It is repeated over and over again that stop loss is necessary. And those who trade without one are doomed. My opinion is different…

Stop Loss Hurts Performance

There are not many cases where the use of a stop loss adds an edge to a strategy. It almost always makes most parameters worse, except for the maximum loss. First to the basics…

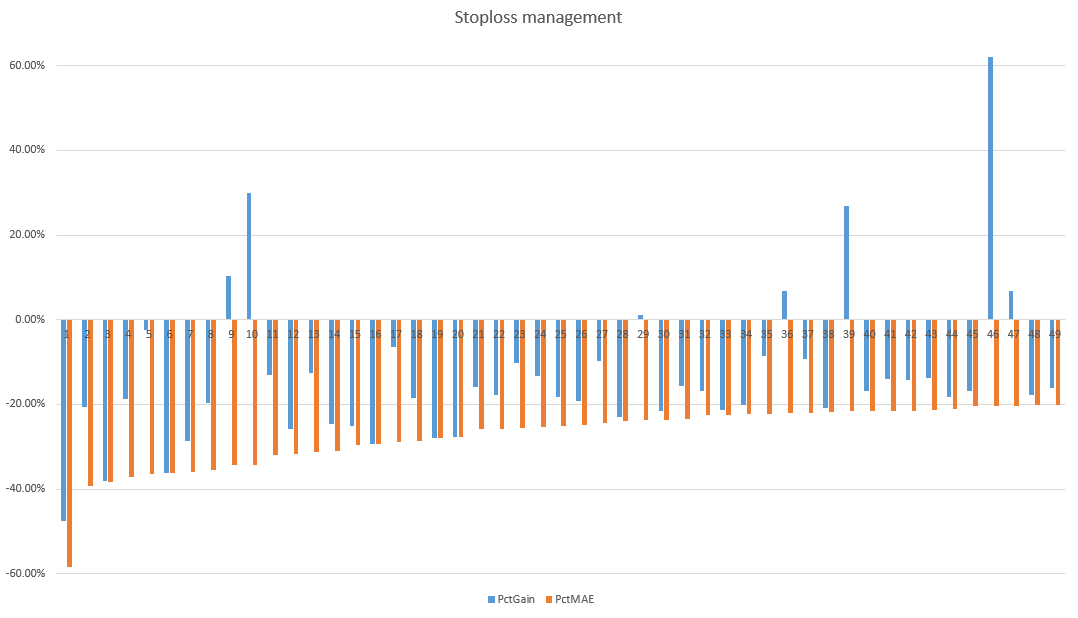

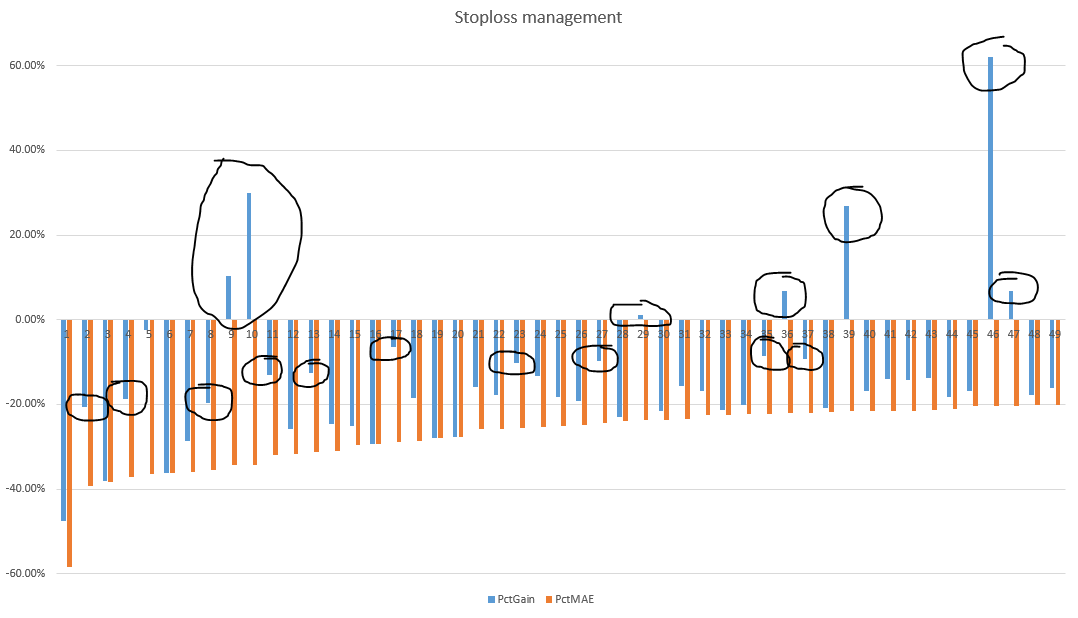

Maximum Adverse Excursion (MAE)

MAE measures the largest loss suffered by a trade while it is open. MAE analysis is key to understanding how your strategy works.

Specific example:

Momentum Catcher – breakout strategy to the long side

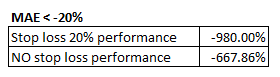

Let’s look at an MAE that is worse than -20%: Where did such trades close? Close to the MAE? Or did they tend to revert?

Trades with a High MAE Tend to Revert

Take another look at the chart. Many times these trades ended in a small loss or even in profit. Markets tend to revert in extremes.

