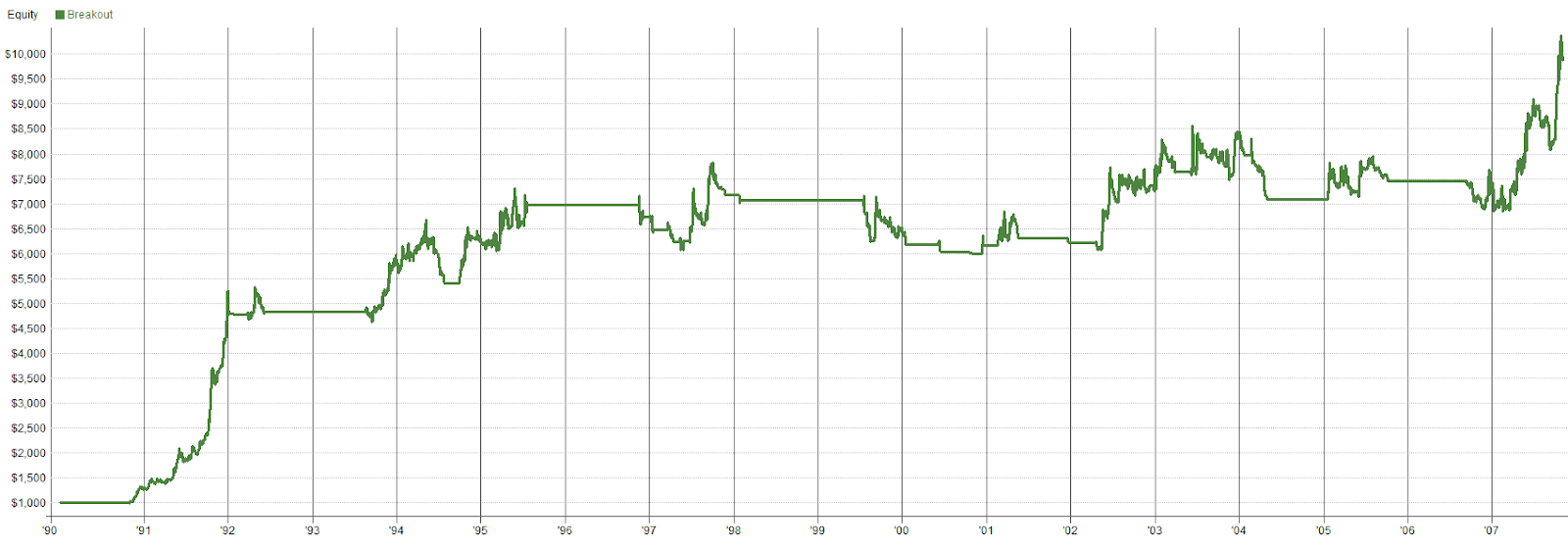

Case Study: Breakout Trading Strategy

Let's present a simple breakout strategy with these rules:

Entry: The highest high of the last 30 days, with BTC above its MA50 as a regime filter.

Exit: After 3 days at the close.

Testing across multiple coins demonstrates consistent profitability. The strategy "works on multiple coins" and performs well during bull markets, though it experiences whipsaws during false breakouts in sideways markets.

