At Robuxio, we apply an all-weather(under any market conditions) approach to trading crypto with robust, uncorrelated strategies.

Institutional and retail clients use these strategies within our automated portfolio trading service:

Robuxio’s Strategy Groups

Trend Strategies

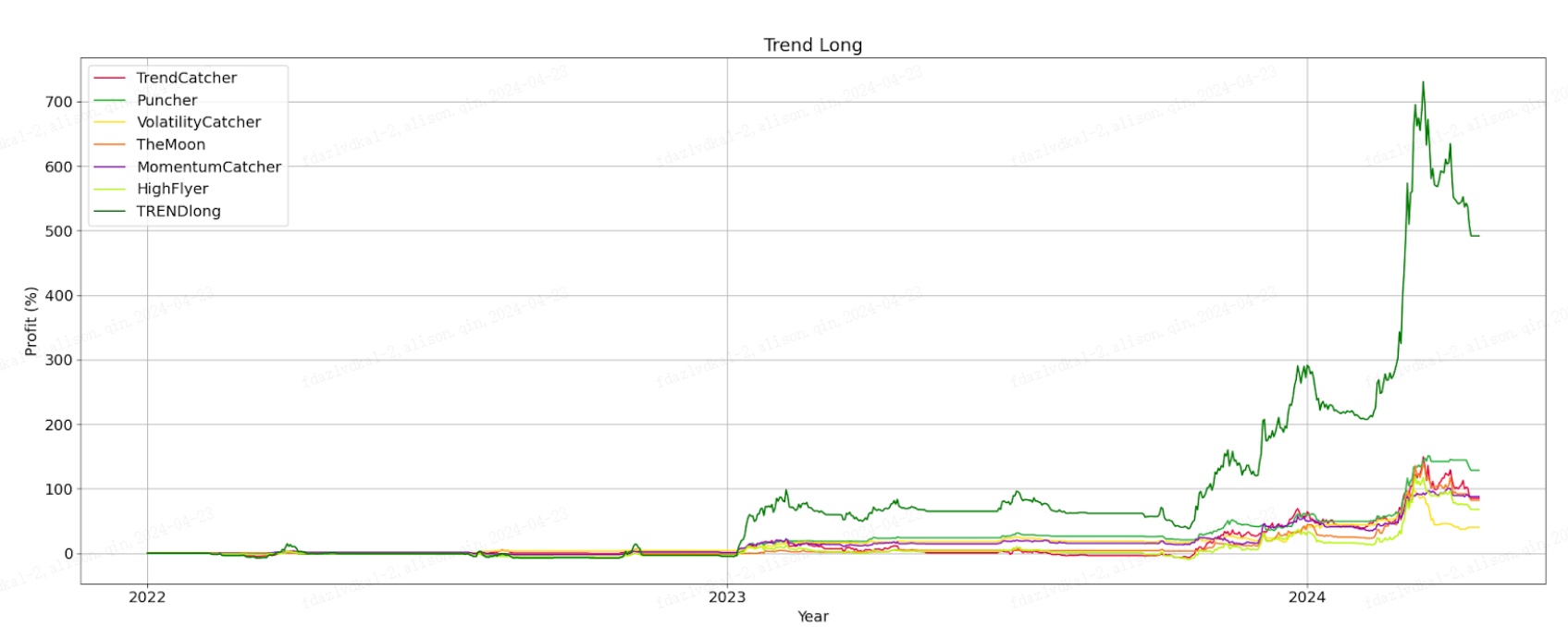

Trend strategies are most effective during strongly rising or falling market phases. If such a phase lasts for months, these strategies can appreciate by hundreds of percent. Profitable trades typically last for weeks or months, and losing trades are closed quickly.However, trading these strategies on a stand-alone basis is challenging because they can have extended periods where they underperform and managing them is mentally demanding.

But when these strategies perform well, it’s an exhilarating ride! And our portfolios soar!

Long Trend Strategies: The Money Makers

These strategies are the real money makers capitalizing the potential of crypto as an exponential asset from the long side.

