Let’s talk about how trading approaches can be differentiated. There are two primary factors to consider – entry philosophy and holding period. Entry philosophy refers to the criteria used to enter a trade, while holding period refers to how long an asset is held.

Entry Philosophy and Holding Period

- Trend Following:

- Identifies and follows the current trend in the market

- Uses a longer holding period to capture larger profits

- Positions can be held for weeks or months

- Mean reversion:

- Believes prices tend to move back towards their mean or average level over time

- Uses a shorter holding period to capture small profits

- Positions are held for a few days or hours

- Breakouts:

- Identifies when the price breaks through a key level of support or resistance

- Uses a medium-term holding period to capture the momentum of the price movement

- Positions are held for a few days or weeks

Trend Following

Trend Following involves identifying the current trend in the market and holding onto it for as long as possible to capture larger profits. This approach is characterized by a longer holding period, with the goal of riding the trend as long as possible and capturing larger profits.

The characteristics of trend trading include a lower win rate but larger profits, with a focus on cutting losses and letting winners run. Trend traders often experience high drawdowns and whipsaws when there is no clear trend in the market.

Advantages of trend trading include the potential for large profits and the ability to capture long-term trends in the market. Disadvantages include the risk of high drawdowns and the need for patience to wait for trends to develop.

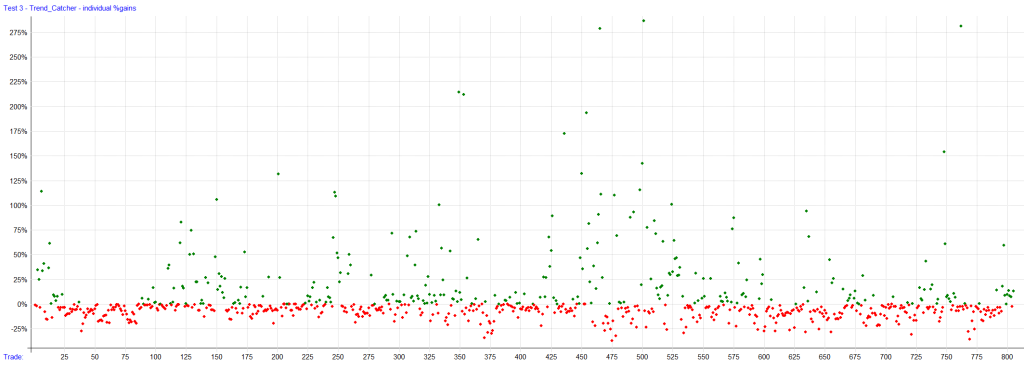

Our Trend Catcher strategy is a good example of a Trend Trading Strategy. We use a simple 50-day moving average to identify the direction of the trend on Bitcoin, and with a simple 20-day moving average, we ride the trends on the altcoins.

As you can see, our win rate is low (35%), with lots of small losses, but some very big winners to offset them all! Lot’s of winners you can’t even see on the chart because they went up 1000%+

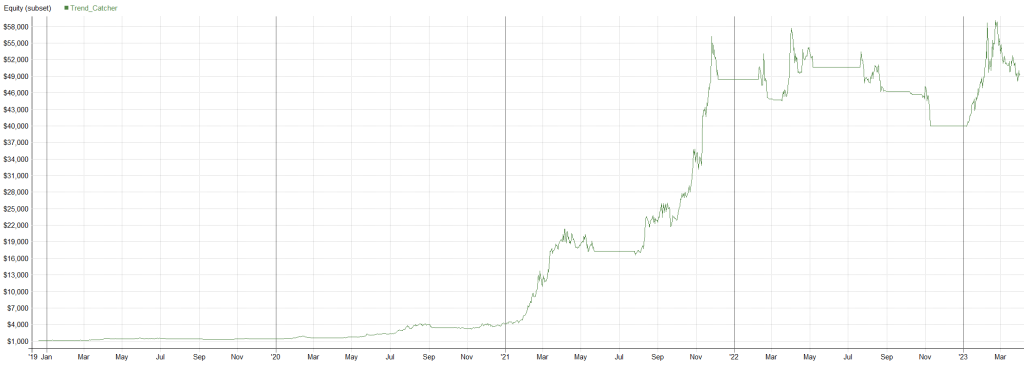

Here you can see very well that we need a trend in the market to make money, no trend leads to whipsaws and drawdowns in your trading account.

Mean Reversion

Mean reversion is a type of trading approach where traders aim to take advantage of short-term price movements in the market.

