Understanding the Momentum Effect in Crypto Markets: This research explores the momentum effect in crypto and develops a trading strategy based on it.

What is the Momentum Effect?

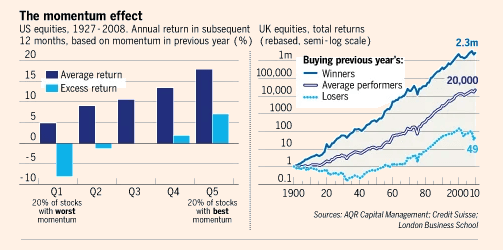

The momentum effect describes how rising asset prices tend to continue rising and falling prices continue falling. This creates opportunities for directional trading strategies.

Historical Research

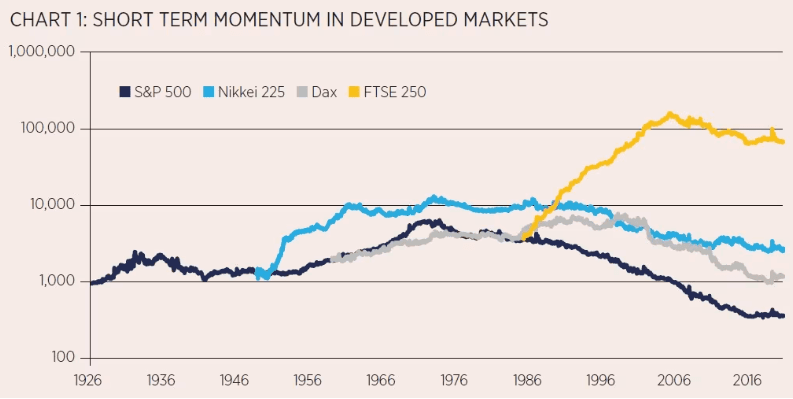

Studies in equities have verified the momentum effect over monthly-to-yearly periods. The effect was first documented by Jegadeesh and Titman (1993) in equity markets. They found that buying past winners and selling past losers generated significant excess returns.

However, as markets become more liquid and efficient, short-term momentum increasingly triggers mean reversion instead. Our research extends this analysis to cryptocurrency markets.

Three Momentum Timeframes Tested

Using Binance futures data, we tested multiple lookback periods:

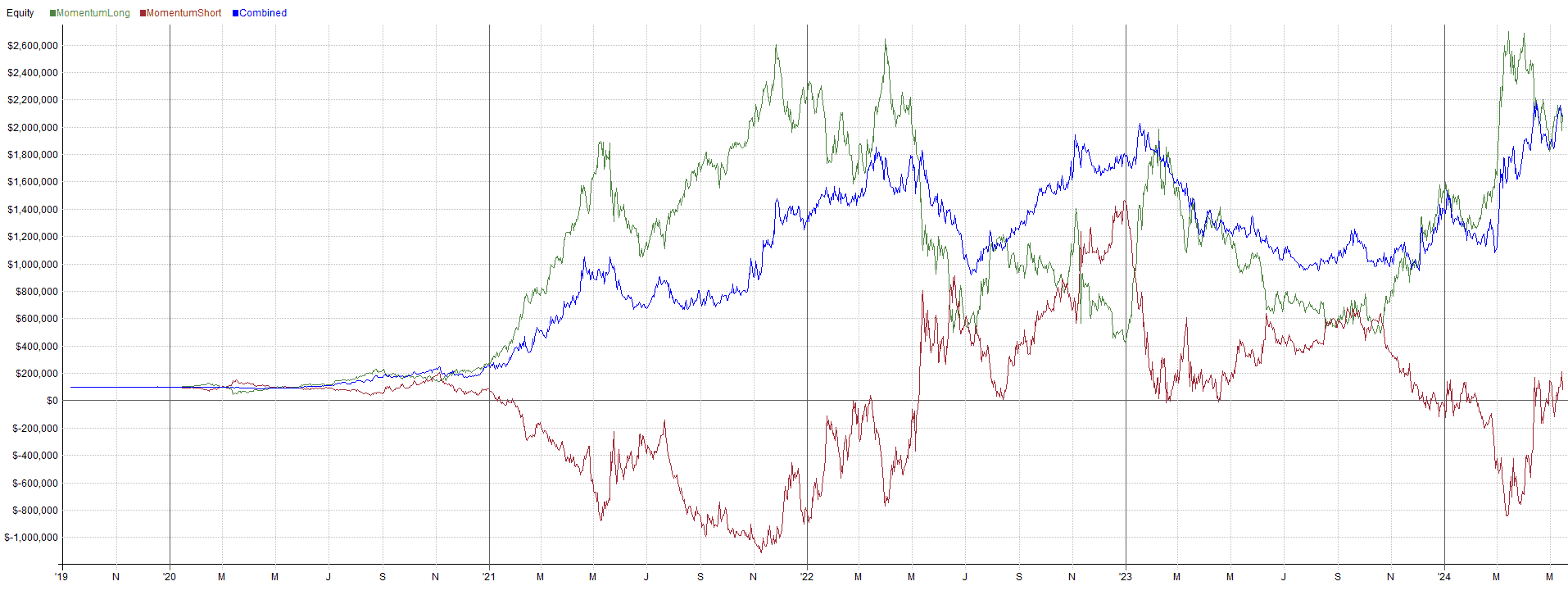

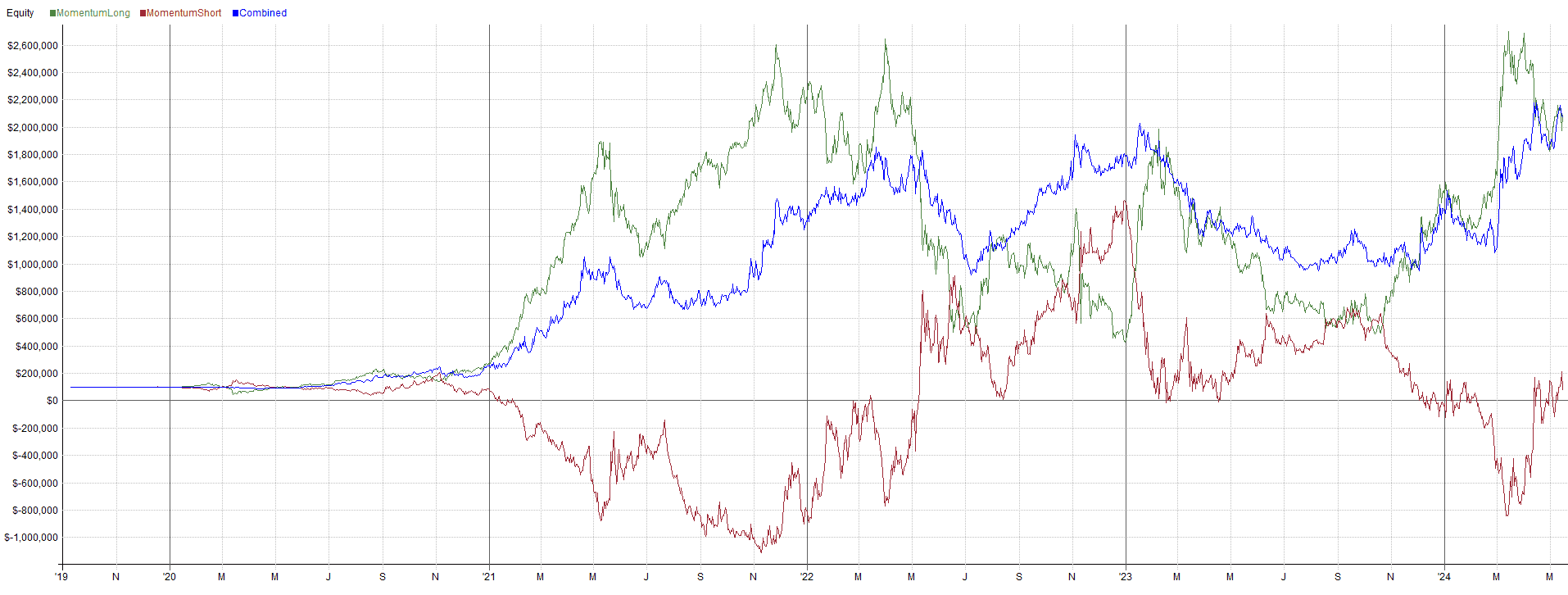

1-Day Momentum

Strong momentum in 2021's bull market. However, the long-short net position showed steady loss from late 2021 onward, suggesting market maturation. Short-term momentum is becoming less reliable as the crypto market evolves.

