Welcome to the first article in our series on algorithmic crypto trading!

We decided to publish a series of articles that will show you how to trade cryptocurrencies in a systematic way, using hard statistics instead of relying on the advice of influencers.

Today we’re going to lay the foundation. I will teach you your first systematic trading strategy and show you how to apply this approach. All this using the specific example of Bitcoin and Ethereum.

What is systematic trading?

It is a way of trading that uses pre-set rules to make buying and selling decisions. It may sound complicated, but the rules of the basic trading system can be simple.

And we’ll start with one such basic strategy.

First take a look at the following chart. It shows Bitcoin and its 50-day moving average. If Bitcoin is growing, it is above this moving average. If Bitcoin is falling, it is below this moving average.

Let’s try to come up with our first systematic strategy based on this observation.

The rules will be as follows:

If Bitcoin closes above this moving average on the daily chart, I will buy Bitcoin. If the closing price of Bitcoin is below this moving average, I will close the position – sell Bitcoin. That’s it.

Conditions:

Buy Bitcoin: Close price > Moving Average (50)

Close position (Sell Bitcoin): Close price < Moving Average (50)

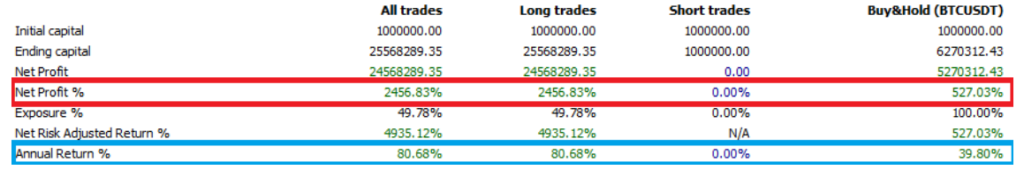

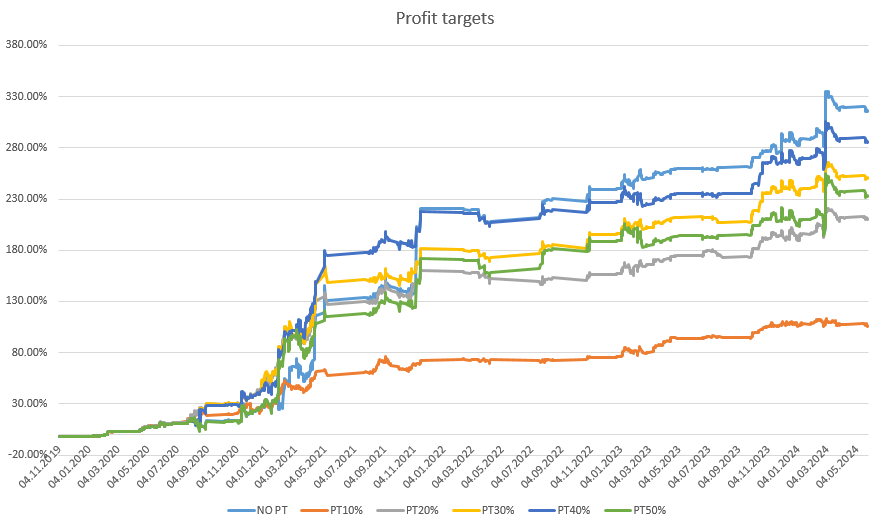

You might be thinking that it’s too simple to work. Let’s look at the results of this strategy since November 1, 2017.

Look at 2 lines in particular. Net Profit % and Annual Return %. The total profit of the strategy is almost five times bigger compared to just Bitcoin hodling. The average annual return is twice as much.

25X vs. 5X!

Moreover, you don’t need any additional software to use such a strategy. Just a chart and a moving average.

