Short-term momentum struggled on small coins, while mean reversion performed well across both small and large coins. Momentum is stable on bigger coins. Learn more in this analysis.

Understanding Market Conditions

Different market conditions favor different trading strategies. By analyzing how various approaches perform across market caps and timeframes, we can better understand the current market regime.

Our Analysis Framework

We tested two fundamental trading strategies applied to different market segments:

Short-Term Momentum Long

This approach purchases coins showing recent price appreciation, betting on trend continuation.

Mean Reversion Long

This strategy buys coins that have deviated from their average price, anticipating a return to baseline levels.

Key Findings

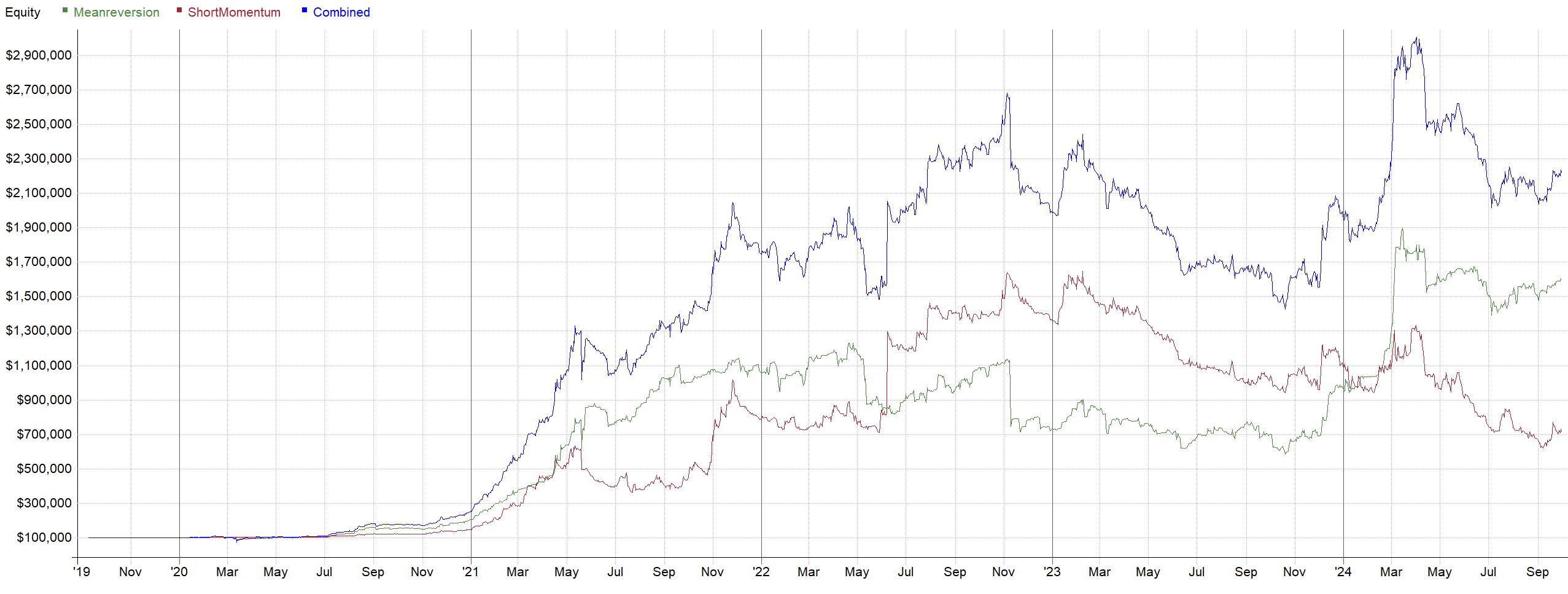

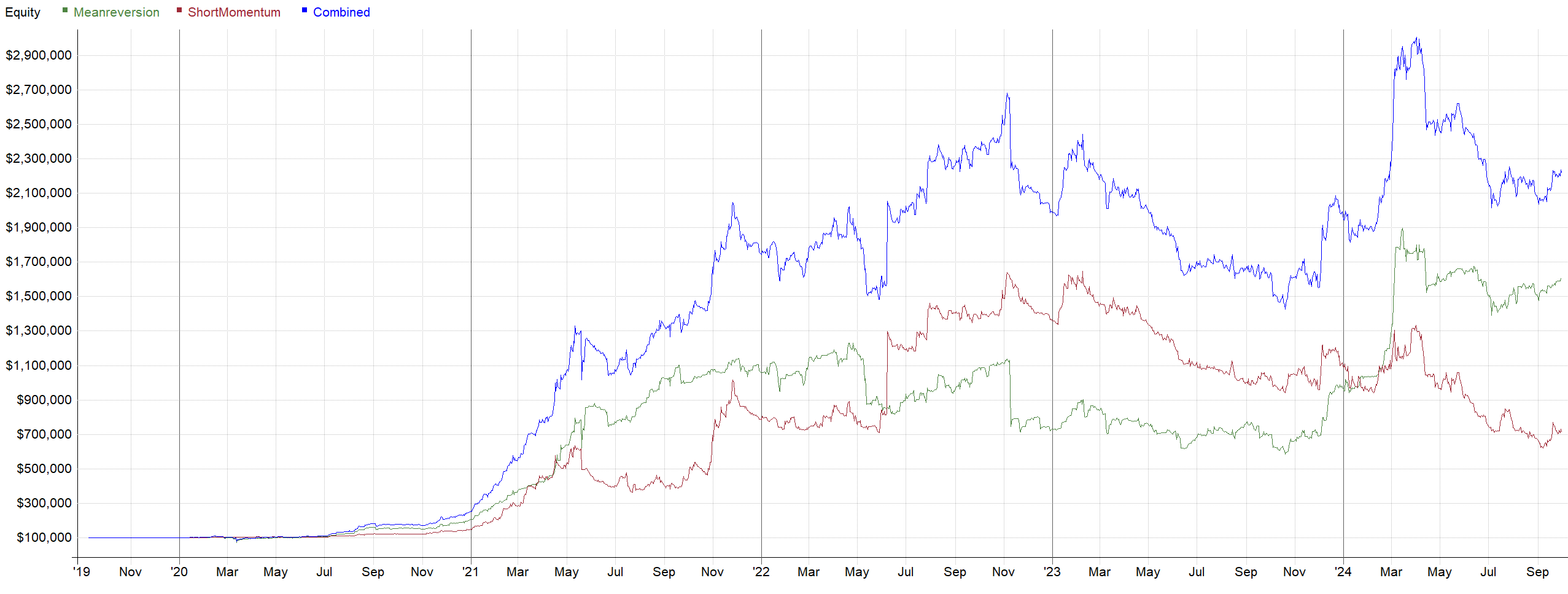

Top 20 Coins by Volume

Short-term momentum had a hard time on small coins this year. The strategy struggled to generate consistent returns in the smaller cap segment.

Mean reversion demonstrated strong results across both asset sizes, proving to be a more reliable approach regardless of market cap.