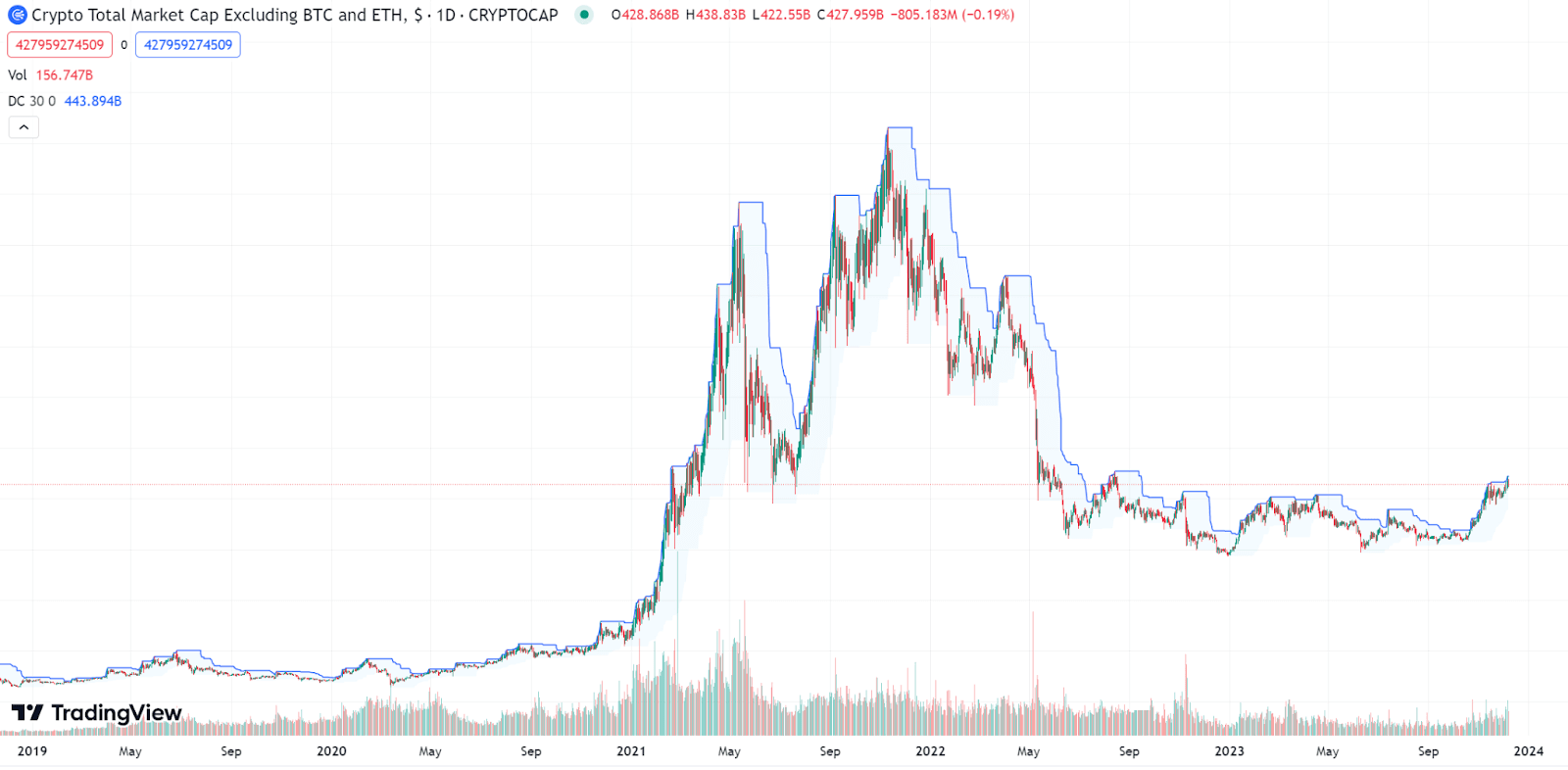

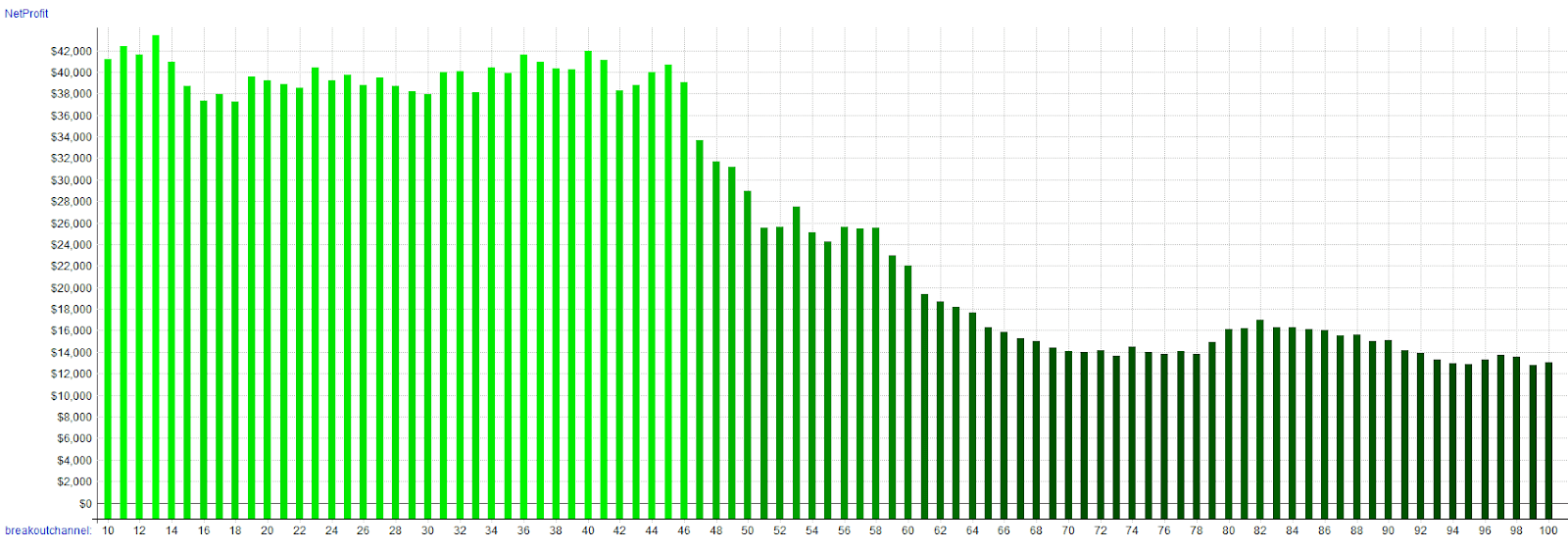

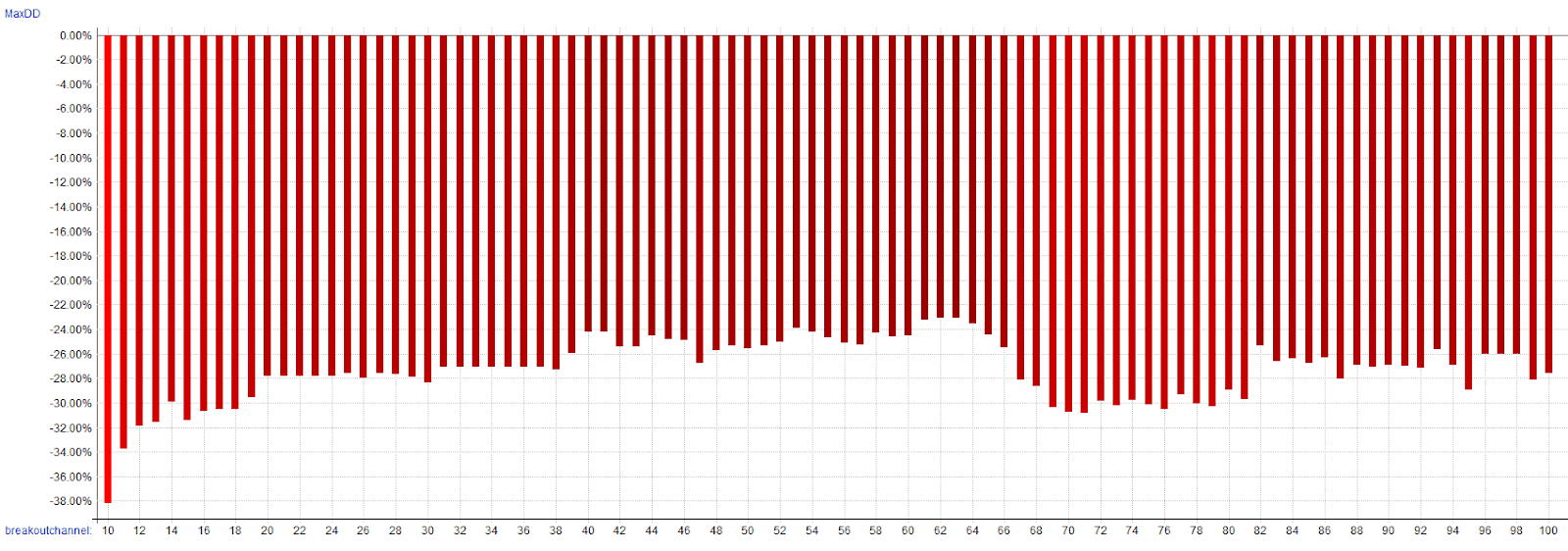