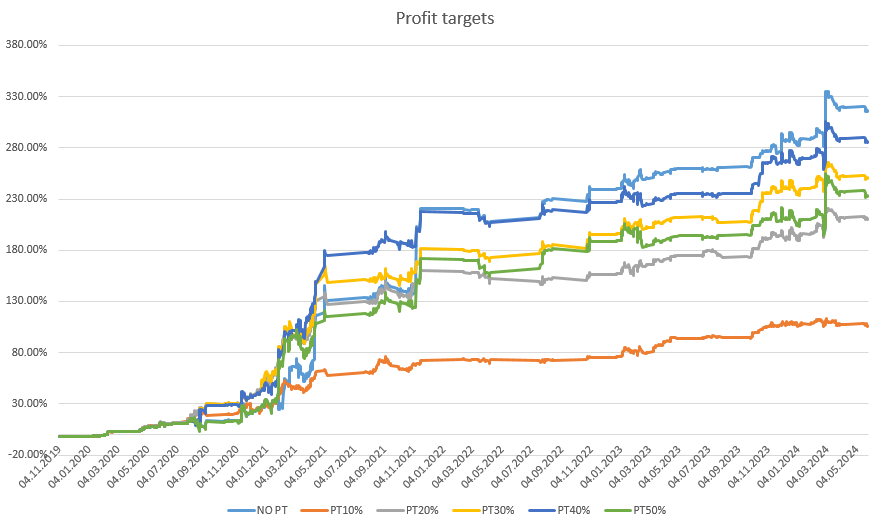

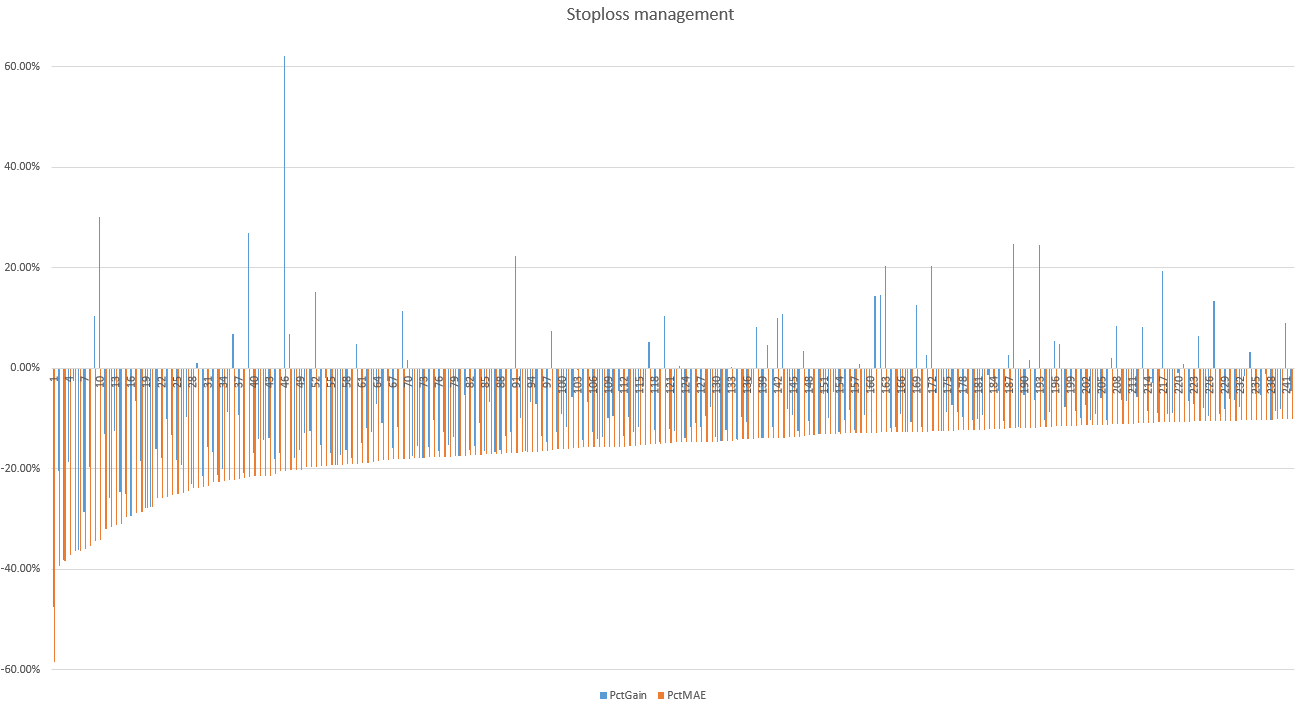

20% Stop Loss vs. NO Stop Loss

An amateur would decide: I’ll give the market 20%. Big mistake. With a stop loss, you would have lost 46% more.

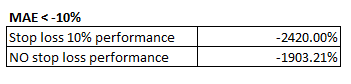

10% Stop Loss vs. NO Stop Loss

The next thought might be: the stop loss is too large. Let’s close the losses earlier and let the market grow.

Using a stop loss of 10% seems reasonable…

Stop Loss Doesn’t Work Here Either

You would have lost 27% more with a stop loss. Even though you potentially limited many trades that went as low as -20%, -30% or even lower. Still, it’s a worse result. Markets tend to revert in extremes.

Stop Loss is Just Another Form of Risk Management

Stop loss is only about risk management. You’re reducing the potential risk at the cost of worse results. There are better solutions. Especially if you’re trading a portfolio.

How/When to Use Stop Loss?

- If you can’t do anything else, use it. You have to manage risk somehow.

- Protection against black swans when you’re shorting. You can use some really wide stop loss to limit extreme losses.

- Trading with leverage. This is where it is significantly easier to go to extremes that can wipe out your entire account. Consider using leverage in general…

Always Manage Your Risk!

This article is not about a “buy and hope” strategy. It’s about showing there are smarter ways to manage risk. And it’s always worth thinking about risk in the first place. You can’t make money without proper risk management because you’ll lose it before you get a chance.

Have an Exit Strategy

Stop loss is a form of risk management, not exit management. There is almost always a better exit strategy than a stop loss.

Do your research properly.