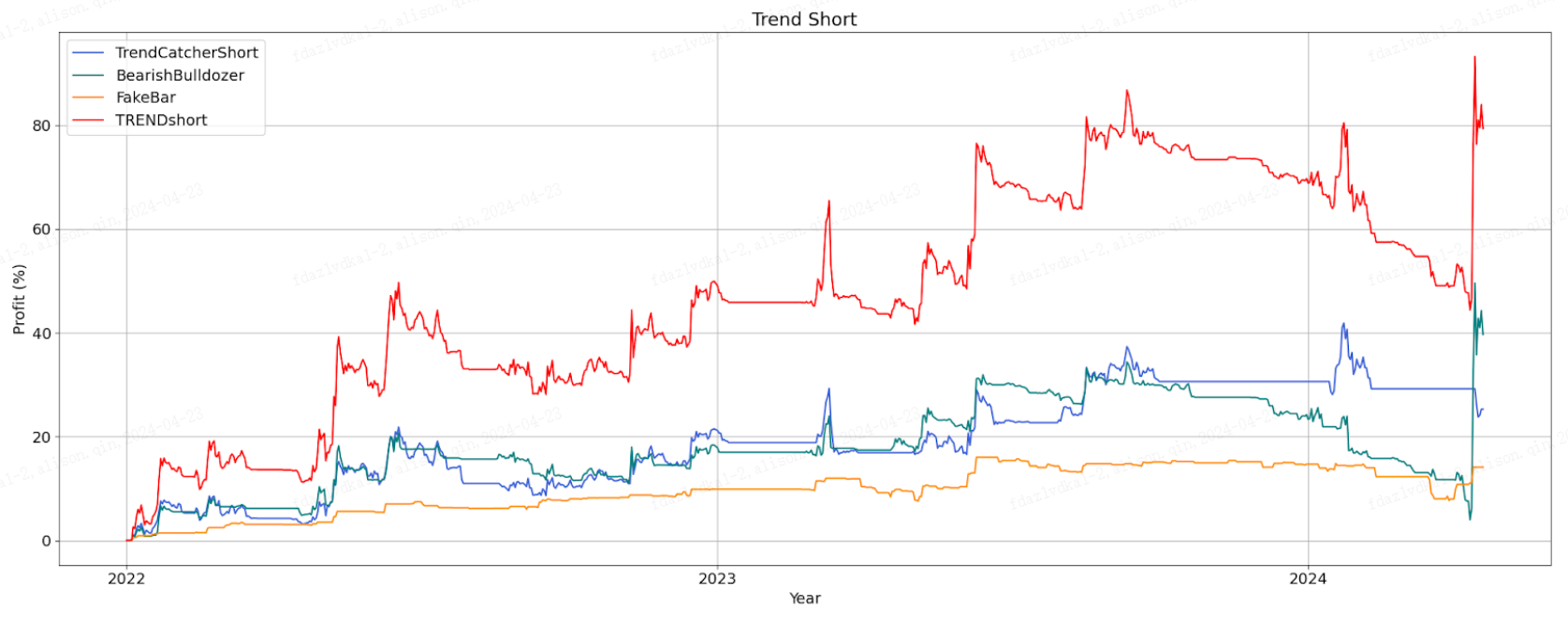

Short Trend Strategies: The Hedgers

Yes, they earn money in bear markets. However, their primary setup is to hedge the portfolio against strong and rapid declines.

Losing in strong trends is essentially their job.

As you can see the short trend strategies hedged very well against the sudden market drop we experienced the week before making this chart.