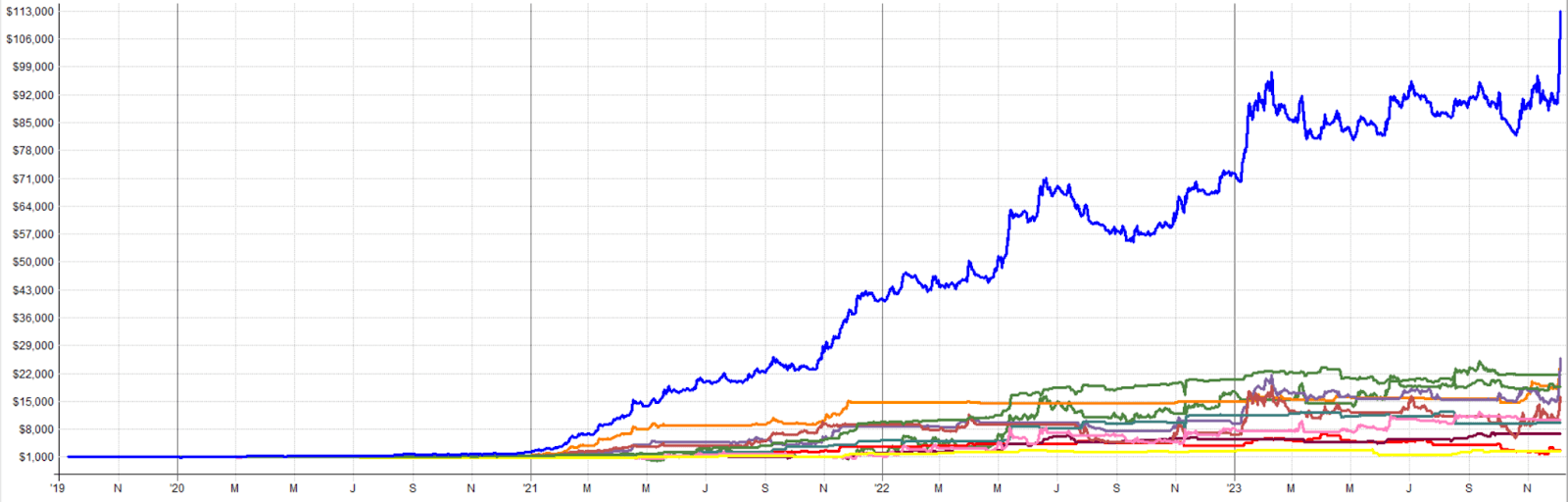

Parameter Range Testing

We test breakout periods from 10 to 100 days, finding that "all channel high parameters were profitable, from the 10-day breakout to the 100-day breakout, with 30 days being around the midpoint."

