It is repeated over and over again that stop loss is necessary. And those who trade without one are doomed. But is it really essential?

The Conventional Wisdom

"Always use a stop loss" is perhaps the most repeated advice in trading. The logic seems unassailable:

- Limits your losses

- Prevents emotional decisions

- Protects your capital

But like many things in trading, the truth is more nuanced.

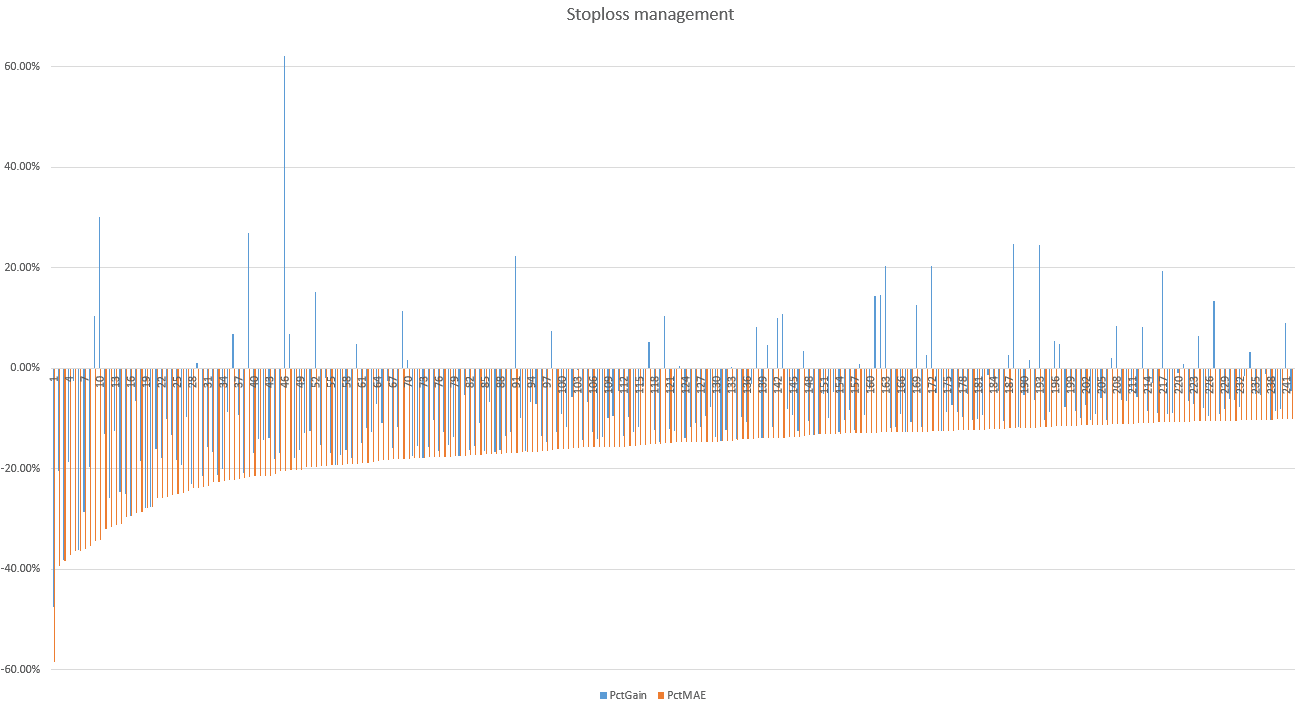

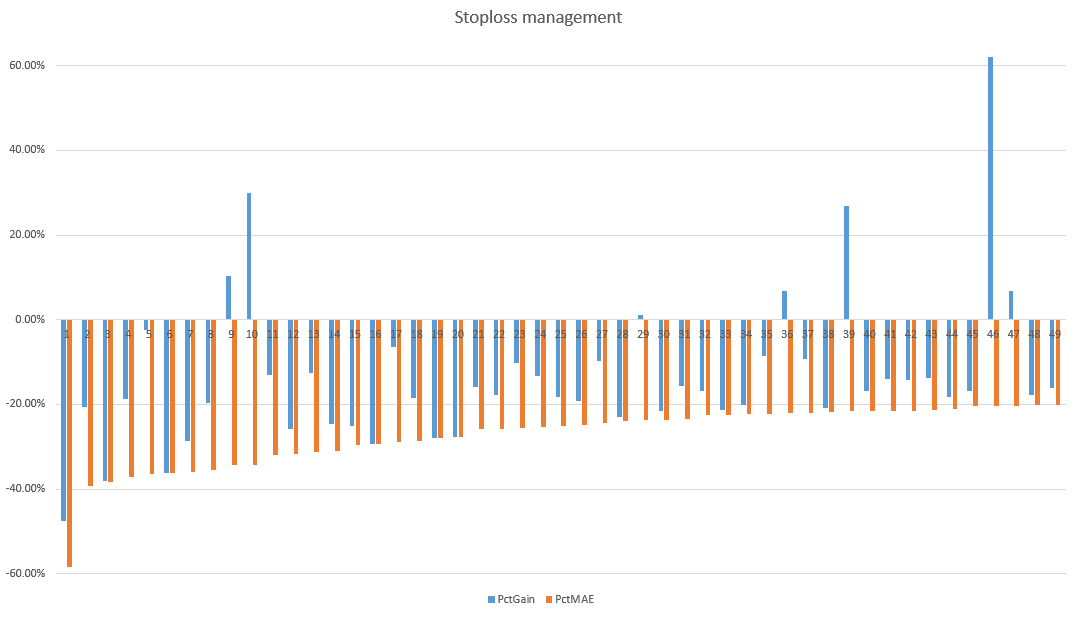

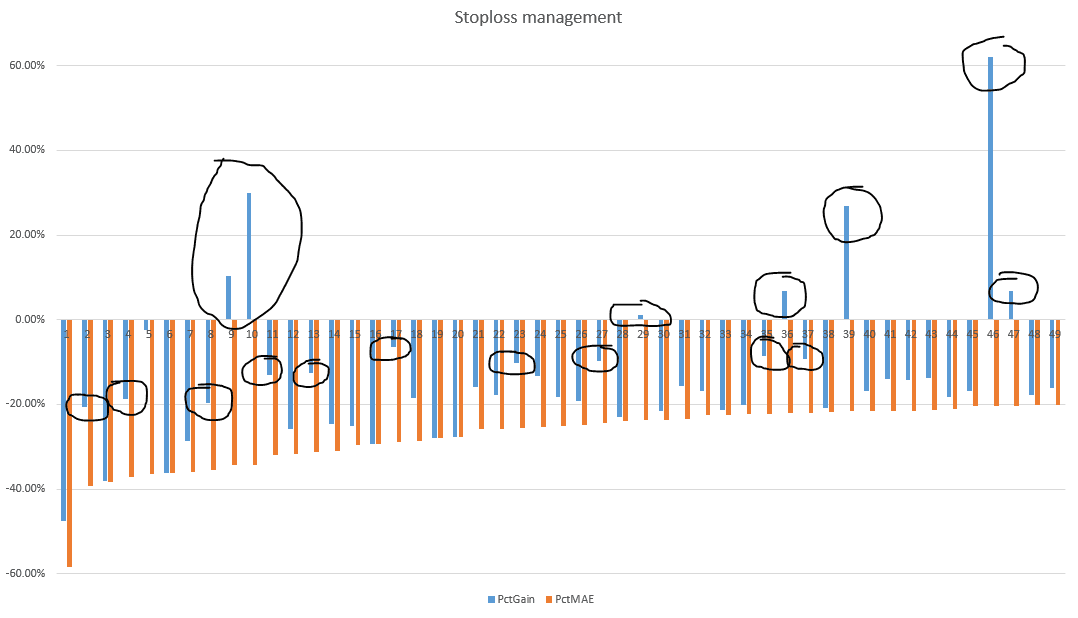

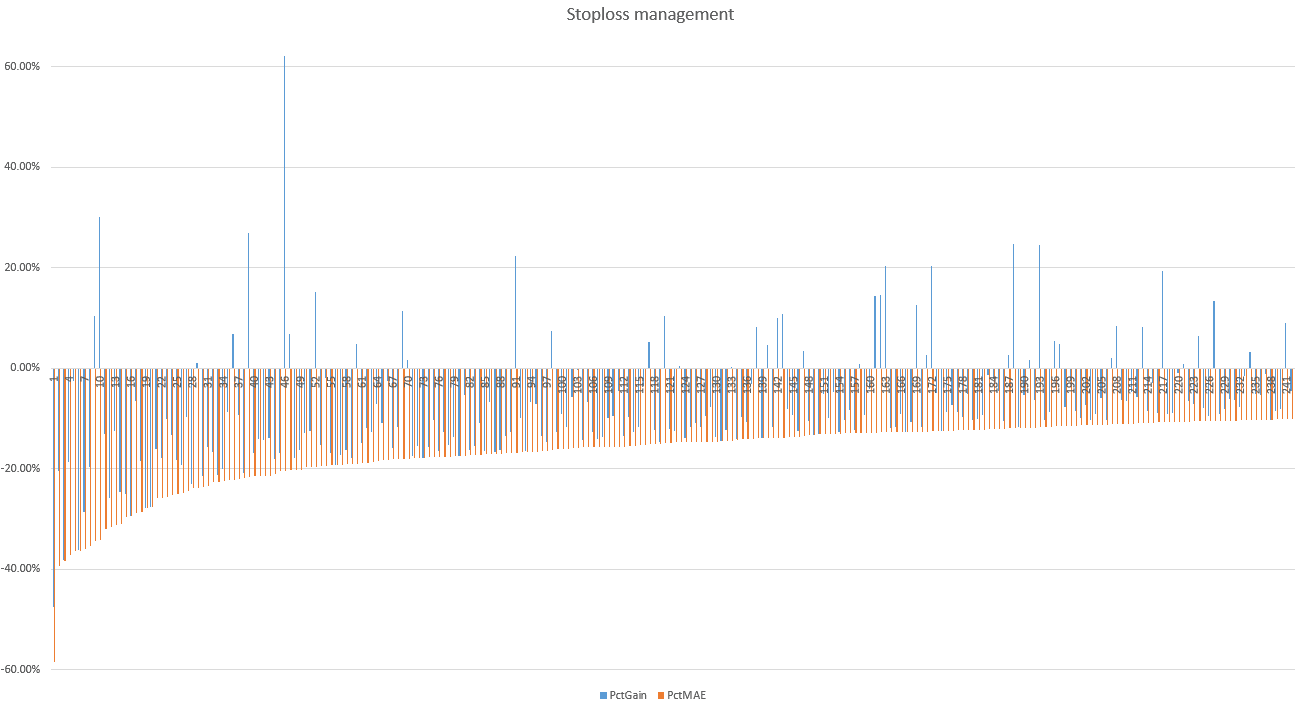

Maximum Adverse Excursion (MAE) Analysis

To understand how stop losses affect strategy performance, we use Maximum Adverse Excursion (MAE) – the largest loss suffered by a trade while it is open.

The Surprising Finding

Looking at our momentum breakout strategy, we found something counterintuitive: trades experiencing severe temporary losses (exceeding -20%) frequently recovered and ended profitably or with minimal losses.

This demonstrates that markets tend to revert during extreme moves, making premature exit strategies counterproductive.

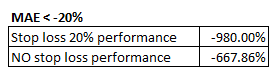

Performance Comparison

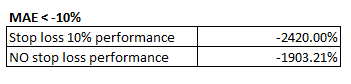

We tested the same strategy with and without stops:

The results were striking:

- 20% Stop Loss: Would have resulted in 46% more losses than no stop loss

- 10% Stop Loss: Would have resulted in 27% more losses than no stop loss

Even stopping out on trades that eventually declined to -20%, -30%, or lower, the stop loss strategy underperformed.

Why Stops Hurt Mean Reversion

Mean reversion works by buying "oversold" assets. But how do you know when oversold becomes "more oversold"? You don't.

A mean reversion trade that goes against you may simply be offering a better entry. A stop loss forces you to exit when you should be holding (or adding).

When Stop Losses Help

Trend Following

Trend following REQUIRES stops. The strategy is based on cutting losers quickly.

With stops: Many small losses, occasional big wins = Profitable Without stops: Few big losses wipe out all gains = Disaster

Breakout Trading

Similar to trend following – you need to exit failed breakouts quickly.

High Leverage

If you're using significant leverage, stops prevent catastrophic losses.

Shorting

When shorting, using stop losses as protective measures against "black swans" makes sense.

Better Risk Management Approaches

If not stop losses, then what?

1. Portfolio-Level Risk Management

Instead of individual trade stops, manage risk at the portfolio level. Diversify across uncorrelated strategies.

2. Position Sizing

Risk less per trade. If a 20% adverse move is acceptable, size your position so that 20% move = 1-2% of account.

3. Proper Exit Strategies

Develop exit strategies based on research, not arbitrary price levels. Time stops, trailing stops, or indicator-based exits.

4. Reconsider Leverage

If you need tight stops to manage risk, you may be using too much leverage.

The Middle Ground

Some traders use a "catastrophe stop" – a very wide stop that only triggers if something is fundamentally wrong:

- Normal trade: No stop

- Catastrophe stop: 25-30% below entry

This protects against true disasters while avoiding whipsaws.

Conclusion

"Always use a stop loss" is not universal truth. Stop loss functions as risk management rather than exit strategy.

The right approach depends on:

- Your strategy – Trend following needs stops; mean reversion may not

- Your timeframe – Shorter timeframes = tighter stops make sense

- Your position sizing – Smaller positions can survive without stops

- Your leverage – Higher leverage requires tighter risk controls

Proper research and risk management are essential for sustainable trading success. Question everything – including the most repeated advice.

Pavel – Robuxio