Before exploring more specific topics, it's crucial to understand the fundamental concept of "risk of ruin." Algorithmic or systematic trading operates as a long-term endeavor where the law of large numbers becomes relevant. The fundamental goal is to remain actively engaged in trading, with risk of ruin serving as a metric for the probability of being unable to continue.

Larry Hite, a pioneer in systematic trading, articulated this principle concisely: "I have two basic rules for winning in trading and life: 1. You have to place bets to have a chance of winning. 2. If you lose everything, you can't continue playing."

Through comprehending risk of ruin, traders emphasize capital preservation. Should you deplete your entire capital, you exit the game and cannot capitalize on future trading prospects. Understanding this potential for ruin enables traders to operate more logically, decreasing the likelihood of making hasty, emotion-driven choices that could worsen risk of ruin.

Analyzing Risk of Ruin with a Simple Example

Imagine being the proprietor of a small-town casino possessing a $1M budget, committed to maintaining business viability. Two scenarios involving roulette will be examined, prioritizing the casino's fiscal stability.

Roulette Probability Basics

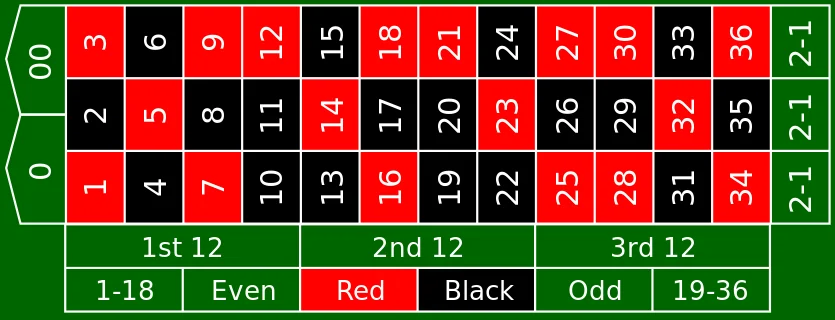

In roulette, the probability of accurately predicting color varies based on the version played. The American roulette variant contains 38 total slots: 18 red slots, 18 black slots, and 2 green slots (representing 0 and 00).

The probability of guessing the correct color (red or black) is calculated as follows:

- Number of favorable outcomes (red or black): 18

- Total number of possible outcomes: 38

Therefore, the probability of getting the correct color is:

18/38 ≈ 47%

Casino Owner's Perspective

As casino proprietor, you possess an edge over patrons. With a 53% probability of winning, theoretically, for every $100 customers wager, you should earn $3. This appears promising.

Now examine risk of ruin analysis across two different scenarios where players select a color.

Scenario 1: A single customer possessing a $1M budget, wagering all capital on a chosen color.

Scenario 2: Ten customers each possessing $100,000 budgets, playing at separate tables, also wagering all capital on a chosen color.

As a responsible casino operator, assessing risks linked to distinct scenarios proves essential.

Scenario 1 Analysis

Should you permit scenario 1 in your casino?

In this circumstance, risk of ruin is quite elevated at 47%. This represents a 47% probability that you must compensate the customer the complete million dollars, which would devastate your casino's budget and necessitate bankruptcy filing. Recognizing this substantial risk, permitting this scenario would be imprudent.

Scenario 2 Analysis

Instead, scenario 2 delivers a more sustainable method, safeguarding your casino's monetary well-being and limiting significant loss probability. The likelihood of experiencing ruin in this situation is merely 0.05%.

Calculation:

Risk of Ruin = (Probability of losing a single bet)^(Number of bets) Risk of Ruin = 0.47^10 = 0.05%

Trading Consequences

Computing risk of ruin for roulette is straightforward. You understand advance knowledge of winning probability and specifically the magnitude of profit and loss. Trading proves substantially more intricate, and numerous calculation methodologies exist.

Without delineating them specifically, these principles apply for diminishing risk of ruin:

- The reduced capital you allocate per transaction, the diminished your risk of ruin becomes.

- The greater number of instruments you trade concurrently within a single strategy, the diminished your risk of ruin becomes.

- The increased quantity of uncorrelated strategies within your trading portfolio, the further you reduce your risk of ruin.

From these observations, you can recognize that safeguarding your account necessitates properly distributing your portfolio across numerous uncorrelated strategies. In executing this distribution, each strategy should partition its capital into numerous smaller allocations.

In a portfolio constructed according to these principles, the probability of risk of ruin descends to a minimum.

The Math of Ruin

Consider this: if you lose 50% of your capital, you need a 100% return just to get back to even. If you lose 75%, you need a 300% return. The deeper the hole, the harder it is to climb out.

| Drawdown | Return Needed to Recover |

|---|---|

| 10% | 11% |

| 20% | 25% |

| 30% | 43% |

| 50% | 100% |

| 75% | 300% |

| 90% | 900% |

This asymmetry is why capital preservation is more important than chasing big returns.

Factors Affecting Risk of Ruin

1. Win Rate

The percentage of winning trades. Higher is better, but even strategies with 40% win rates can be profitable with proper risk management.

2. Risk-Reward Ratio

The average winning trade divided by the average losing trade. A ratio of 2:1 means winners are twice as large as losers.

3. Position Size

The percentage of capital risked per trade. This is the most controllable factor in managing risk of ruin.

4. Correlation

Trading multiple correlated positions is like taking one large position. Diversification reduces risk of ruin.

Practical Guidelines

To keep risk of ruin acceptably low:

-

Risk 1-2% per trade maximum - This ensures you can survive a string of losses.

-

Never add to losing positions - This is how accounts blow up.

-

Diversify across strategies - Don't put all your eggs in one basket.

-

Monitor drawdowns - Have rules for reducing position sizes during drawdowns.

-

Keep reserves - Don't trade with money you can't afford to lose.

The Gambler's Ruin Problem

Even with a positive edge, you can still go broke if your bets are too large. Consider a coin flip game where you win $1.10 when heads and lose $1.00 when tails. You have an edge, but if you bet your entire bankroll each flip, you'll eventually go broke.

This is why position sizing is the most important risk management tool you have.

Conclusion

In trading circles, individuals frequently declare that possessing an edge constitutes all necessary requirements for profitability. However, as demonstrated in this piece, that represents an incomplete narrative. Even possessing an advantage, ruin remains possible. Risk management proves essential at this juncture.

Comparable to how a casino proprietor must contemplate risk of ruin despite maintaining an edge, traders must emphasize risk management. Without it, you face potential capital elimination—an undesirable outcome.

Subsequent blog posts will investigate distinct methodologies and approaches for implementing productive risk management in trading. We will demonstrate capital protection techniques and strategies for preventing account destruction. Since in trading, success requires not solely possessing an advantage—it demands sophisticated risk management for sustainable returns.

In the next article, we will discuss Martingale vs. Anti-Martingale money management approaches.

Pavel – Robuxio