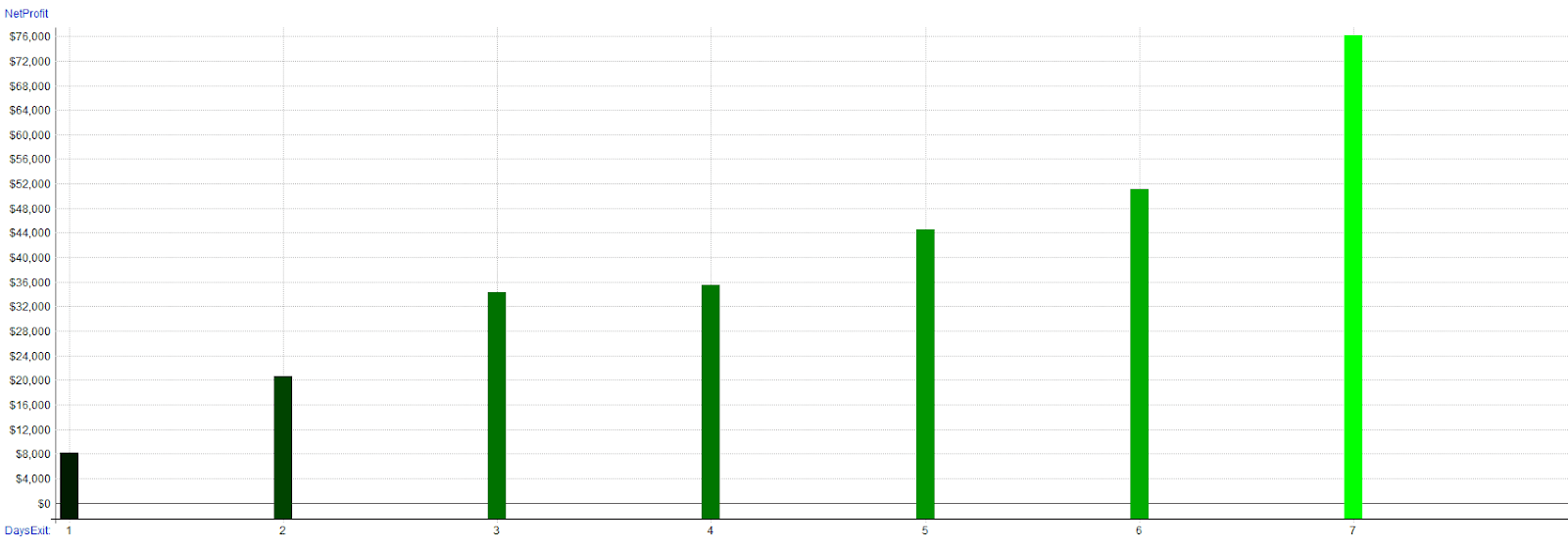

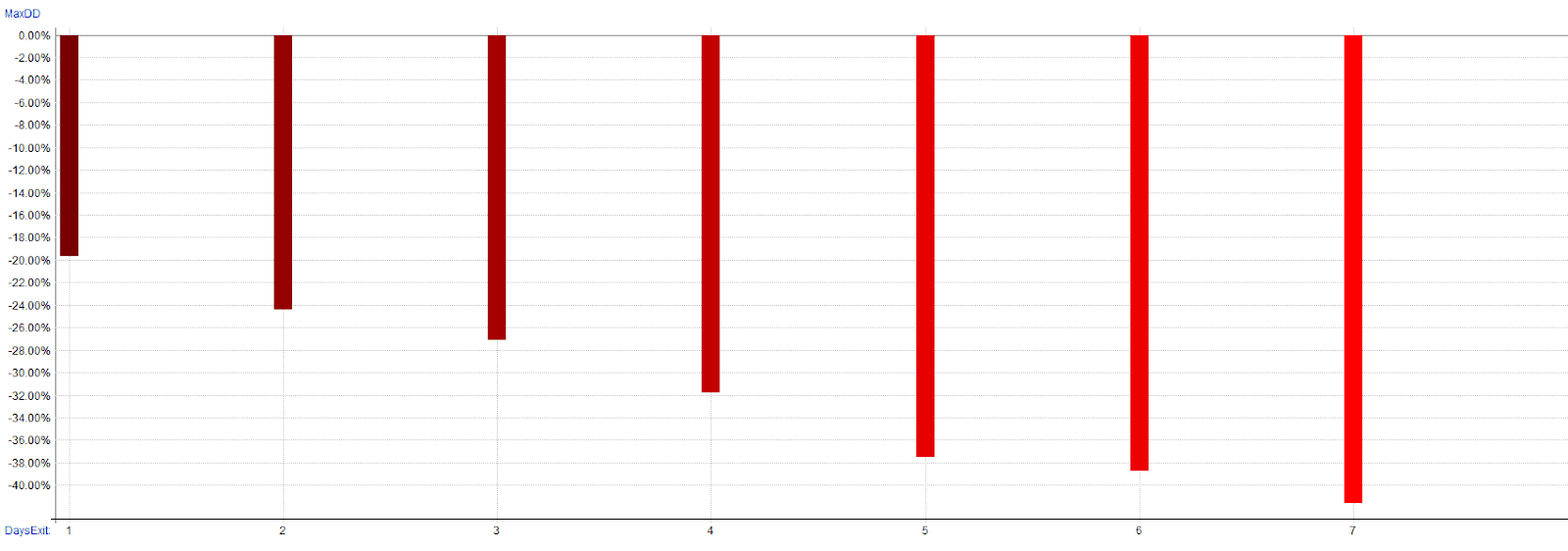

Exit periods ranging from 1 to 7 days show that longer holding periods increase profitability with corresponding increases in drawdown.

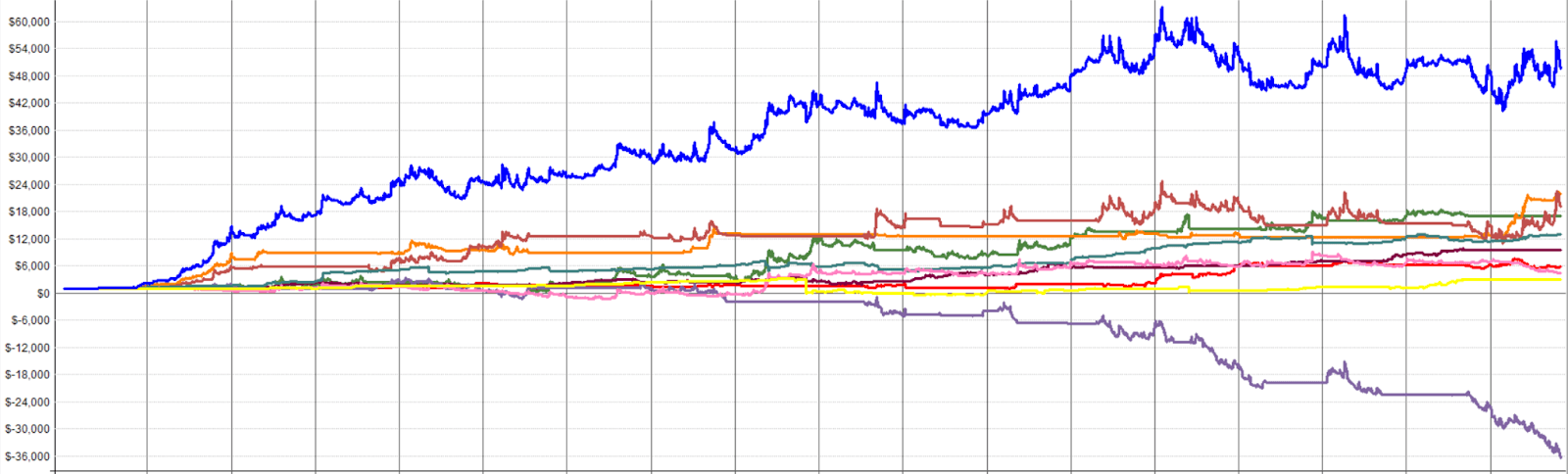

Timeframe Testing

Testing the same strategy on 4-hour candles with adjusted parameters (300MA instead of 50MA) yields stable results, confirming the strategy's robustness across different timeframes.

Portfolio-Level Robustness

Even within a diversified portfolio of uncorrelated strategies, individual strategy failures don't significantly impact overall performance, as "one failing strategy isn't a big deal at all."

Key Lessons

Given the limited historical data in crypto, strategies must be extremely simple and logical. Anything more complex is likely to fail.

Stay away from low timeframes, stay away from the optimizers. Start with an idea first, something you observe in the market and then try to explain it with simple terms.

Resist the temptation to tweak your strategy to avoid some bad trades or to include some exceptions so you would not have missed a good trade. This will always lead to overfitting.

