In the previous blog post we looked at how a very simple system can significantly increase profits compared to holding the underlying asset. Just by using a 50-day average and one rule, we were able to generate five times more profit on Bitcoin than simply holding

How is this possible?

The reason is simple: due to the huge price volatility of crypto.

High volatility is a powerful weapon for traders who know how to use it. The higher the price fluctuations, the more likely it is to close a trade at a big profit. And big profits are important to cover losses, which we can never avoid in trading.

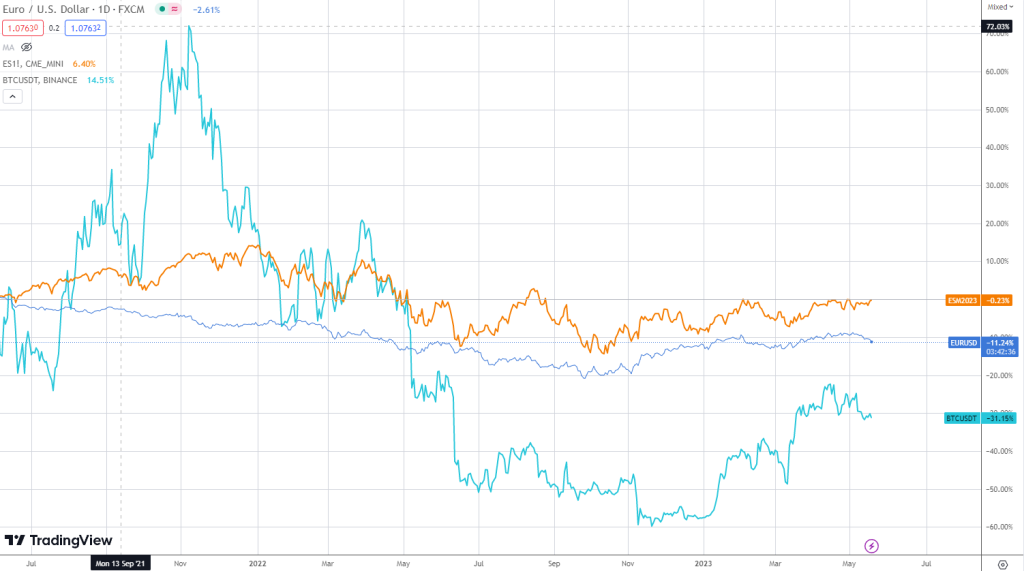

Volatility Comparison

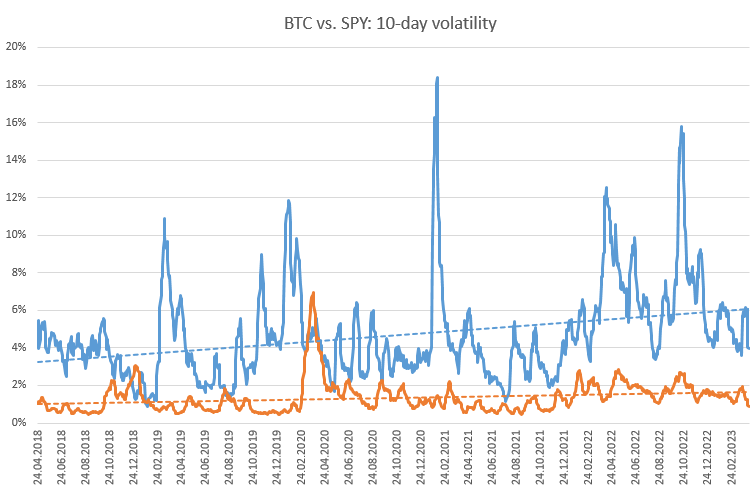

Take a look at the chart below to understand how huge the volatility in crypto is.

The average daily volatility of the most famous stock index – the S&P 500 – over the last 5 years is 1%. Bitcoin’s average daily volatility over the same period is 5%.

Bitcoin’s volatility is 5X greater! That’s a huge difference.