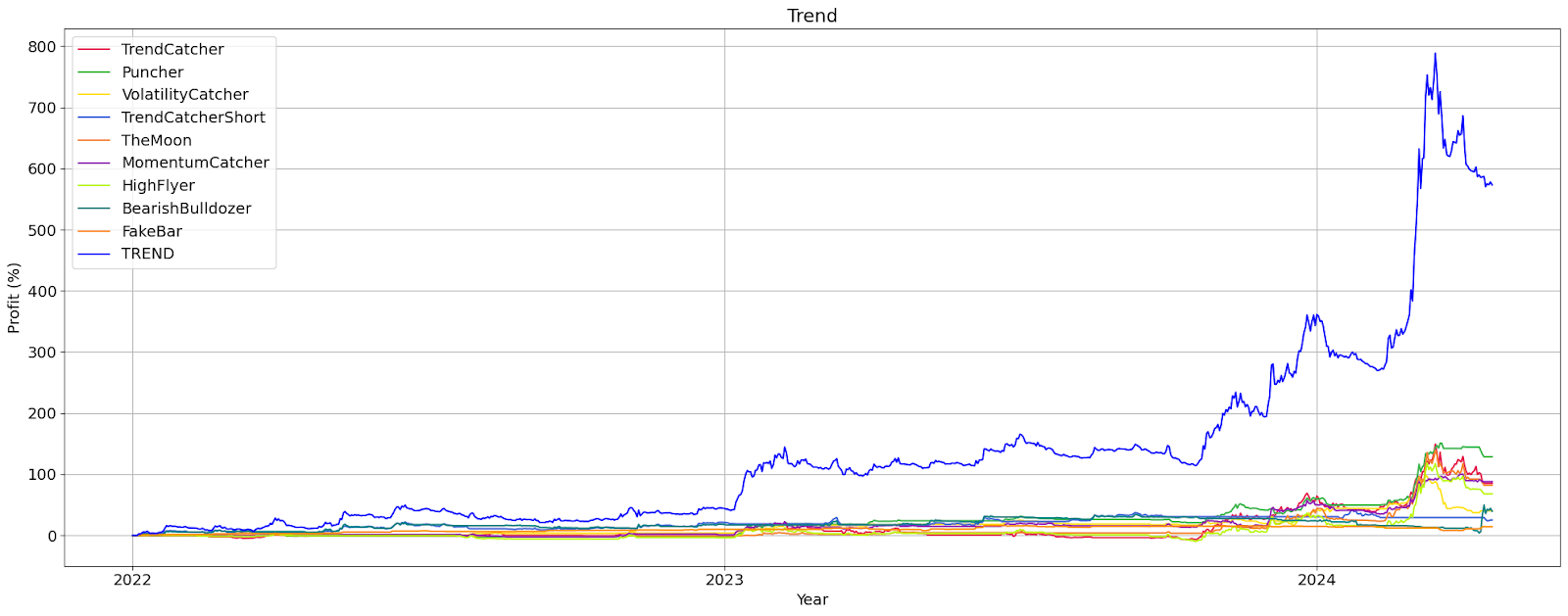

The Backbone of Our Service: Trend Portfolio

However they have one drawback: they require extended market movements to generate profits, which are not that common.

As a result, their performance can be quite volatile.

MR (Mean Reversion) Strategies

That is why we also include mean reversion strategies in our portfolio. They profit from short-term inefficiencies and strong market overreactions.

Even a market moving sideways is sufficient for them to generate profits.

Here are examples of such trades:

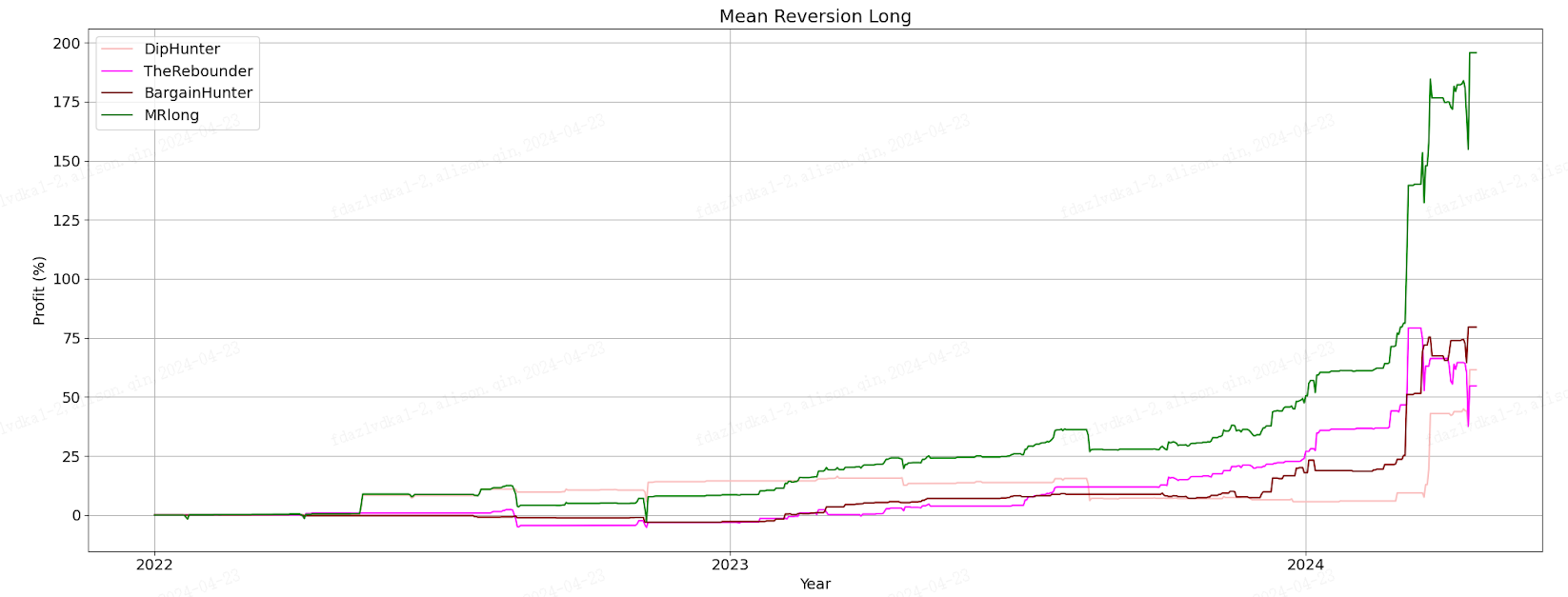

Long Mean Reversion Strategies:

Robuxio’s mean reversion strategies for the long side:

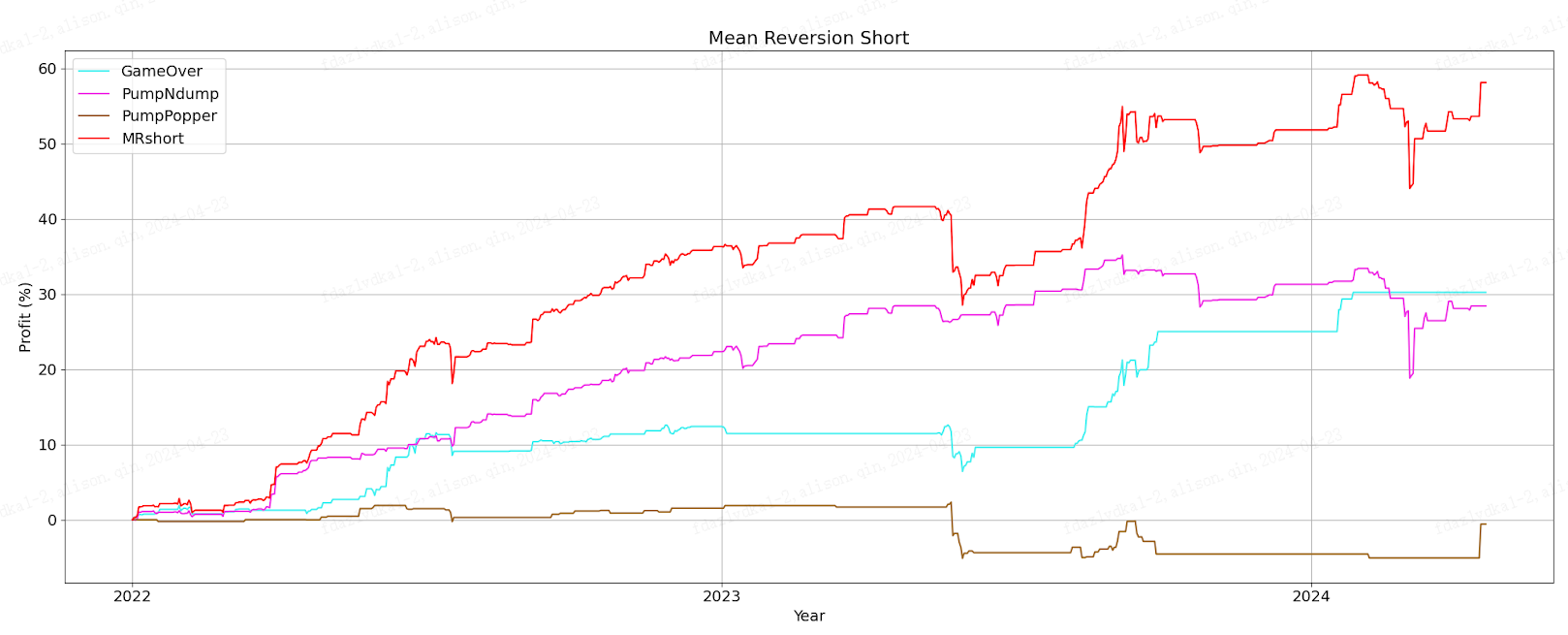

Short Mean Reversion Strategies:

The short mean reversion strategies also have specific roles within the portfolio:

a) Profiting from strong short-term overreactions on the long side.

b) Hedging our long trend strategies. In extreme cases, we open short-term short positions instead of closing profitable long positions that have the potential to continue rising.

