Learn about the crucial role of position sizing in trading and discover the impact of fixed dollar amount, fixed percentage, and the Kelly Criterion on your strategies.

Why Position Sizing Matters

You can have the best strategy in the world, but without proper position sizing, you'll either:

- Risk too little and miss out on potential gains

- Risk too much and blow up your account

Position sizing is the bridge between strategy and survival.

Position Sizing Methods

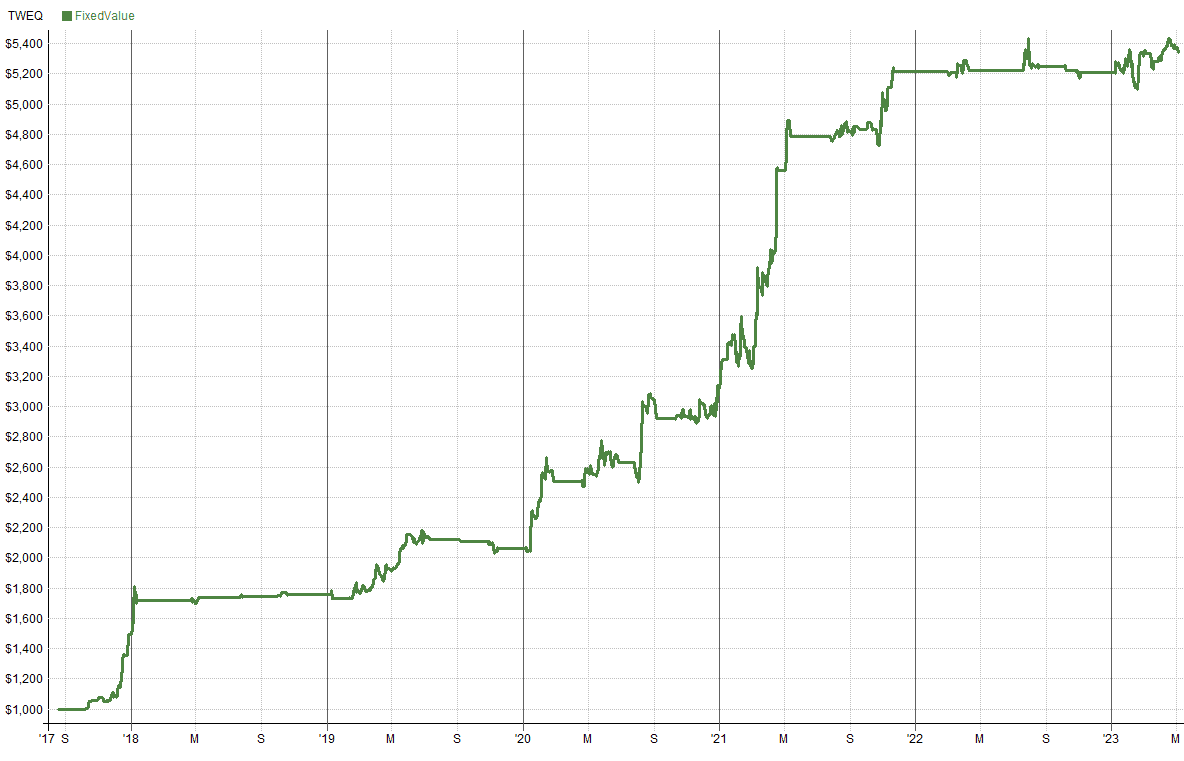

1. Fixed Dollar Amount

How it works: Risk the same dollar amount on every trade.

Example: Always risk $500 per trade, regardless of account size.

Pros:

- Simple to implement

- Easy to calculate

Cons:

- Doesn't scale with account growth

- Risk percentage changes as account size changes

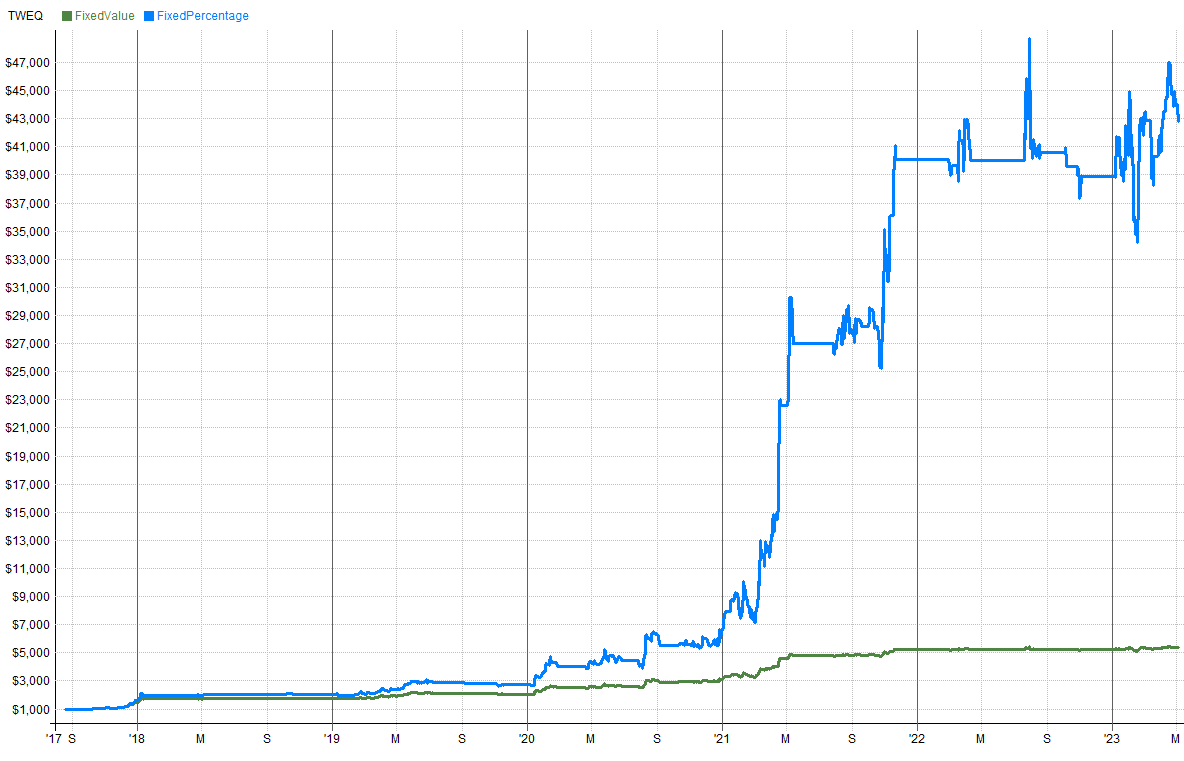

2. Fixed Percentage

How it works: Risk a fixed percentage of your account on each trade.

Example: Always risk 2% of current account value.

Calculation:

Position Size = (Account Size × Risk %) / (Entry Price - Stop Loss)

Pros:

- Scales with account size

- Consistent risk exposure

- Compounds gains effectively

Cons:

- Requires more calculation

- Position sizes vary

3. Volatility-Adjusted (ATR-Based)

How it works: Adjust position size based on asset volatility.

Example: Risk 2 ATR per trade, sizing position so that 2 ATR = 2% of account.

Pros:

- Normalizes risk across different assets

- Accounts for changing market conditions

Cons:

- More complex to implement

- ATR can lag in fast-moving markets

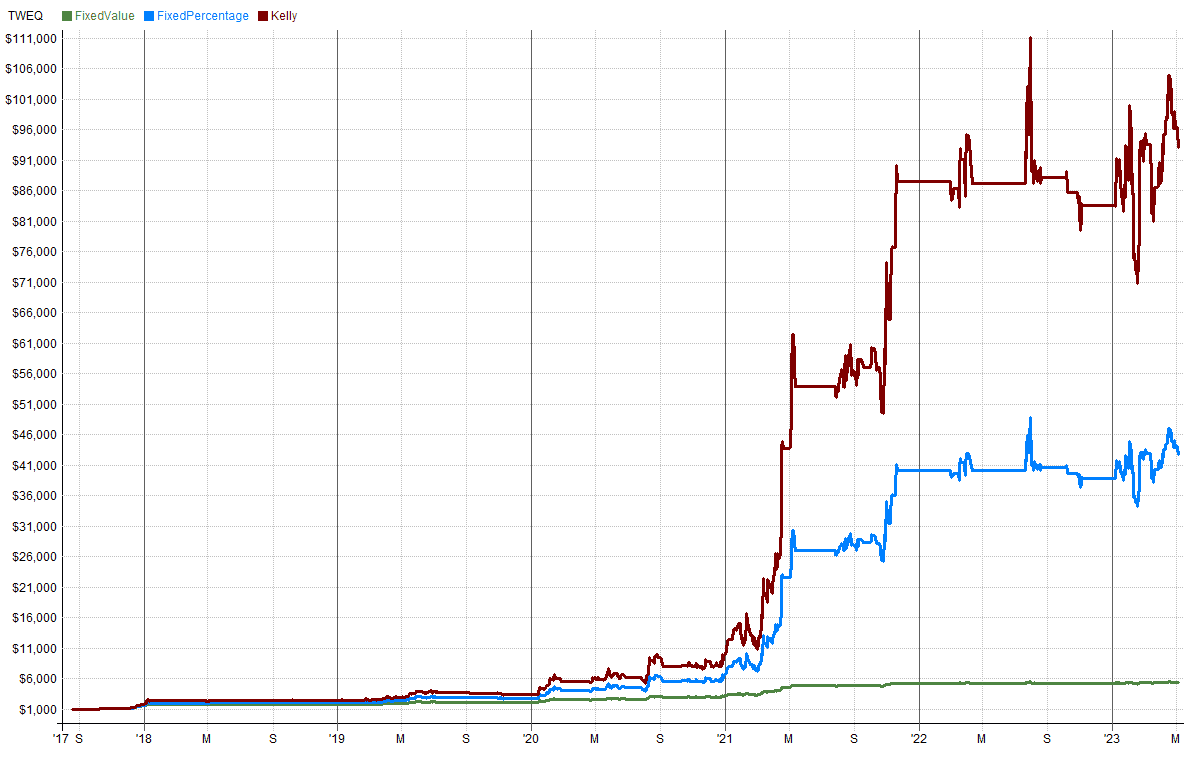

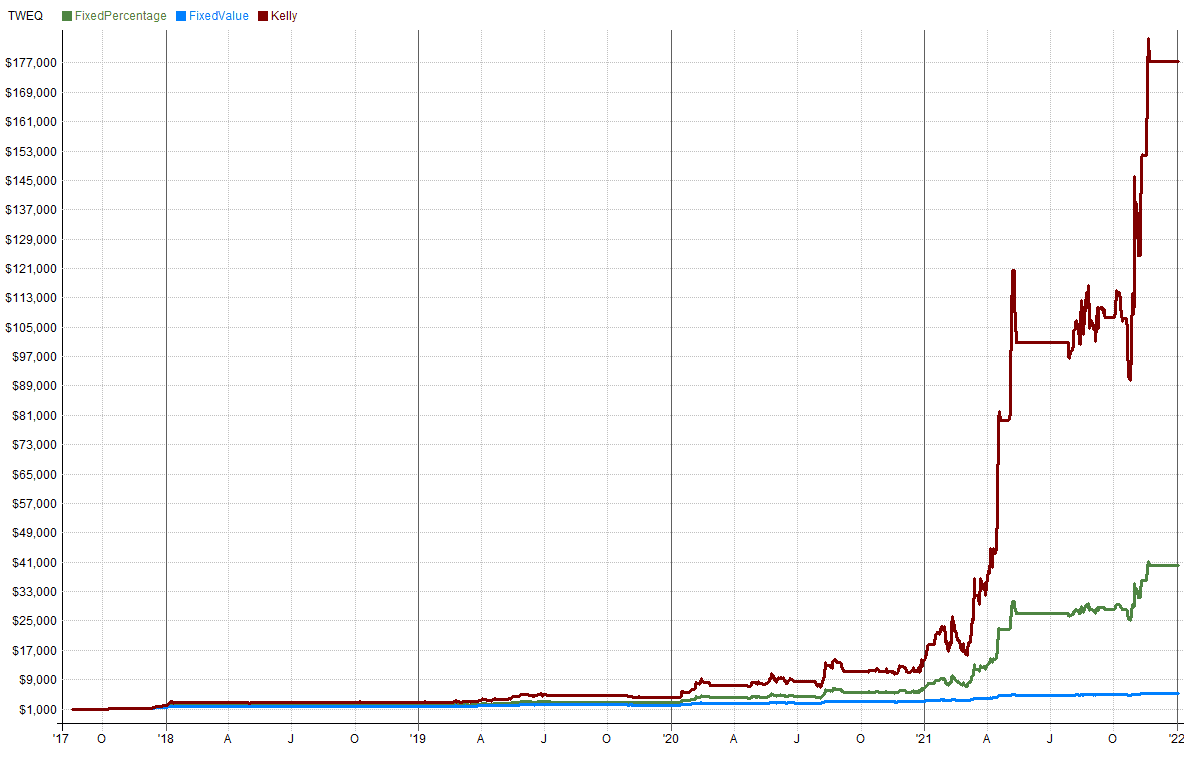

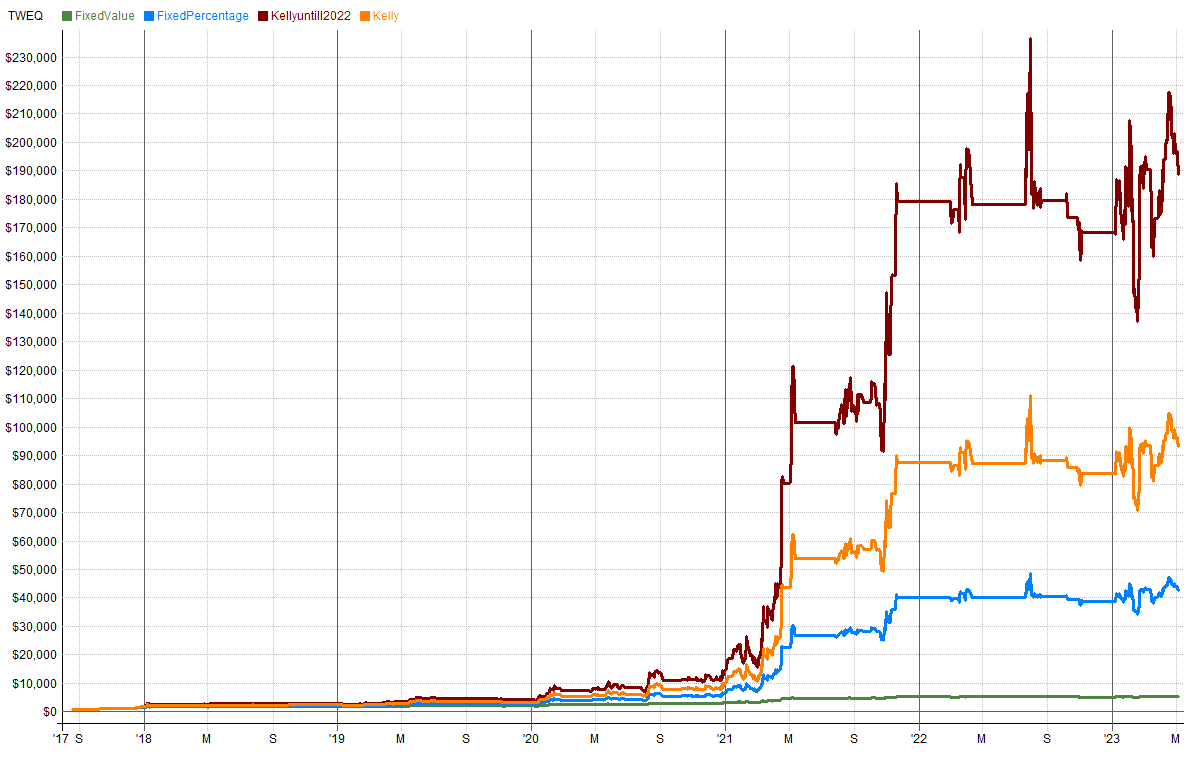

4. Kelly Criterion

How it works: Mathematically optimal position sizing based on your edge.

Formula:

Kelly % = (Win Rate × Avg Win / Avg Loss - Loss Rate) / (Avg Win / Avg Loss)

Example: If your win rate is 60% and you win $2 for every $1 risked:

Kelly % = (0.6 × 2 - 0.4) / 2 = 0.4 = 40%

Reality Check: Full Kelly is extremely aggressive. Most traders use "Half Kelly" or less.

Comparing Position Sizing Methods

| Method | Complexity | Risk Control | Growth Potential |

|---|---|---|---|

| Fixed Dollar | Low | Poor | Limited |

| Fixed Percentage | Medium | Good | Good |

| Volatility-Adjusted | High | Excellent | Good |

| Kelly Criterion | High | Optimal (theory) | Maximum |

Practical Recommendations

For Beginning Traders

- Use fixed percentage: 1% risk per trade

- Simple, effective, survivable

For Intermediate Traders

- Use volatility-adjusted sizing

- Account for market conditions

- Scale position sizes with confidence

For Advanced Traders

- Consider fractional Kelly (Quarter to Half)

- Adjust for correlation between positions

- Monitor portfolio-level risk

Position Sizing Rules at Robuxio

- Maximum 2% risk per trade - No single trade can hurt us significantly

- Portfolio-level limits - Maximum 10% at risk across all positions

- Volatility adjustment - Reduce size in high-volatility periods

- Drawdown scaling - Reduce size during drawdowns

Common Mistakes

- Over-sizing after wins - Feeling invincible leads to oversized positions

- Revenge trading - Increasing size after losses to "make it back"

- Ignoring correlation - 5 positions in correlated assets = 1 huge position

- Not adjusting for volatility - Same position size in calm and volatile markets

Conclusion

Position sizing is where mathematics meets psychology. The "optimal" position size is one that maximizes returns while allowing you to sleep at night and stick to your strategy.

Start conservative. As you gain experience and confidence in your strategy, you can gradually increase position sizes. But always remember: capital preservation comes first.

In the next article, we will put everything together and discuss building a profitable crypto trading strategy from scratch.

Pavel – Robuxio