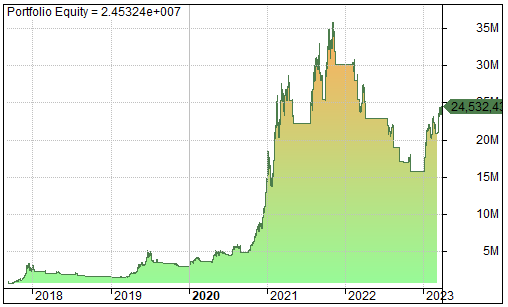

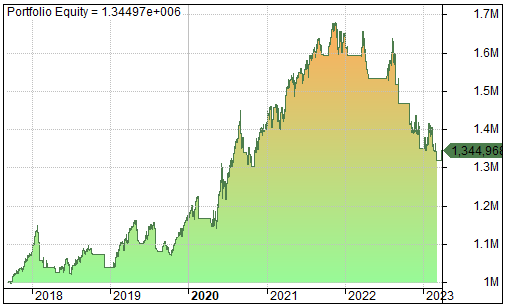

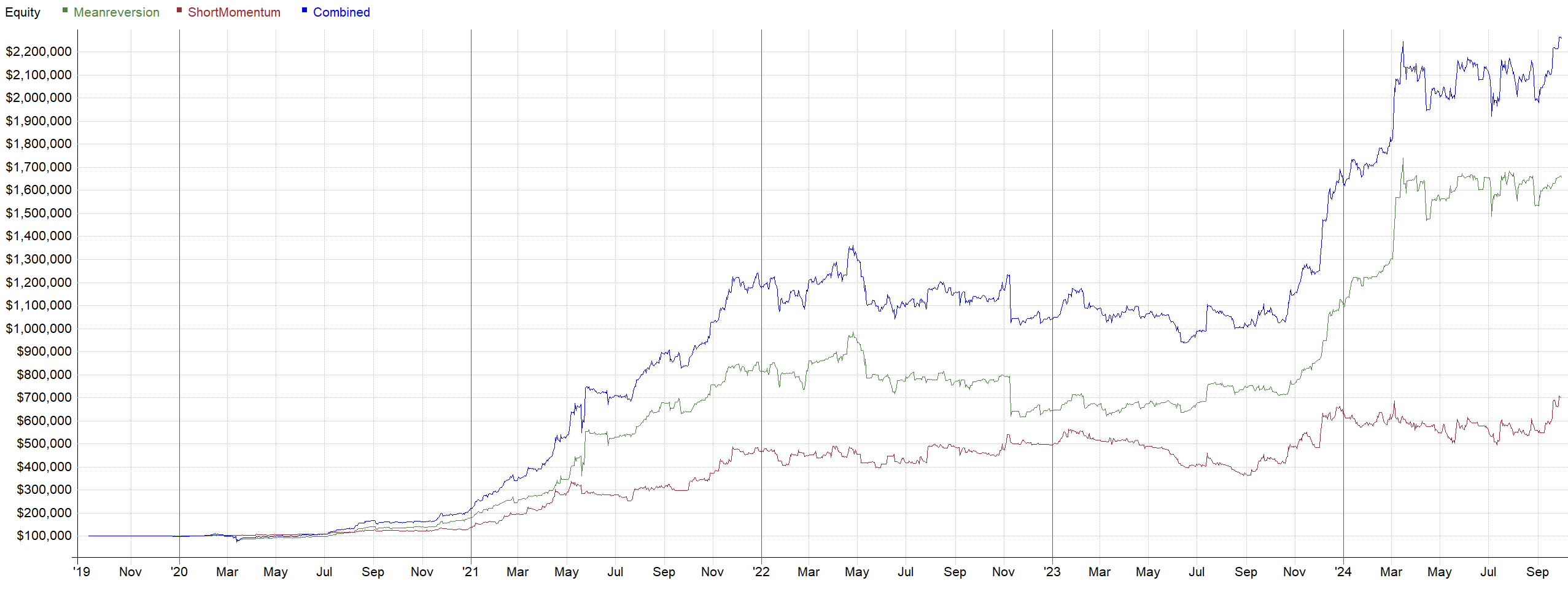

This volatility is even more evident in our simple system from the previous blog post.. Using the same rules, starting the test on October 1, 2017, the strategy on Bitcoin had a profit of 25X (or 2400%), while the total profit on the S&P 500 was only 1.34X (or 34%).

This shows the incredible difference that can be achieved on a high volatility asset using compound interest strategies!

This, by the way, is also why people in traditional finance automatically take annual profits in crypto above 15-20% as a scam. They are operating in a completely different reality

Reasons for High Volatility in Crypto

- Immature market

Crypto is young. It is still looking for its utility and a correct and stable price level. There is always high volatility associated with this discovery phase.

This was similar, for example, in the 1970s in the commodities market (such as gold, soybeans or orange juice). Today these are mature markets, but previously their volatility was huge.