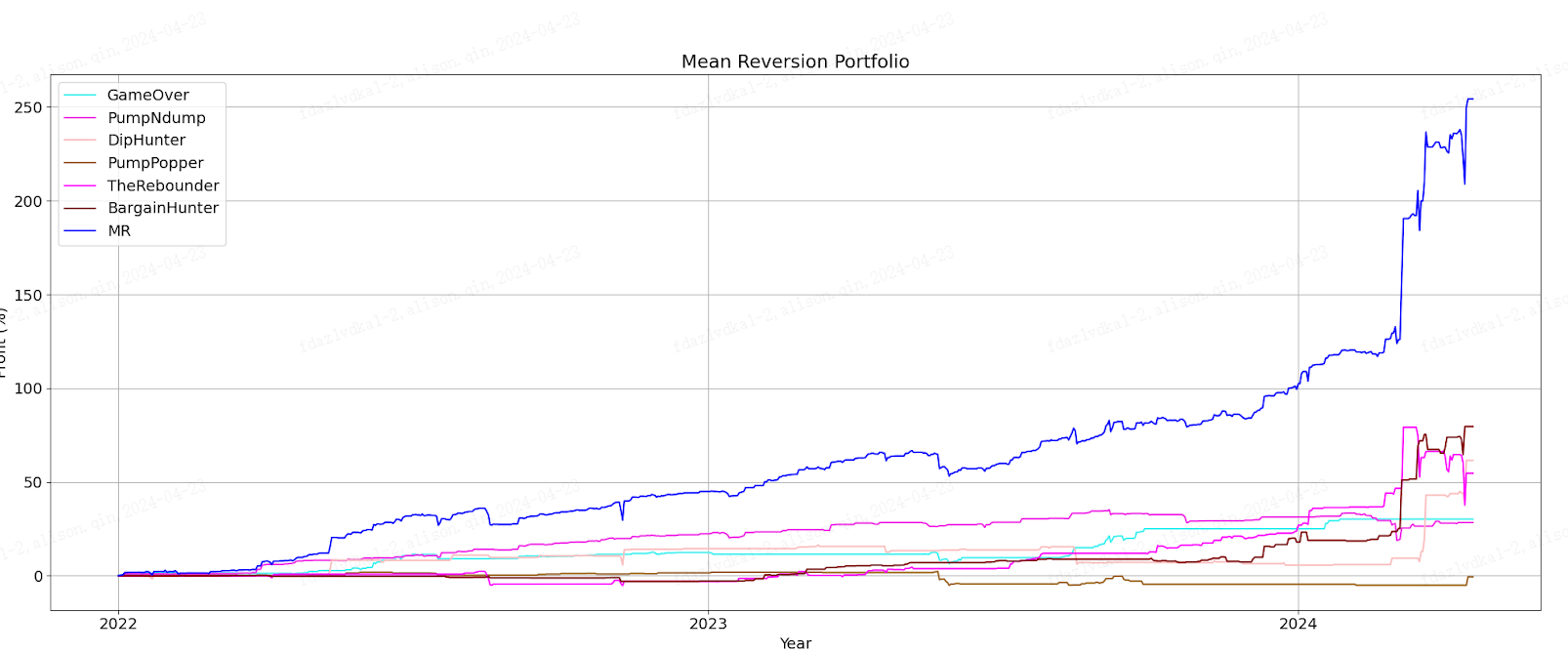

Mean Reversion Portfolio

Tracking the performance of mean reversion strategies collectively is beneficial. Often, long positions balance out short positions, and vice versa.

This sub-portfolio comprises solely mean reversion strategies:

As you can see, employing mean reversion strategies for both long and short positions significantly enhances stability.