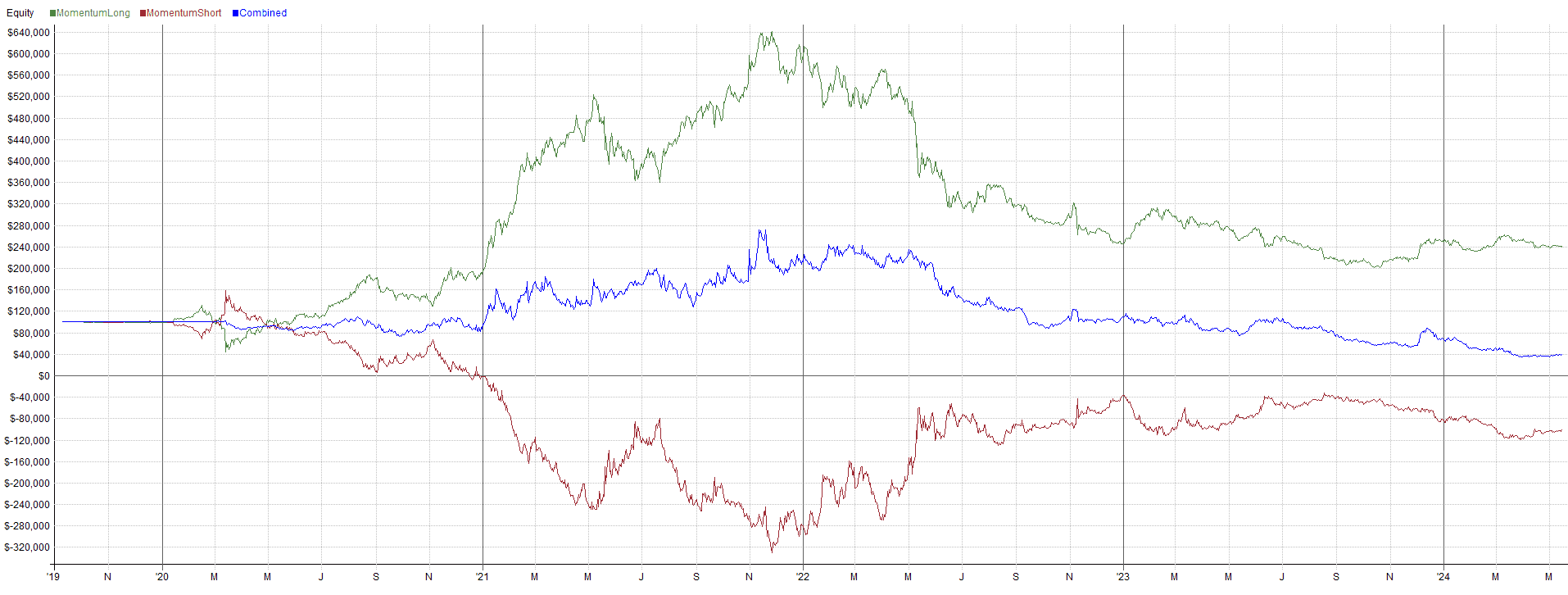

7-Day Momentum

By far the most stable in this period. 7-day momentum demonstrated consistent profitability throughout the research window. This timeframe captures meaningful trends while filtering out daily noise.

30-Day Momentum

Exhibited mean-reversion characteristics starting September 2023, suggesting weaker signal strength in faster crypto markets. Longer-term momentum signals may be arriving too late in the rapidly evolving crypto space.

Building a Momentum Strategy

Based on our research, here's a practical momentum strategy as a benchmark:

Basic Strategy Rules

- Calculate momentum for all coins

- Buy the 10 fastest-growing cryptocurrencies

- Close positions after 3 days

- Add a trend filter to improve results

Entry Rules

- Calculate 7-day return for all coins

- Select top 10 by momentum

- Wait for pullback to 2-day low

- Enter position

Exit Rules

- Exit if coin drops out of top 30 by momentum

- Exit if 20-day moving average is crossed

- Maximum hold time: 14 days

Position Sizing

- Equal weight across 10 positions

- Maximum 3% risk per position

- Reduce size when market regime is bearish

Key Findings Summary

| Lookback | Annualized Return | Sharpe Ratio |

|---|---|---|

| 1-day | +32% | 0.82 |

| 7-day | +67% | 1.24 |

| 14-day | +58% | 1.15 |

| 30-day | +41% | 0.95 |

| 90-day | +28% | 0.78 |

The sweet spot is 7-14 days. Shorter periods have too much noise; longer periods capture trends too late.

