Profit Targets Hurt Performance: Especially in Trend and Breakout Strategies.

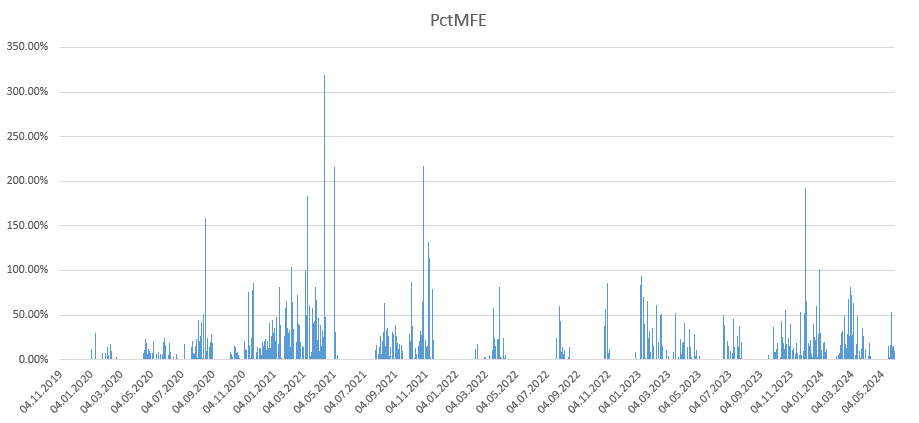

Maximum Favorable Excursion (MFE)

To understand why profit targets hurt performance, we need to look at Maximum Favorable Excursion (MFE) – the maximum amount of profit that was available while a trade was open.

This analysis helps us understand strategy characteristics and identify outliers – the big winning trades that make directional strategies profitable.

The Profit Target Paradox

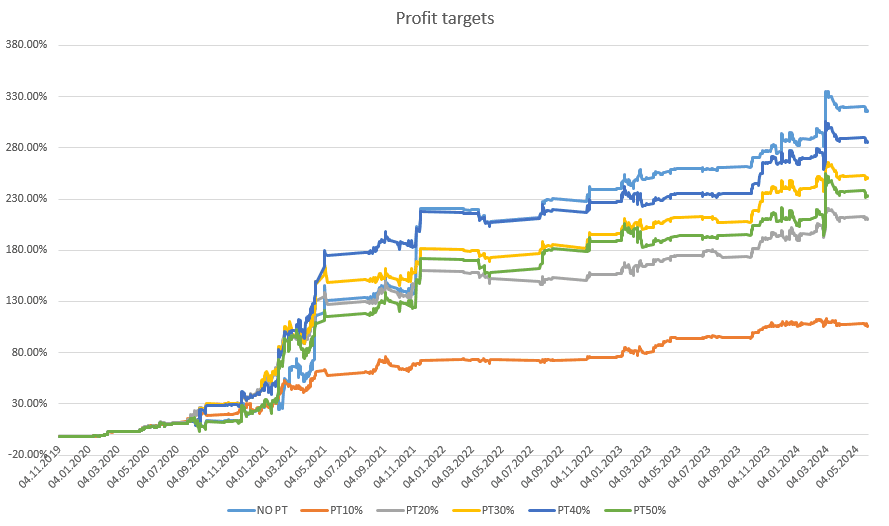

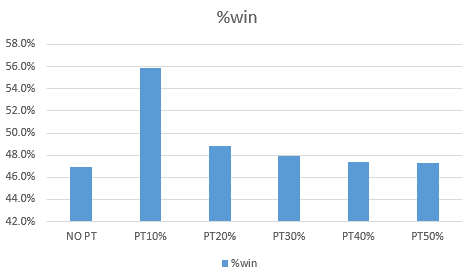

Here's the paradox: while profit targets increase win rate stability, they damage overall returns.

In our Momentum Catcher strategy example:

- A 10% profit target boosted win percentage by 20%

- But it reduced overall performance by 65%

Why? Because directional strategies succeed by capturing major outlier moves. These are the trades that turn a losing month into a winning year. Artificial profit targets cap these opportunities.

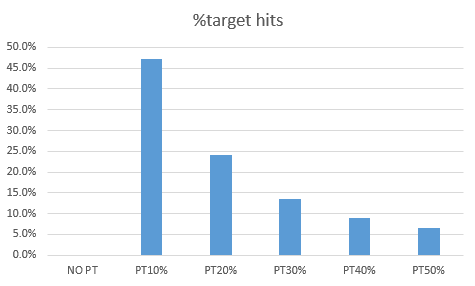

Diminishing Impact of Larger Targets

Larger profit targets have less influence on strategy performance because they're hit less frequently. A target that's only hit 6% of the time provides minimal value – you're barely affecting the strategy at all, but you're still capping your best trades.

Why Profit Targets Contradict Directional Strategies

The core philosophy of trend following and breakout trading is simple: cut losers quickly, let winners run.

Profit targets directly contradict "let winners run." You're artificially constraining your profitable opportunities when the market is doing exactly what you predicted.

Think about it:

- BTC 2020-2021: 10x+ move

- ETH 2020-2021: 15x+ move

- SOL 2020-2021: 100x+ move

A 2x profit target captures 2x. Letting it run captures 10x-100x. The math is clear.

Better Exit Alternatives

Instead of rigid profit targets, consider these approaches:

For Trend and Longer-Term Strategies

Trailing exits – Let the market tell you when the trend is over. A trailing stop follows the price up and exits when momentum reverses.

For Shorter Timeframe Strategies

Winning trade exits – Exit based on specific price action or indicator signals rather than arbitrary percentage targets.

For Momentum Strategies

Time stops – Exit after a certain period. This works well for short-term momentum because the strategy is designed to capture quick moves.

When Profit Targets Make Sense

Mean Reversion

Mean reversion trades expect prices to return to normal, not continue trending. Small profit targets (1.5x-2x) align with this expectation and can improve performance.

Scalping

High-frequency strategies need quick exits. Profit targets help manage rapid position turnover.

Psychological Comfort

If you psychologically cannot handle giving back open profits, a wide profit target (5x+) may help you stay in trades longer than you otherwise would.

Conclusion

Exit logic should align with entry logic. Since markets remain unpredictable, rigid profit targets undermine directional strategy potential by artificially constraining profitable opportunities.

Profit targets feel good psychologically – you're "locking in" gains. But for trend and breakout strategies, they systematically hurt performance by cutting your best trades short.

The hardest part of trading isn't finding good entries. It's staying in winning trades long enough to let them become big winners.

Let your winners run.

Pavel – Robuxio