Crypto is a momentum market. Everyone knows it.

In this article, I will look at the behavior of the market from the perspective of the different momentum regimes.

Based on the conclusions, I will create a basic trading model.

What is the Momentum Effect?

The momentum effect is the empirically observed tendency for rising asset prices to continue rising and for falling prices to continue falling. This market factor is fundamental to directional trading strategies, which capitalize on trends and momentum. Simply put, thanks to this effect, a rising price often leads to even higher prices, while a falling price leads to even lower prices.

Momentum Effect Research

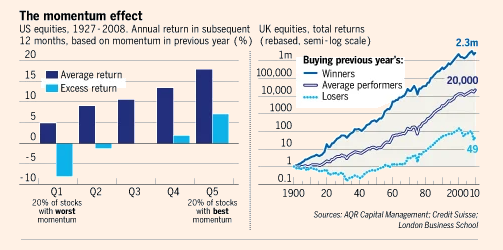

Numerous studies have highlighted the power of the momentum effect. In equities, this effect has been verified repeatedly over periods ranging from months to a year. For instance, examining the performance of stocks that were winners or losers over the past year and then holding them for the following year reveals significant differences in returns.

Short-term Momentum Effect

On the other hand, it seems that the more liquid and efficient the asset, the more likely short-term momentum triggers a mean reversion reaction.

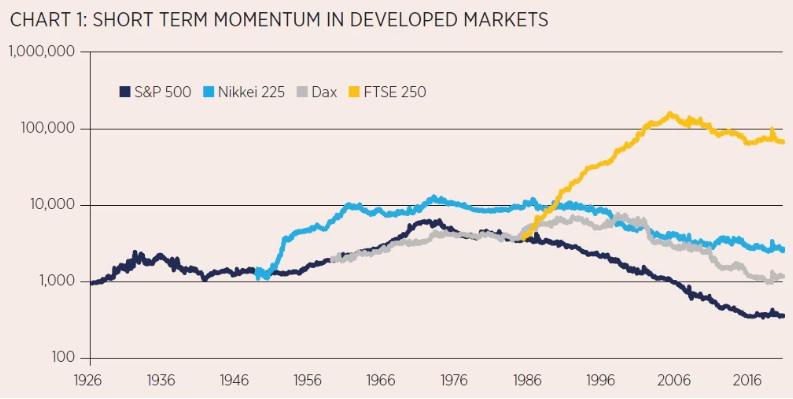

See the study below:

Momentum is defined as measuring the stock markets’ return last week, and if positive, then go long, while if negative, then go short.

Short-term momentum stopped working in the US and Japan in the late 1970s, in Germany in the 2000s, and in the UK around 2005.

Applying Momentum to Crypto

We have little data in crypto, so I always rely on more general research. Hence the intro above…

Crypto is a significantly faster market, we’ll adjust the conditions slightly and look at 3 situations:

1. Short-term momentum: 1-day momentum

2. Middle-term momentum: 7-day momentum

3. Long-term momentum: 30-day momentum

Data: Binance futures, survivorship bias free database

Trading costs: 0 – study only, we explore the nature of the market

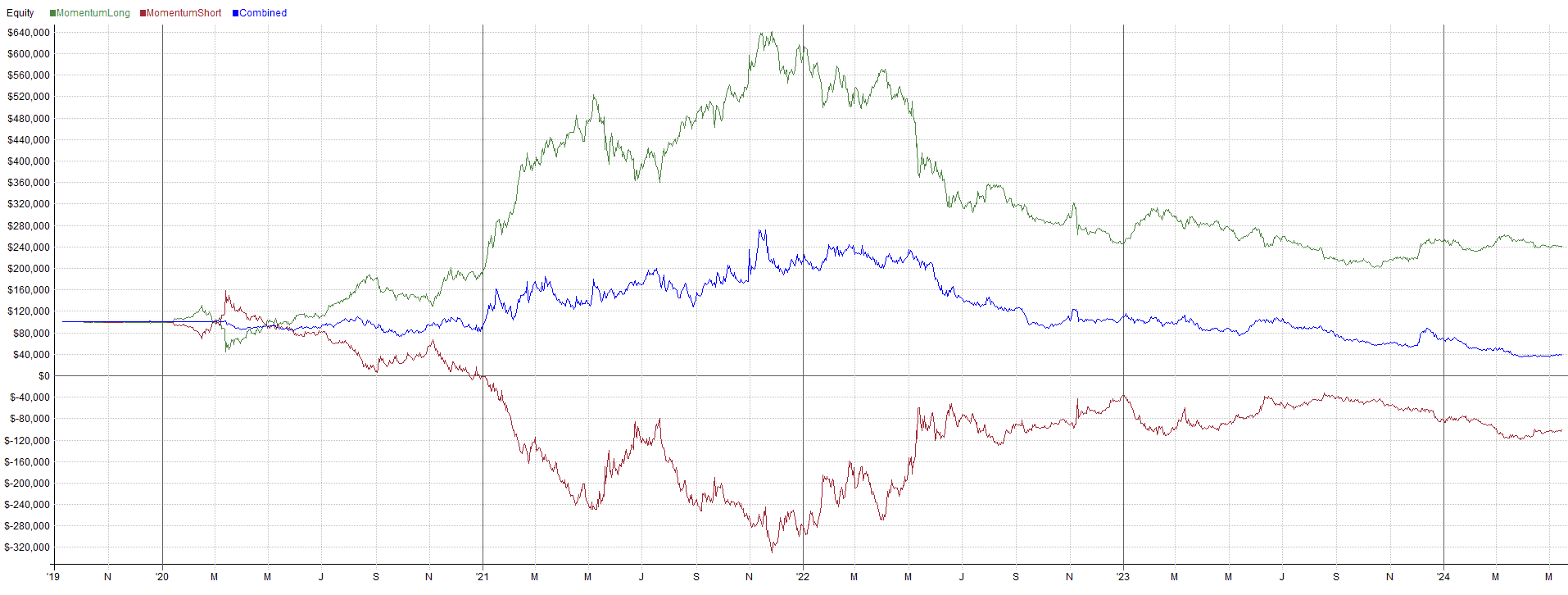

Short-term Momentum (1-day)

The test involves buying the 10 most rapidly growing cryptocurrencies and selling the 10 least growing ones daily, rebalancing the portfolio each day.