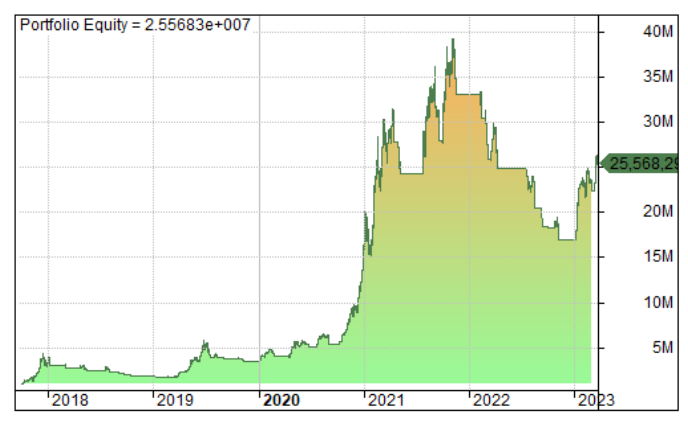

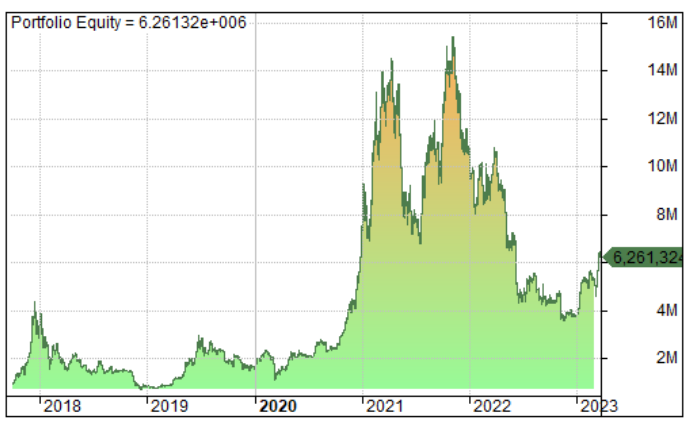

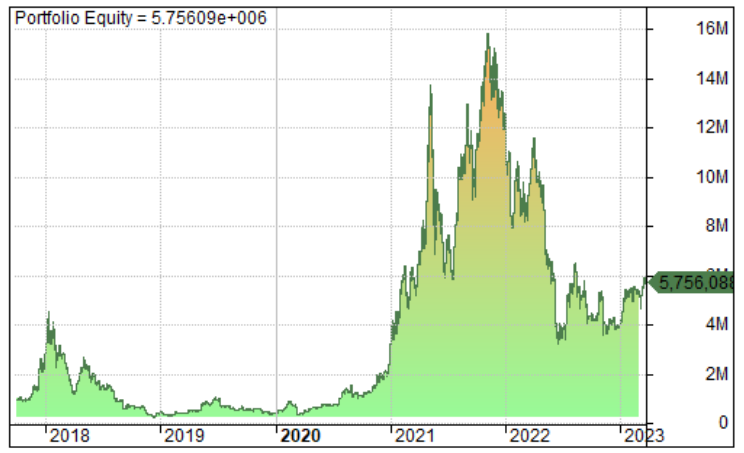

Compare the equity curve of the strategy and Bitcoin hodling:

The strategy’s equity curve grows more steeply and has fewer dips. It could be definitely better. But keep in mind this is a very basic strategy. And even that beats Bitcoin hodling five times.

