Trend trading, also known as trend following, is the most basic and robust form of trading.

The basic principle of trend following strategies is to capture a trend and stay with it for as long as possible while cutting the losers short.

As the well-known systematic trader Nick Radge puts it, “Trend following is like hitchhiking. When you hitchhike, you don’t know who will pick you up or where they’re going. Similarly, in trend following, you don’t know when a trend will start or where it will take you, but you can identify the trend and ride it until it ends.”

Is the trend following on cryptocurrencies profitable?

Absolutely! And a lot! For trend following to be profitable, it needs strong trends. Cryptocurrencies can trend strongly, and trend following is probably the most profitable approach for trading them. However, it does have its pitfalls.

What exactly is a trend?

The trend phase of the market is the opposite of a sideways-moving market. A trending market creates a series of new highs and lows and moves in a certain direction, either up or down. According to most sources, the market is in a trending move only 20%-30% of the time, with the remainder of the time being mostly sideways movement.

How to identify a trend?

The basis of trend trading is trend identification. It should be as simple as possible. Ideally, you want to get into all the stronger trends on a given coin.

Basic approaches:

- Crossing the Moving Average – The candle closes above its moving average.

- Crossing Moving Averages – The faster moving average crosses the slower moving average

- Using the MACD indicator to identify a rising market.

- Tracking the rate of change over a period of time.

- Breakout of X days range.

There are really a lot of approaches, and in the long run there really isn’t that much difference between them.

What are the best trend following strategies for cryptocurrency trading?

There are many strategies. Among the most popular are:

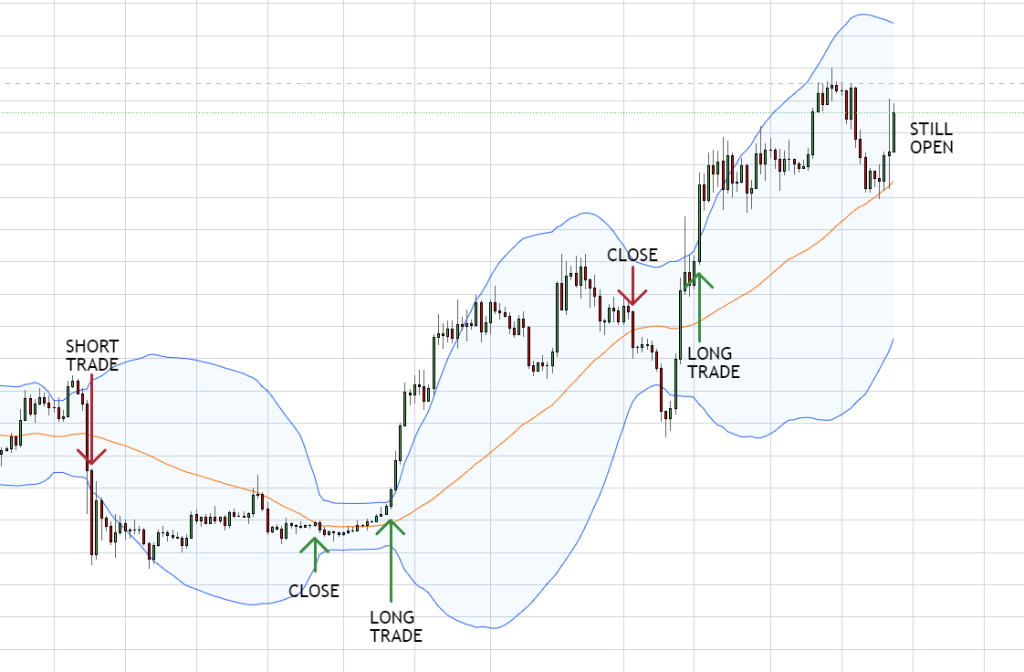

- Moving Average Crossover – Enter when the price crosses the moving average to the upside. Exit when it closes below the moving average. An example is our Trend Catcher strategy. You can download the full description here.

- Dual moving Average – Enter when the quicker moving average crosses the slower one.

- Bollinger Band Breakout – The long trade is open when the candle closes above the upper channel A trailing stop loss based on the moving average is usually used to close the trade.

- Donchian Channel Breakout – Very similar to Bollinger Band Breakout. This channel just does not account for volatility. It is purely about High or Low breakouts over the last e.g. 40 days.

