Especially in case of trend and breakout strategies.

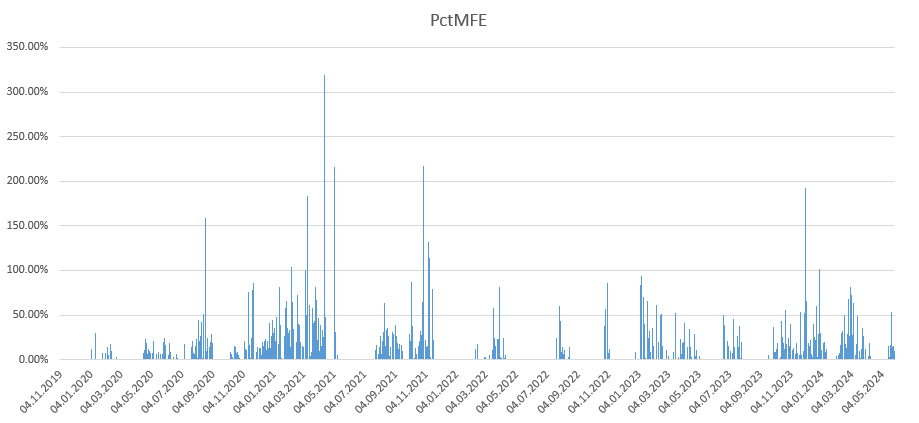

1) Maximum Favorable Excursion (MFE)

Definition: The maximum amount of profit that was available while a trade was open.

Why is MFE analysis important?

To understand the strategy characteristics.

It shows the number of major outliers and the potential of the strategy.

The MFE chart below is for the Momentum Catcher strategy. We will analyze it further.

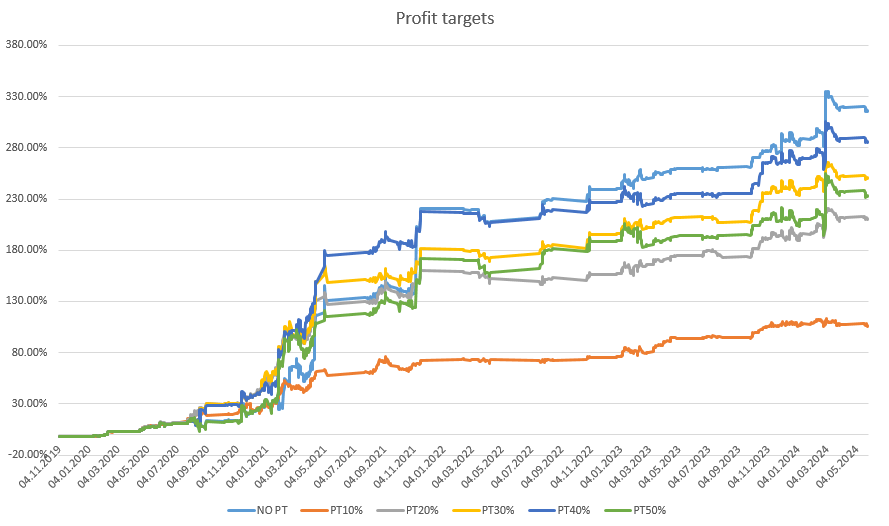

2) The advantage of profit targets:

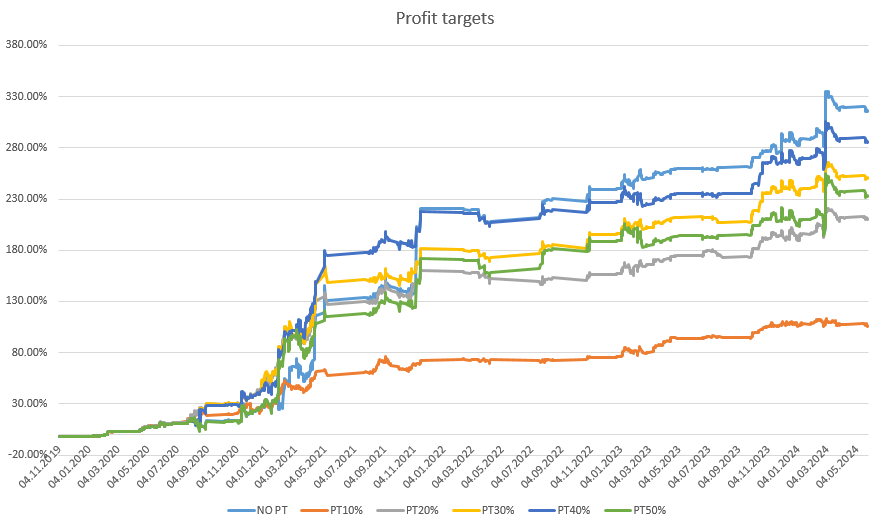

Profit targets increase the stability of profits. Especially if they are small enough.

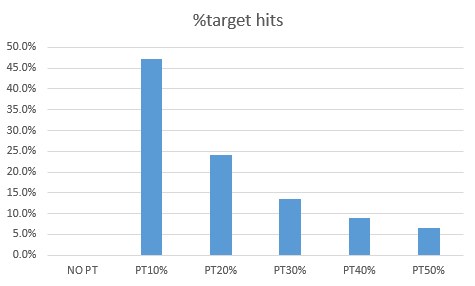

The lower the PT, the higher the chance of being hit.

It’s logical.

But…

3) The disadvantage of profit targets:

They reduce the potential of positive outliers!

And it’s significant.

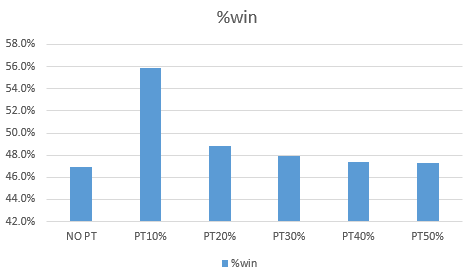

In this example, the 10% profit target increased %win by 20%.

Is it a win, though?

The performance of the strategy dropped by 65%!

4) The bigger the profit target, the better?

In theory, it seems that the bigger the profit target, the more the strategy makes.

However, the logic is different: the bigger the profit target, the less impact it has on the performance of the strategy.

Or else: The less influence it has on reducing the impact of outliers on strategy performance.

After all, does a profit target that is hit 6% of the time make any sense?

5) Directional strategies are about outliers

You enter because you expect a larger swing.

Big outliers are not common, but they can affect performance significantly.

Don’t reduce their impact with an additional artificial condition.

6) What are the alternatives?

There are several effective alternatives to profit targets:

- Trailing Exit: Best for trend and longer-term breakout strategies. It limits risk while allowing the market to rise.

- Winning Trade Exit: Suitable for shorter-term trading. Exit the position when it shows a profit at the close of the trading timeframe.

- Time Stop: Effective for short-term momentum strategies. Exit after a set number of bars (days), depending on the desired momentum.

7) Why these exit strategies work better?

Because you are not artificially limiting the potential of a given trading situation. Markets are very difficult to predict. Therefore it is better to choose exit logic according to entry logic. And there is not much logic in profit targets for directional strategies.