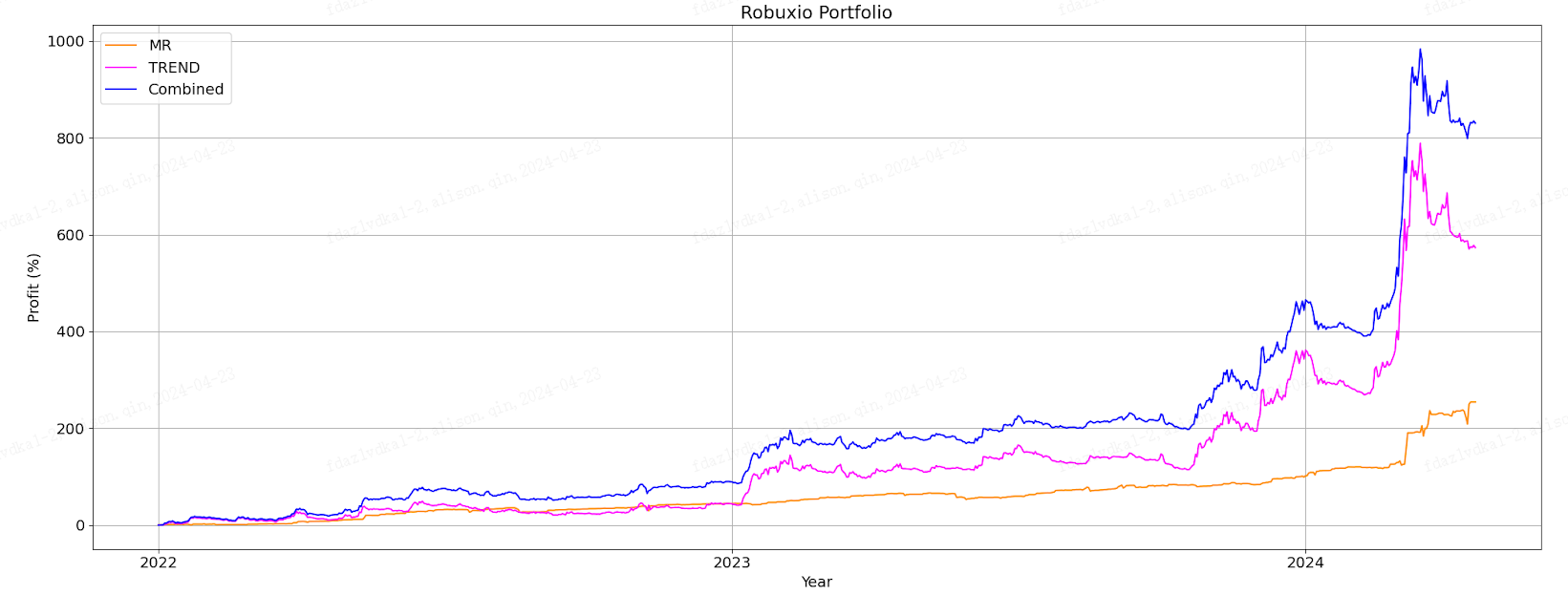

Portfolio

When the entire portfolio is considered:

- Trend strategies drive returns upward.

- Mean reversion strategies contribute to stability.

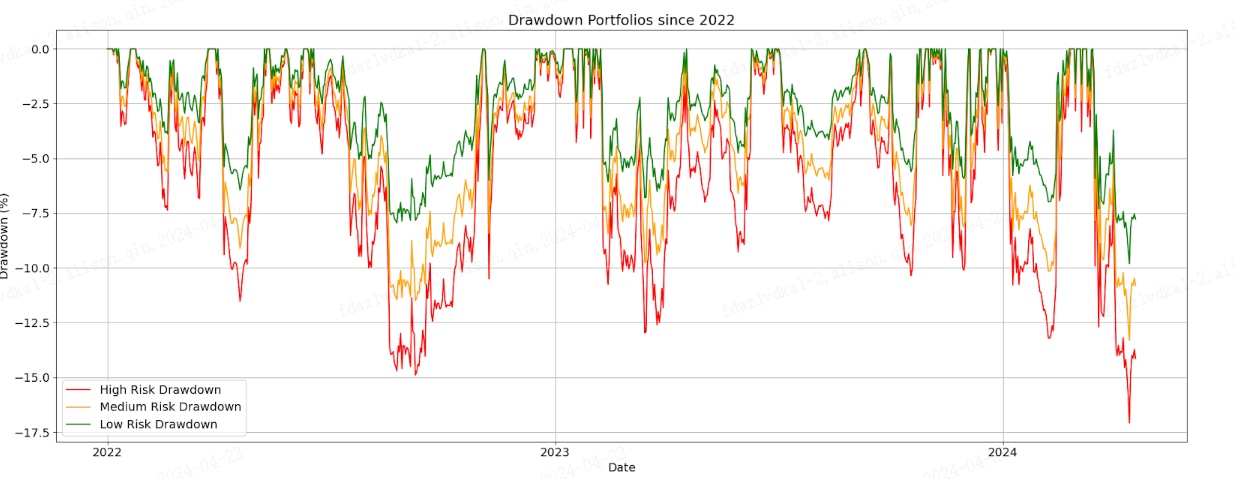

What’s the result? A portfolio that adeptly adjusts to market fluctuations, effectively minimizing drawdowns and stabilizing returns.