Basic characteristics of trend following

A large number of small losses, and this is why so many people don’t stick to trend following. Normally, 65%-70% of all trades result in small losses. However, when profits do occur, they can be many times bigger than losses. This is why it’s crucial not to exit a trade too early since the profits have to make up for many smaller losses to generate profit. One good trend pays for them all!

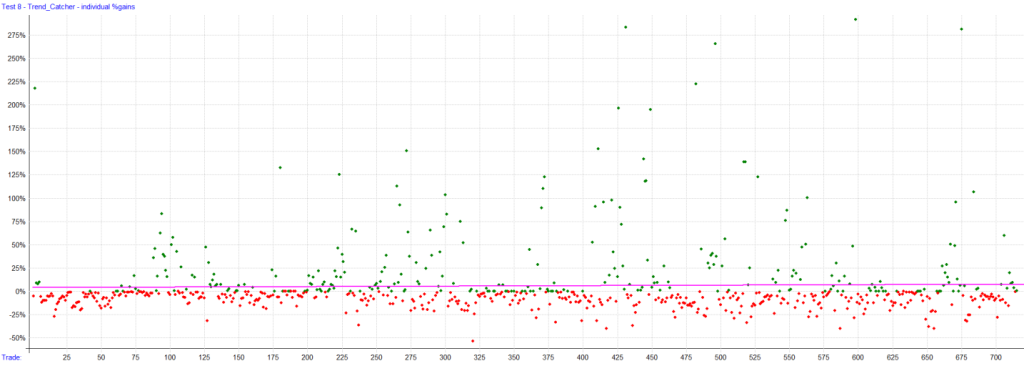

Check out our Trend Catcher. One dot is one trade. There are many more red dots than green ones. And yet this strategy is one of our most profitable!

Trend followers like to keep things simple!

Yes. This is absolutely true. You need to keep things simple to be sure that if a trend occurs, you will be in the trade. The worst that can happen is that you don’t participate in the biggest trend of the year because of another fancy filter.

Risk management in Trend Following

In trend trading you have a large amount of losses. They often follow each other, especially if the market is in a trendless phase. This is called a whipsaw. Such a period is characterized by a deeper drawdown. Therefore, several points are absolutely crucial:

- Do not use the leverage – Even without the leverage, drawdowns are in the tens of percent range trend following on cryptocurrencies. You don’t want to increase them any further.

- Do not use stop-losses, or use very wide stop-losses – I know, this is a little controversial. But the market needs to have enough room to breathe so that the trend can further develop. But that doesn’t mean you shouldn’t have a fixed exit strategy!

- Don’t rely on the trend on one coin. Diversify! – Divide your trend trading account into several smaller parts, e.g. ten. And trade one coin with each part. You never know where the trend will show up.Large systematic trend trading funds trade dozens of assets at a time. They simply want to catch all available trends.

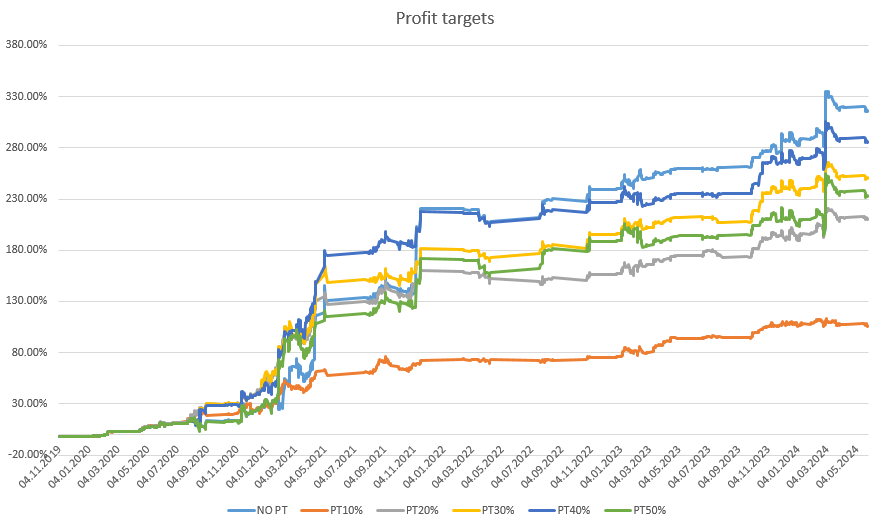

Results of algorithmic trend following on cryptocurrencies.