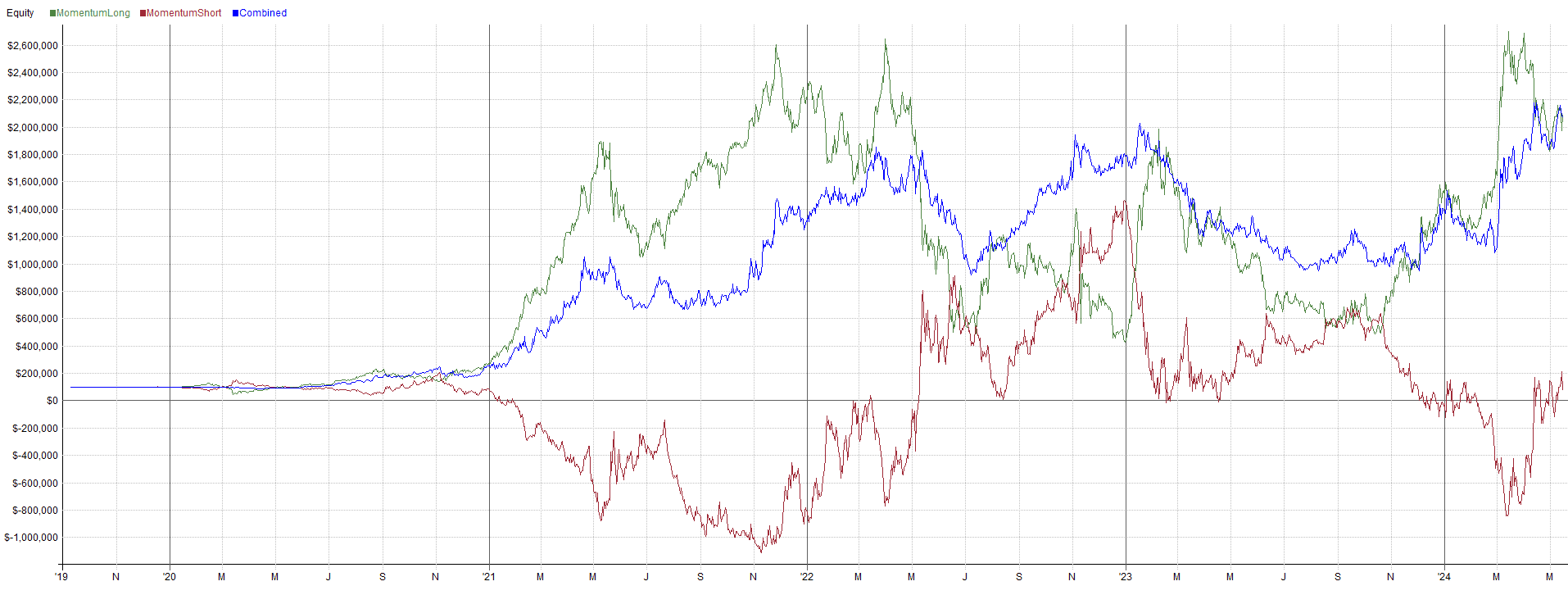

Middle-term momentum (7-days)

Every 7 days, we buy the 10 cryptocurrencies that have grown the most over the past week and sell the 10 that have grown the least, rebalancing weekly.

Long-term Momentum (30-days)

Every 30 days, we buy the 10 cryptocurrencies that have shown the most growth over the past month and sell the 10 with the least growth, rebalancing monthly.

What are the observations:

First, we’re only getting 5 years of data. It needs to be treated as an observation rather than a definitive conclusion.

- Short, 1-day, strong momentum leads more towards mean reversion moves.

One day long momentum only worked in the strong bull market of 2021. For shorts, only in the dips of 2022. However, from the end of 2021, the net position (long-short) brings a steady loss. It may be related to how crypto is maturing. I would assume so. Such a trend is observable on pretty much every asset.

- The 7-day momentum is by far the most stable in this period. The results are obvious, this could be a relevant basis for a trading model.

- 30-day momentum has mean-reversion nature from September 2023. This is quite interesting, although it may be just a coincidence. As of September 2023, it seems to be worth buying the weakest cryptocurrencies. They have appreciated more than the strongest ones. But in general, I think that a 30-day momentum-based position holding is too weak indicator in such a fast market as crypto.

- Momentum is more significant on the long side. This was to be expected. Strong declines in crypto often lead to a mean reversion reaction. In general, momentum trading on the short side (unless it is supposed to be long-only hedge trades) is significantly more difficult. And the tests above clearly prove this.