- Low liquidity market

There is a lack of liquidity in crypto. The volumes traded are very low compared to traditional assets. Due to the low liquidity, even relatively small amounts of money can move the market.

- Market full of amateurs

Crypto is full of small traders who don’t know what they’re doing. They try to grab any tip and jump on any latest trend. Due to lower liquidity, this simply causes strong moves.

- Lack of large institutions and professional funds

The lack of legislation and regulation makes it very difficult for large institutions to access crypto. They would very quickly significantly increase liquidity across the sector and reduce volatility.

The lack of professional money is our big advantage!

- Risk premium due to high uncertainty

We often trade small coins of new projects. There is a high risk of crashes. This risk is always offset by high volatility and high profit potential.

Advantages and Disadvantages of High Volatility

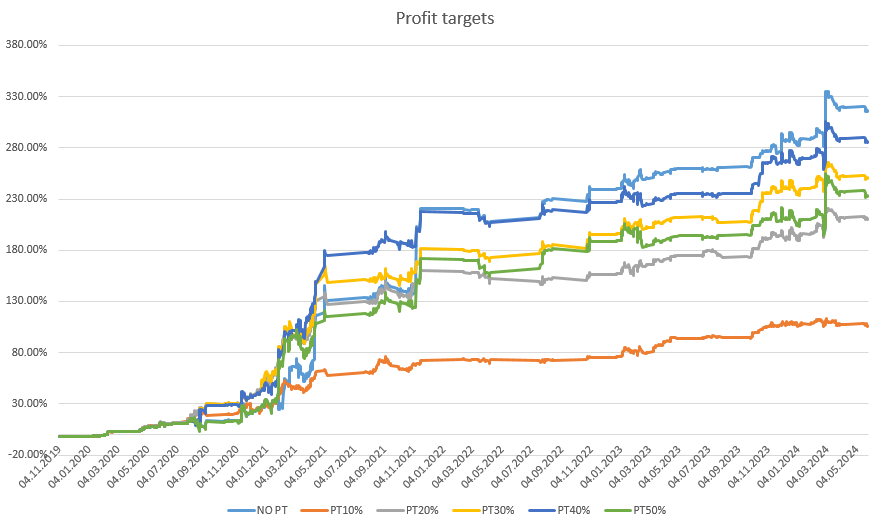

The advantage of high volatility is clear. There is a significantly higher return potential. The higher the volatility, the higher the amount of potential profits. This is true if you know how to take advantage of it.

We proved this with the example of our system above.

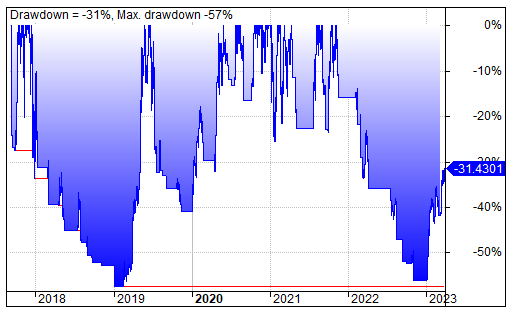

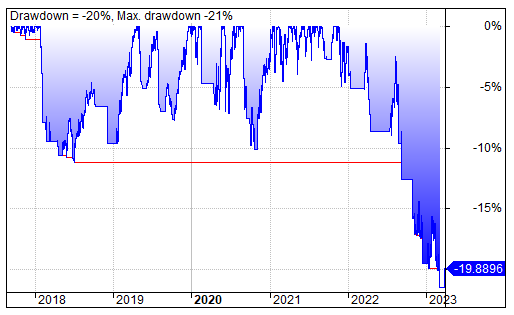

The main disadvantage, on the other hand, is the risk of quick and deep losses if you don’t know what you’re doing. You can see how volatility affects losses in our strategy.

The drawdown in the case of Bitcoin is 2.5X greater than in the case of the S&P 500.

Fortunately, there are many advanced approaches to reduce these drawdowns, such as portfolio trading. We will discuss these later in this series.

Volatility in crypto is a huge advantage. Don’t let anyone convince you that you shouldn’t trade crypto because of it. But it is a reason why you need to approach trading responsibly and know that you are trading the right way.

If you want the complete rules of a strategy that can take advantage of volatility, check out Trend Catcher

In the next article, I will write about the different trading approaches. I’ll show you their advantages and disadvantages and look at specific examples of our strategies.

Pavel – Robuxio