Portfolio resilience demonstrated in practice:

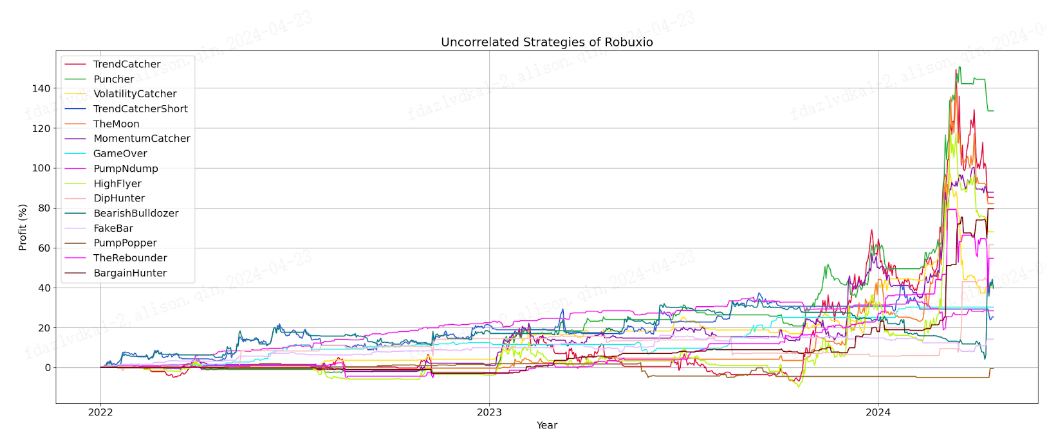

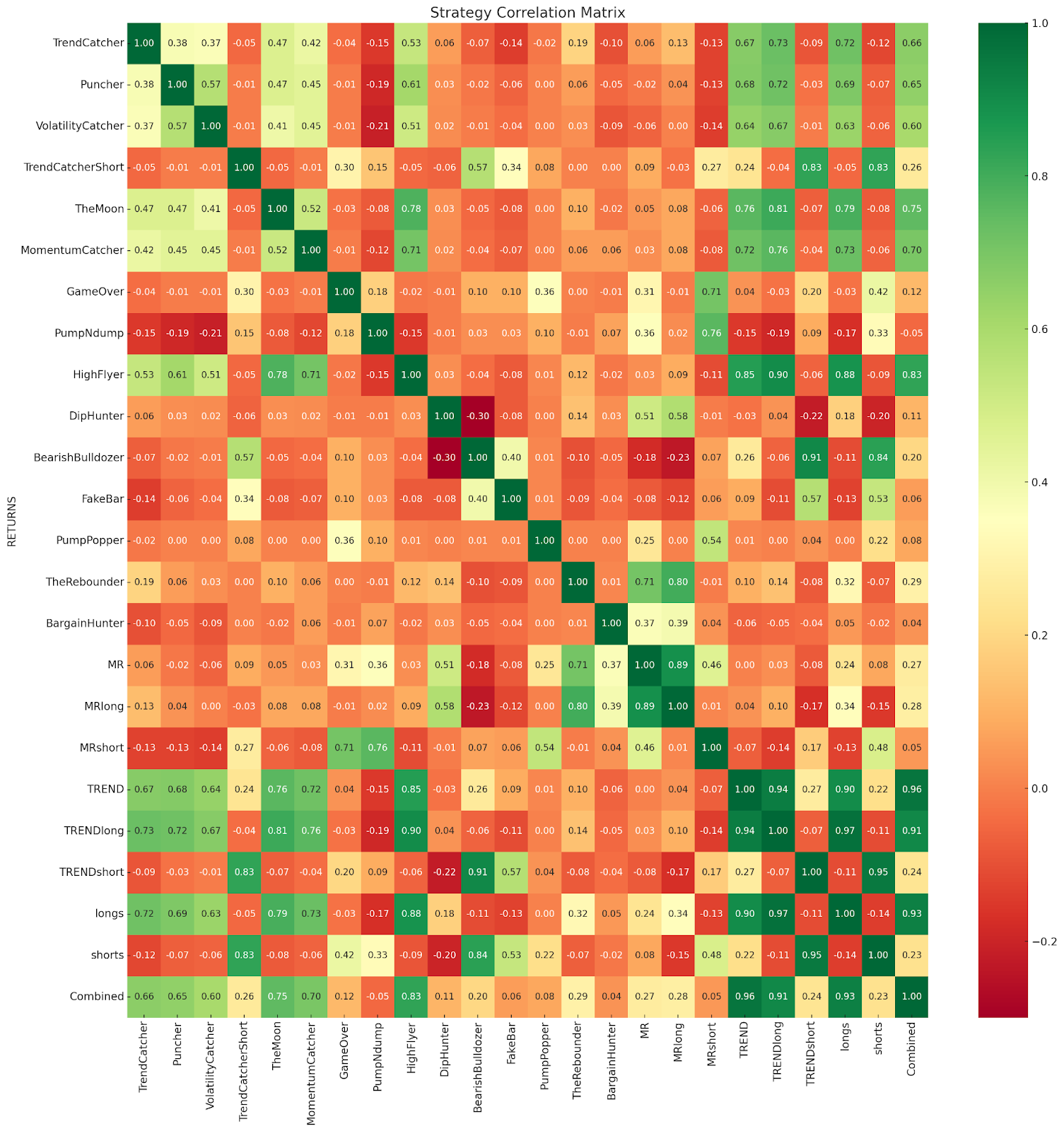

Correlation Among Strategies

As you know, within the same portfolio, we employ multiple strategies that realize profits at different times; this characteristic is known as being uncorrelated. The chart below illustrates this concept: a score of +1 indicates that the strategies profit simultaneously, 0 indicates they profit at distinct times, and -1 denotes that they profit at completely opposing market conditions.