The main idea behind mean reversion is that prices tend to move back towards their average or “mean” level over time. This means that if an asset’s price has been consistently moving above or below its average level, it is likely to eventually revert back to that average. Mean reversion traders look to identify these short-term price movements and capture small profits. They typically hold positions for only a few days or hours, and their win rate is typically higher than trend traders, but their gains are smaller.

However, mean reversion trading can also be riskier, as there may be unexpected market moves. The profitability drops if the market is trending strongly, as the market may not revert back to the mean as quickly or at all.

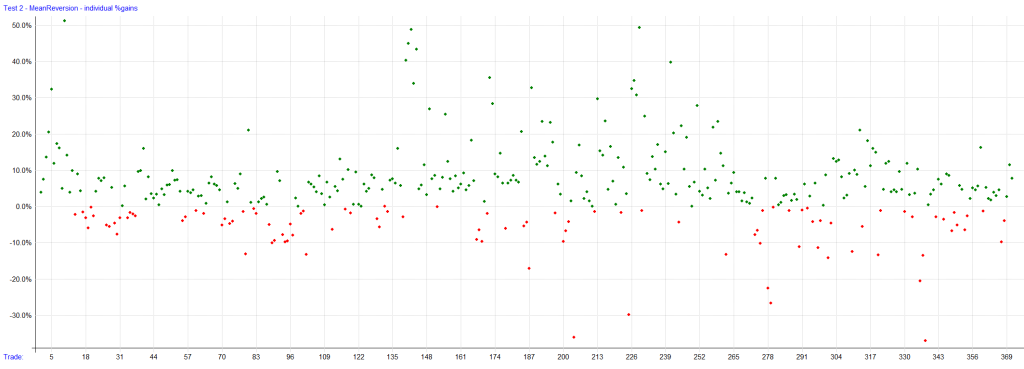

Here is an example of a Mean Reversion trade from our portfolio with the goal to buy pairs that are far below their “mean” level and therefore have a high probability they will revert back up.

On the win/loss distribution you can see very well that we have a higher win rate. But that is also needed because our wins aren’t as big compared to trend trading.

Breakout Trading

Breakout trading is a strategy that is quite popular among traders. In this approach, traders look for an asset whose price is about to break through a significant level of support or resistance.

By identifying such a break, traders hope to capture the momentum of the price movement in the short-to-medium term. Breakout traders usually aim for a higher win rate, although the profits can be smaller than those achieved through trend trading.

Many false breakouts can occur, and traders must manage their risk carefully. Despite the risks, breakout trading can be a useful strategy for traders who want to capture short-term price movements in the market.

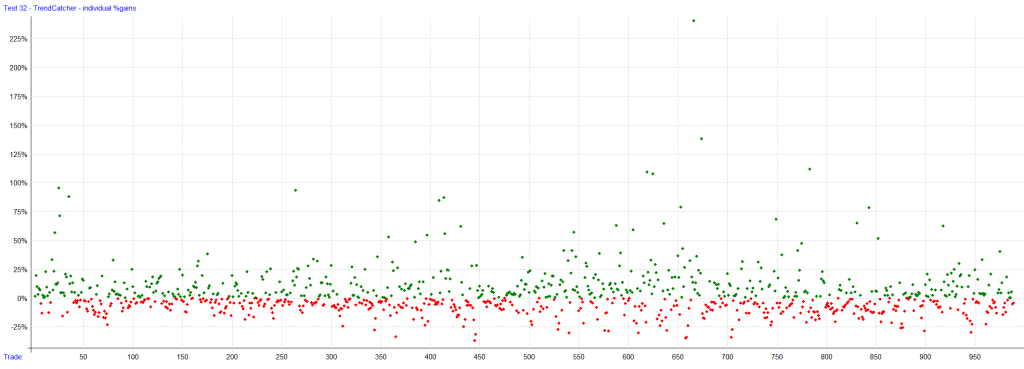

Our Momentum Catcher strategy is very good at catching this momentum, as you can see in the chart below. A strong breakout on Doge and we stay only for a short time in the trade.

The win/loss distribution also shows similarities to Mean Reversion, lots of smaller wins, only way more trades because Crypto is a breakout market.