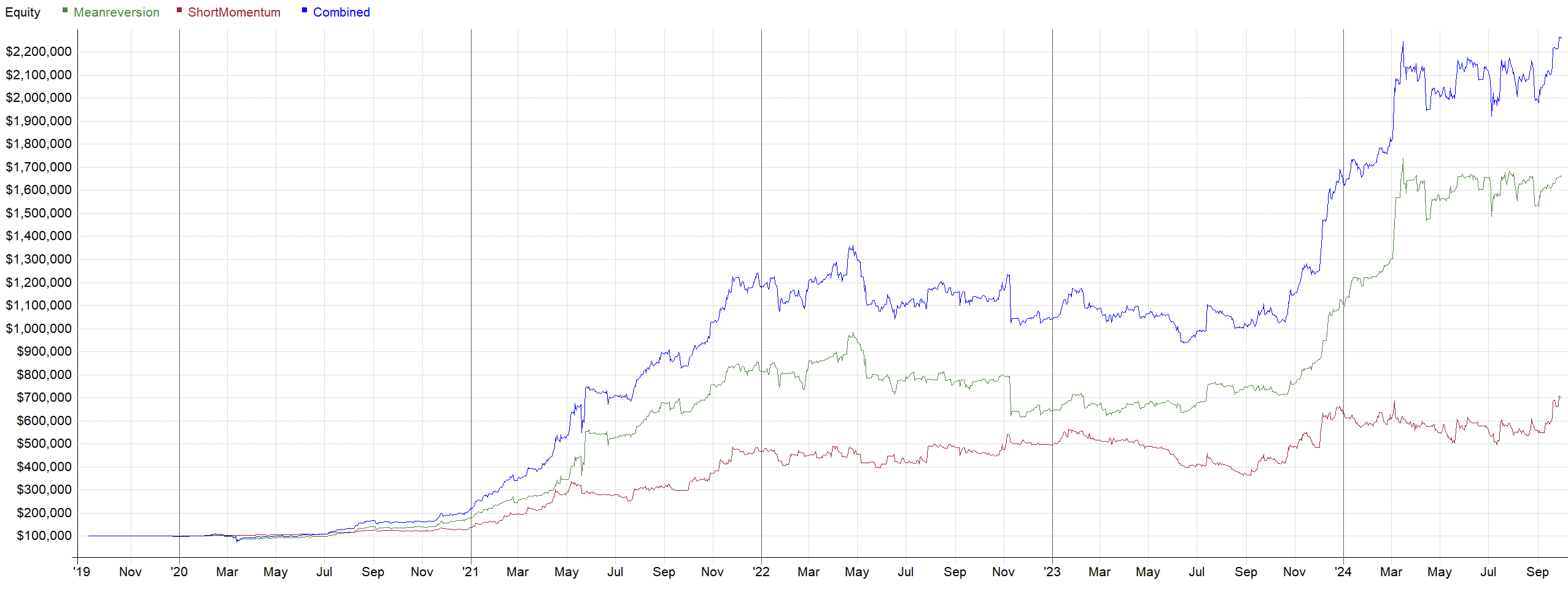

Entire Crypto Futures Market

Mean reversion continued performing well on both large and small coins. The strategy's edge persisted across the entire tradable universe.

Momentum showed greater stability specifically in higher-capitalization coins. Larger caps provide more liquidity and more reliable trend signals.

What This Means for Traders

In Current Conditions:

- Focus momentum strategies on large caps - More reliable signals, better liquidity

- Use mean reversion on oversold opportunities - Works across the board

- Be cautious with small-cap momentum - Higher noise, more whipsaws

- Diversify approaches - No single strategy dominates in all conditions

Regime Indicators

Signs the market may be shifting:

- Momentum performance divergence between large and small caps

- Mean reversion becoming less effective (strong trending market)

- Increased correlation across all assets

Practical Application

For Large-Cap Trading:

- Continue using momentum strategies

- Look for established trends on 7-30 day timeframes

- Add mean reversion for oversold bounces

For Small-Cap Trading:

- Prioritize mean reversion over momentum

- Avoid short-term momentum signals

- Wait for strong trend confirmation before following

Important Note

These models exclude fees and slippage. Robuxio trades a broader universe for enhanced volatility opportunities but requires patience.

Conclusion

Market conditions constantly change, and successful traders adapt their approach accordingly. By monitoring how different strategies perform across market segments, you can better position your portfolio for current conditions.

The key insight: what works on large caps doesn't always work on small caps, and vice versa. Tailor your approach to the specific market segment you're trading.

Pavel – Robuxio