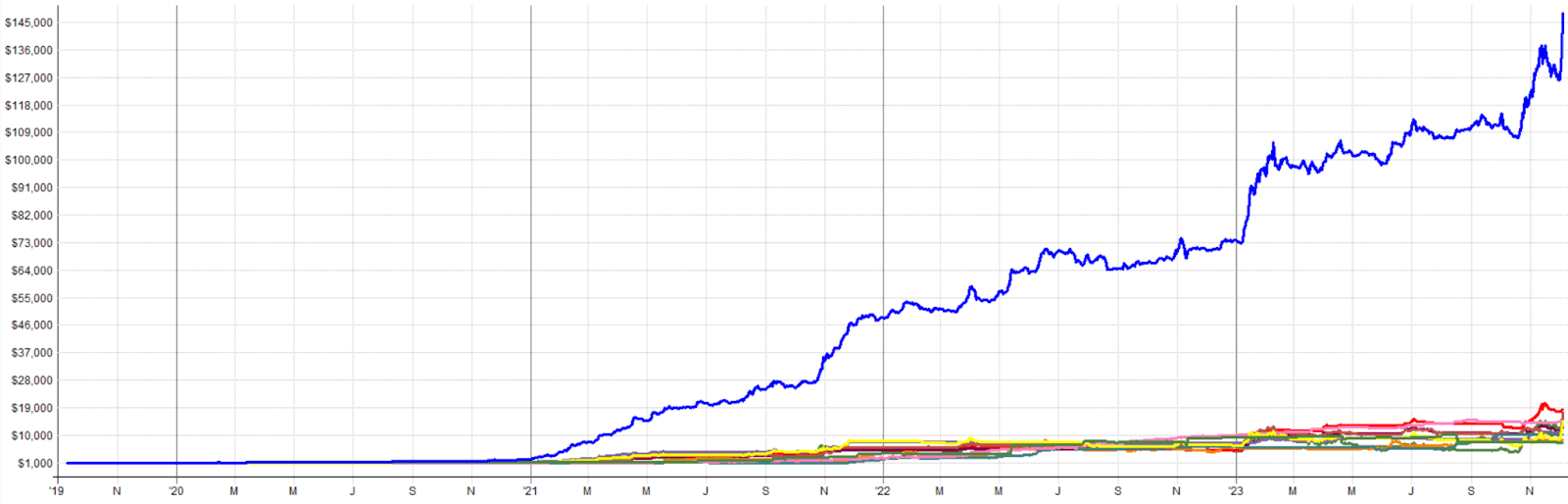

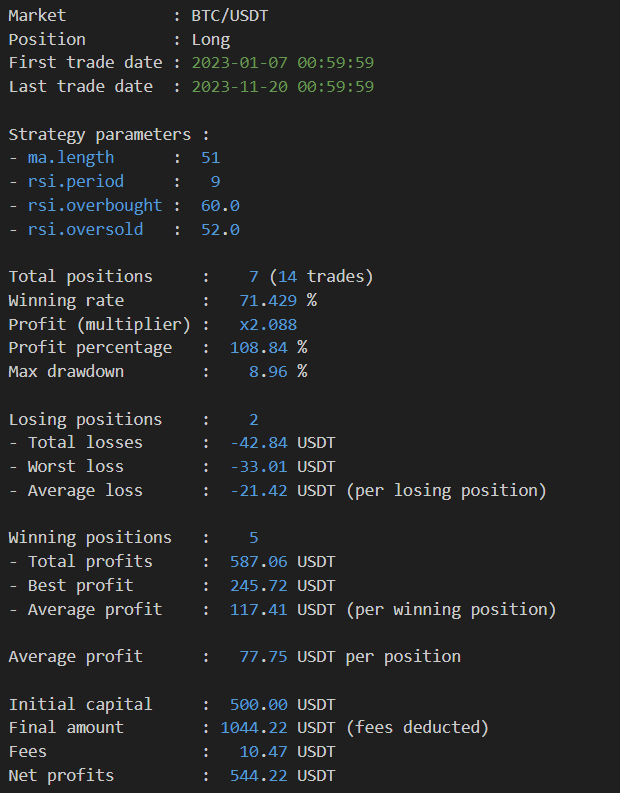

Bonus Challenge

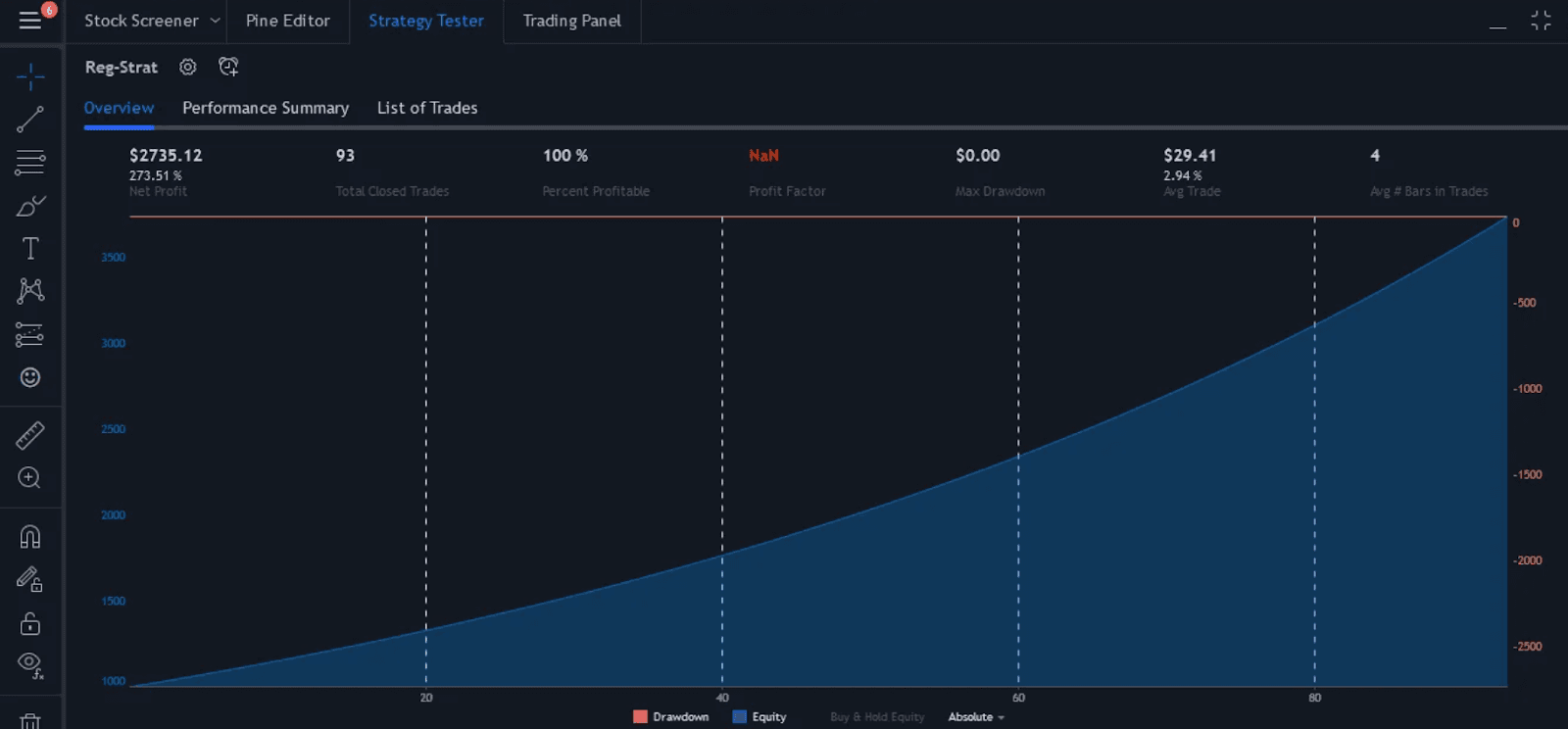

Here's an over-optimized RSI breakout strategy with parameters fine-tuned across 1,750,000 backtests. Can you identify what's wrong with this approach based on learned concepts?

Conclusion

Robustness testing is the difference between backtesting fantasy and trading reality. It's tempting to skip these steps and rush to live trading, but the traders who do the work upfront are the ones who survive long-term.

In the next article, we will discuss portfolio construction – how to combine multiple strategies for better risk-adjusted returns.

Pavel – Robuxio