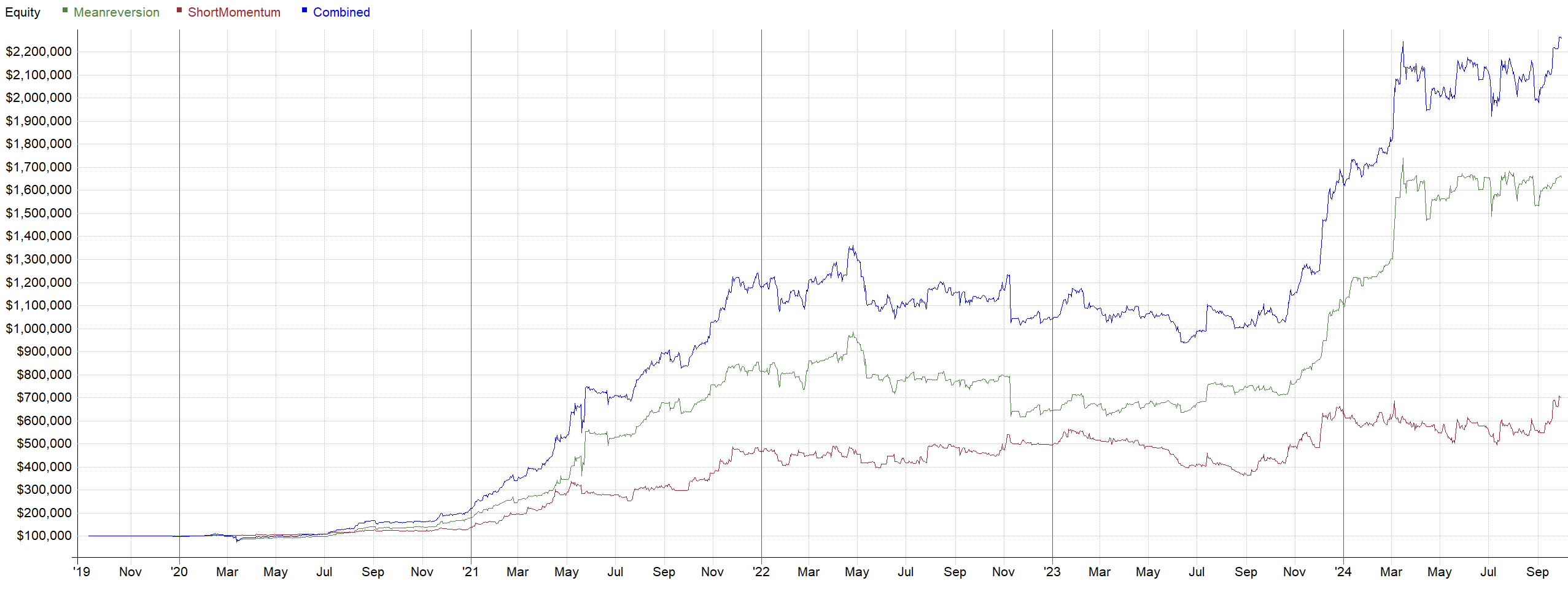

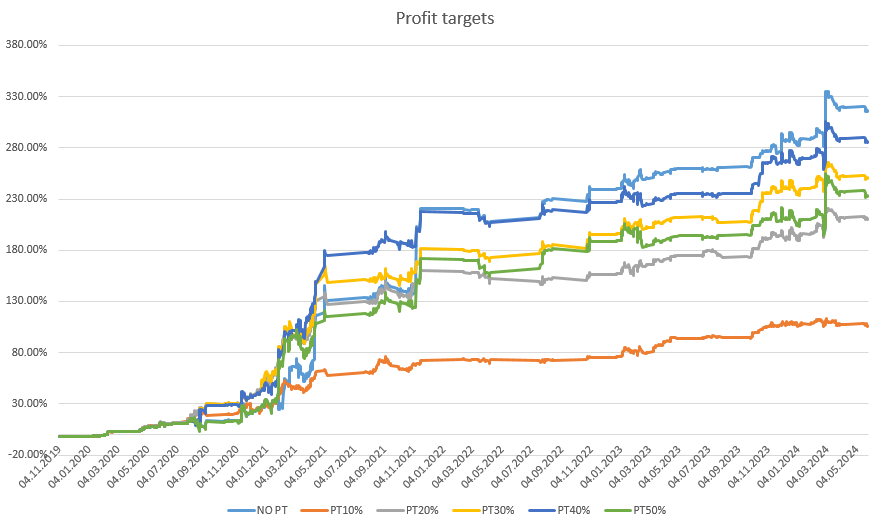

At Robuxio, we believe in a diversified approach to trading, which involves utilizing a portfolio of different trading strategies, including trend trading, mean reversion, and breakout trading.

We recognize that “blackbox” trading systems can be difficult for clients to follow, as they lack transparency about how the system should behave.

Therefore, in our upcoming blog posts, we will dive deeper into each individual approach, providing a detailed analysis of their entry philosophy, holding period, risk management strategies, and real-world examples of their application.

By exploring each approach in-depth, we aim to provide our clients with a comprehensive understanding of the various approaches we take at Robuxio.

Dries