The presence of more yellow and red in the chart is advantageous—it signifies that our strategies are effectively uncorrelated, providing us with a more consistent performance amidst the market’s fluctuations.

We are currently managing 15 such uncorrelated strategies, with each capable of trading up to 20 positions. This diversified approach allows us to spread the risk and increase the potential for returns across various market movements.

Instead of limiting ourselves to a set of roster of coins, we engage with all the liquid, tradable coins currently available. Consequently, we are always in a position to capitalize on new trends in the market.

Managing a portfolio of this complexity is a demanding endeavor. It requires an enormous and robust infrastructure to support automated trading of this scale — and that’s precisely the service provided by Robuxio.com.

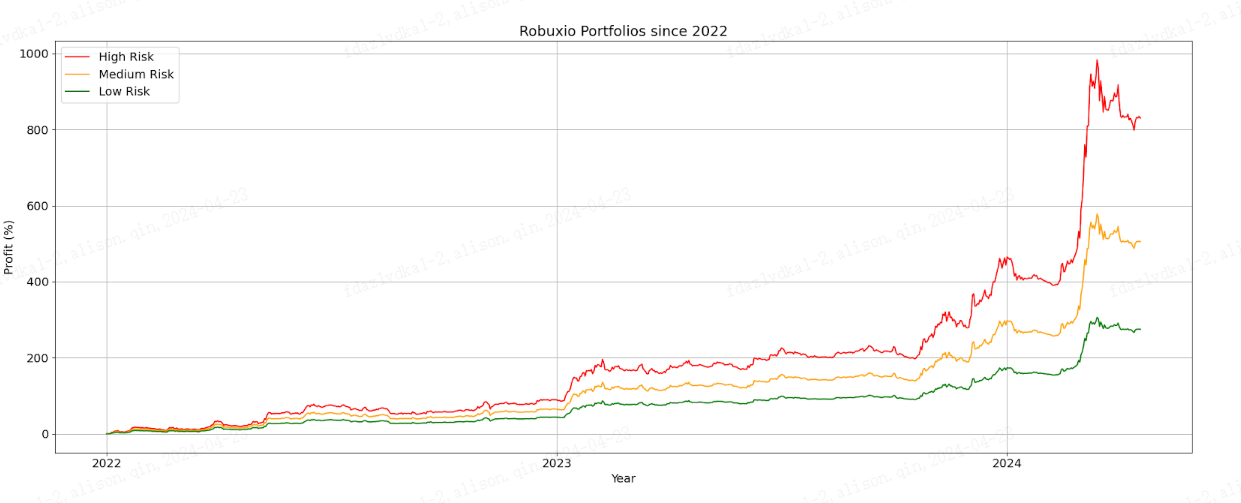

Tailored Risk Profiles

At Robuxio, we offer three portfolios:

- Low Risk

- Medium Risk

- High Risk

You may be curious about the distinctions between them.

While the trading signals remain consistent across all levels, the risk management strategy differs significantly.

The primary difference lies in the allocation of capital to each trade. As the risk level increases, the allocation to each trade also increases, resulting in a more concentrated portfolio. This means you have the same number of positions across all risk levels, but the impact of each trade on your account is more pronounced at higher risk levels.

The ‘High’ risk portfolio yields the highest potential profit, but it also incurs the greatest drawdown and daily volatility.

The ‘Medium’ risk portfolio aims for a balanced approach, with a moderate allocation to each trade to manage volatility.

The ‘Low’ risk portfolio has the smallest allocation to each trade, minimizing the impact of any single trade on the overall account. As a result, this level yields the lowest profit, but it also has the least volatility and drawdown.

This is the Robuxio way of trading – robust!

Imagine the following situation:

- We will explain all the details of our service in an online call or webinar.

- You choose to go subscription or performance based program.

- You connect your exchange account to our automated portfolio trading software via API.

- You choose your portfolio according to the volatility of the account you want to be exposed to.

- We will take care of the rest.

Ready to take the next step in your crypto trading journey? Explore our pricing plans.