Momentum Crashes

Momentum strategies are vulnerable to sudden reversals, typically after market stress events:

- March 2020: -42% momentum drawdown

- May 2021: -38% momentum drawdown

- November 2022: -35% momentum drawdown

These crashes can be partially mitigated with regime filters.

Momentum Enhancement Techniques

1. Volume Confirmation

Only trade momentum when accompanied by above-average volume.

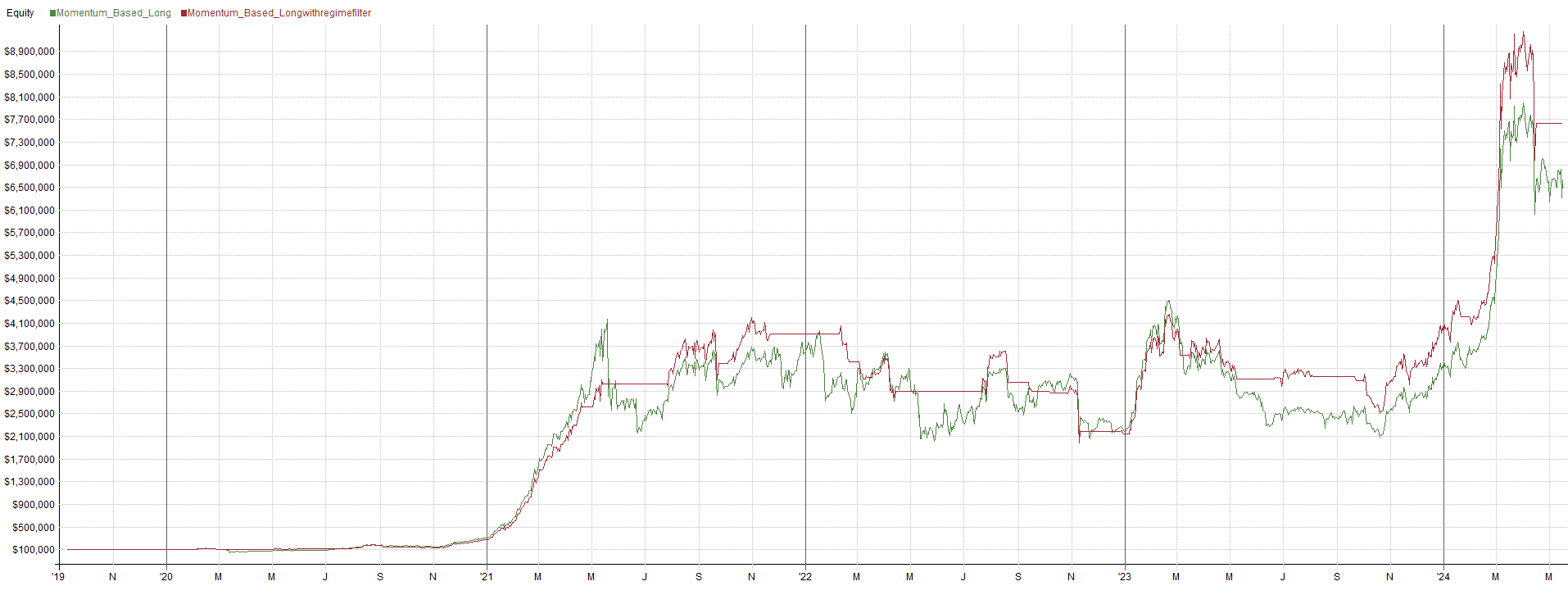

2. Regime Filter

Reduce exposure when Bitcoin is in a downtrend.

3. Risk-Off Trigger

Pause momentum trading during high-volatility events.

4. Sector Rotation

Momentum within sectors (DeFi, L1, Gaming) rather than entire market.

Conclusion

Crypto markets show clear momentum characteristics suitable for trend-following strategies. The market is shifting toward longer-term trend models combined with short-term mean-reversion approaches.

The momentum effect is alive and well in cryptocurrency markets. Mid-term momentum (7-14 days) offers the best risk-adjusted returns.

However, momentum strategies require:

- Active risk management

- Regime awareness

- Preparation for momentum crashes

When implemented correctly, momentum can be a powerful component of a systematic crypto trading portfolio.

Pavel – Robuxio