Trend trading, also called trend following, represents the most basic and robust trading approach. The fundamental concept involves capturing a trend and remaining in it as long as possible while limiting losses.

Core Principle

As systematic trader Nick Radge explains: "Trend following is like hitchhiking. When you hitchhike, you don't know who will pick you up or where they're going."

Profitability on Cryptocurrencies

Trend following proves highly profitable for cryptocurrencies because they generate strong trends. However, this strategy has certain drawbacks requiring careful management.

What Defines a Trend

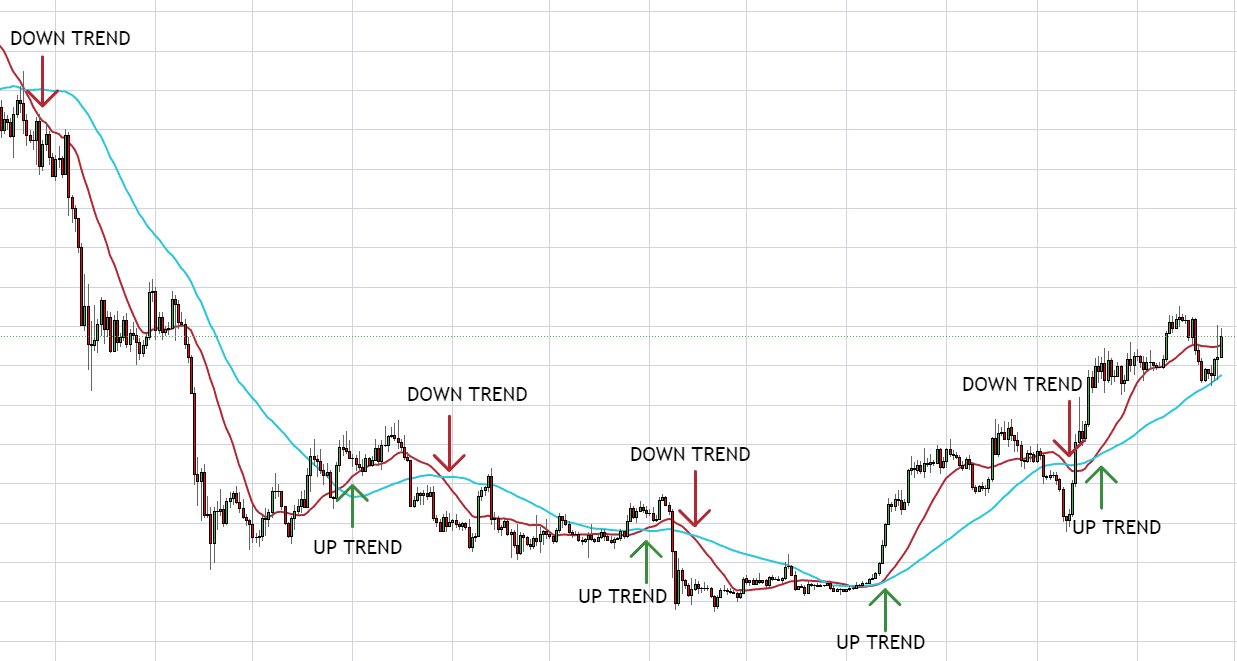

A trend occurs when markets create new highs and lows moving in a specific direction—opposite to sideways movement. Markets typically trend only 20%-30% of the time, with remaining periods showing mostly sideways action.

Identification Methods

Basic approaches include:

- Crossing Moving Averages

- Using MACD indicators

- Tracking rate of change

- Breakout of X days range

Long-term differences between these methods are minimal.

Popular Strategies

- Moving Average Crossover (Trend Catcher example)

- Dual Moving Average approach

- Bollinger Band Breakout

- Donchian Channel Breakout

Key Characteristics

Trend following typically produces 65%-70% losing trades, offset by substantially larger profits when trends materialize. "One good trend pays for them all!"

Risk Management Requirements

- Avoid leverage entirely

- Use wide or no stop-losses

- Diversify across multiple cryptocurrencies

- Trade multiple assets simultaneously

Performance Results

Trend Catcher strategy generates several times higher profits than holding, with 30%-40% lower drawdowns.

Advantages of Trend Following

- Proven robust approach - Works across decades and markets

- Highly profitable - Captures major market movements

- Simple methodology - Rules-based, emotion-free trading

Disadvantages of Trend Following

- Numerous losing trades - 65-70% of trades lose money

- Potential long waiting periods - Big trends don't happen daily

- Psychologically demanding - Requires patience through whipsaws

Conclusion

Trend following works optimally within diversified strategy portfolios, complementing mean reversion approaches. The low win rate is offset by the occasional massive winner that more than compensates for all the small losses.

In the next article, we will explore mean reversion strategies, which take the opposite approach – betting that prices will return to their average levels.

Pavel – Robuxio