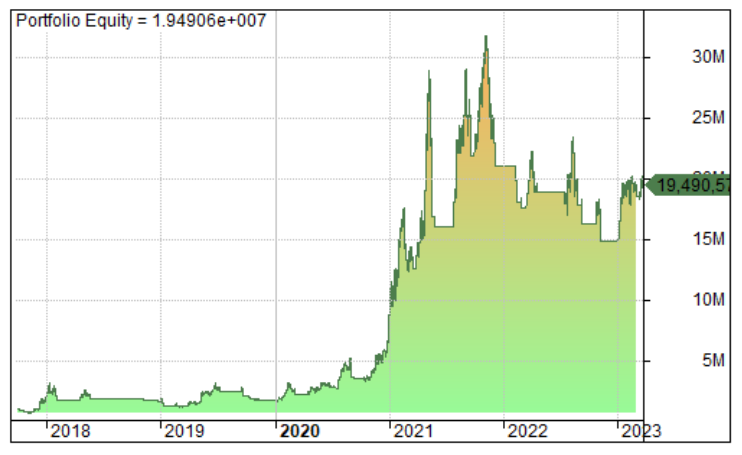

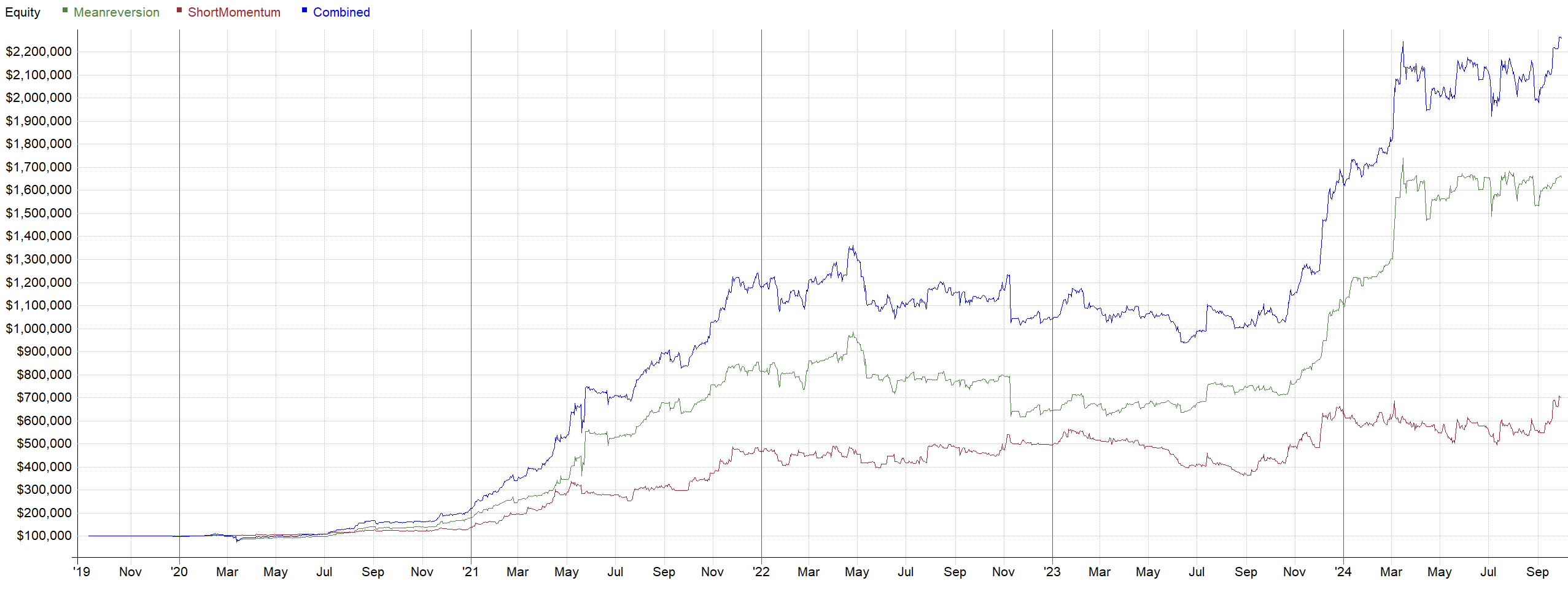

How does such a system work when trading Ethereum?

By trading this simple strategy, you could make almost four times more than by hodling. And don’t forget that we are still at the beginning of our systematic trading journey.

I’ll show you the equity chart of this strategy and the price of Ethereum to give you an idea.

As you can see the strategy works on Ethereum too. This basic trend strategy also works on many other cryptocurrencies, as trend strategies thrive in crypto trading. But we’ll talk more about the types of strategies some other time.

Do you know what is the biggest advantage of systematic strategies for me?

That I can rely on them. By testing them on historical data, I can identify their strong and weak points and prepare accordingly. That’s why I only trade systematically for many years. As a result, I don’t have to rely on the latest hot tips or make emotional decisions about whether to stay in a position or get out. I simply make up a logical system, test it, and then trade it mechanically or automatically.

If you would like to see a more advanced way of trading this strategy with all the rules, check out Trend Catcher

I look forward to meeting you every week in this series and showing you the systematic ways of trading.

Pavel, Robuxio.com