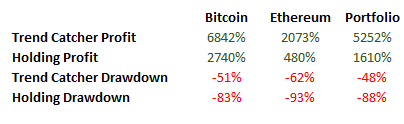

You can compare the results of our trend following strategy Trend Catcher on Bitcoin or Ethereum.

Profits are several times higher than holding and drawdowns are almost 30%-40% lower.

I also composed a small portfolio here where we would trade Bitcoin and Ethereum each with half of the account. The drawdown is slowly starting to decrease and the profit is still very good.

What are the pros of Trend following?

- A very robust approach proven over decades.

- Highly profitable approach.

- Very simple trading style.

What are the cons of Trend following?

- Many losing trades.

- You can wait a very long time for a trending period.

- Psychologically challenging type of trading.

Is trend following for you?

Based on the pros and cons described above, you can decide whether you are patient enough to follow the strategy in the long term.

You need to leave your personal opinions at the door and take every signal. Do you want to be right or make money?

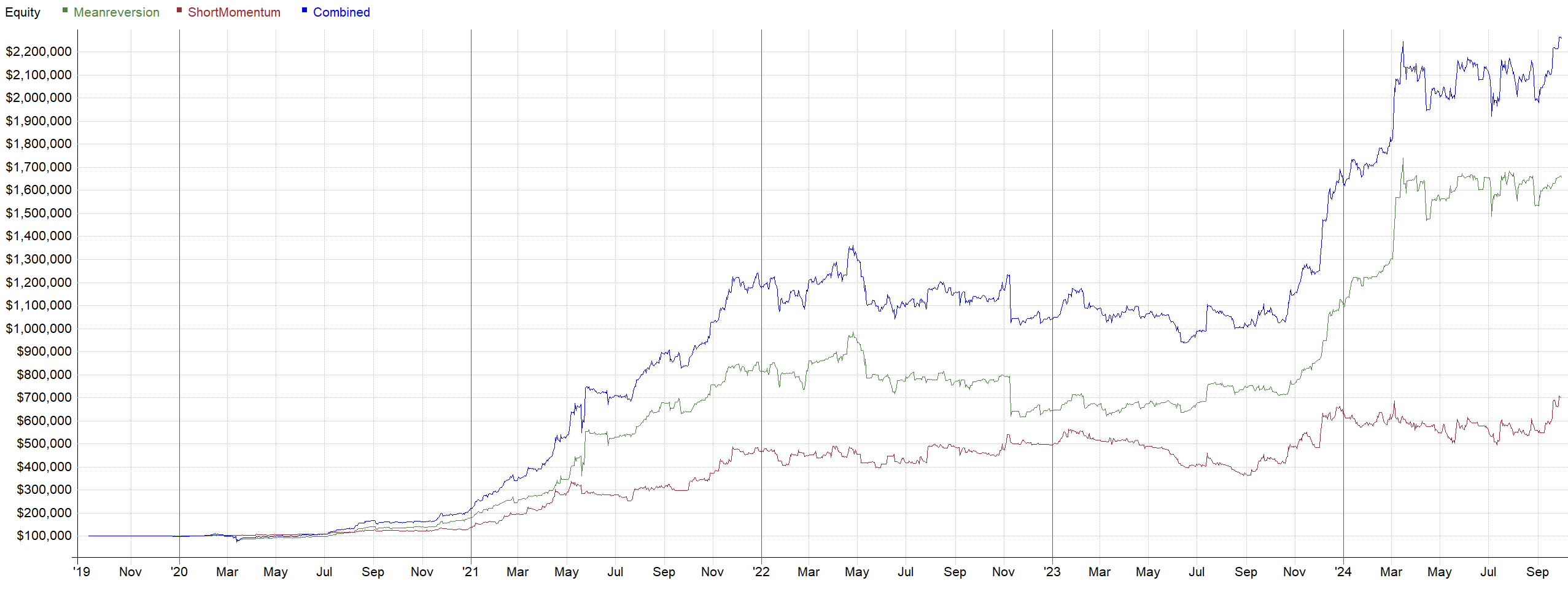

Our philosophy is to have Trend following strategies ALWAYS included in the portfolio of many different strategies. When trend following trading is doing well, the profits are enormous.

In fact, trend following works very well with mean reversion strategies, which we will talk about in our next blog post.

Pavel