Trading Implications

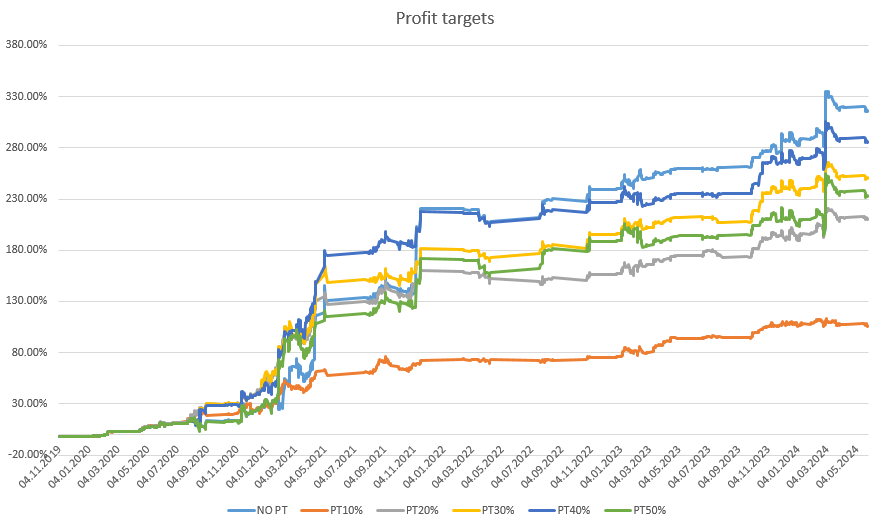

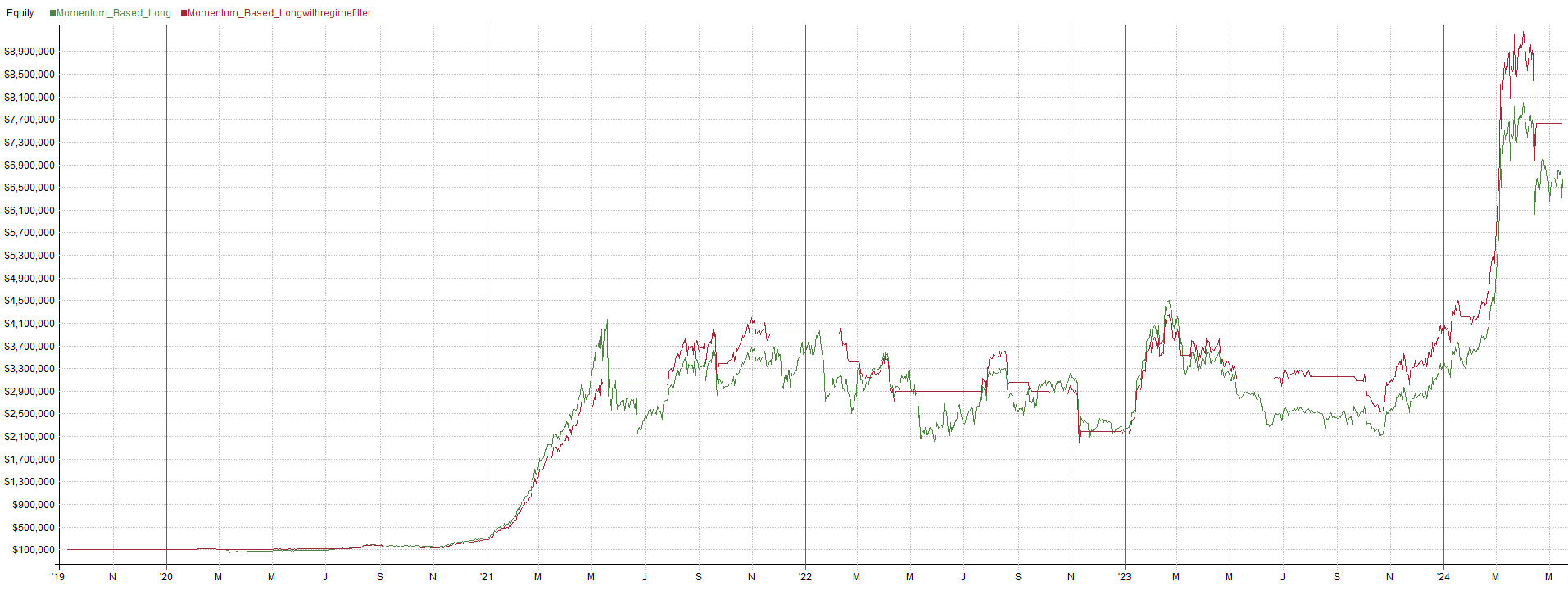

Based on our research, we can outline a basic strategy:

- Buy the 10 fastest-growing cryptocurrencies with a limit order.

- Close positions after 3 days (without optimization).

- Add a trend filter as a benchmark to the same conditions above.

Conclusion

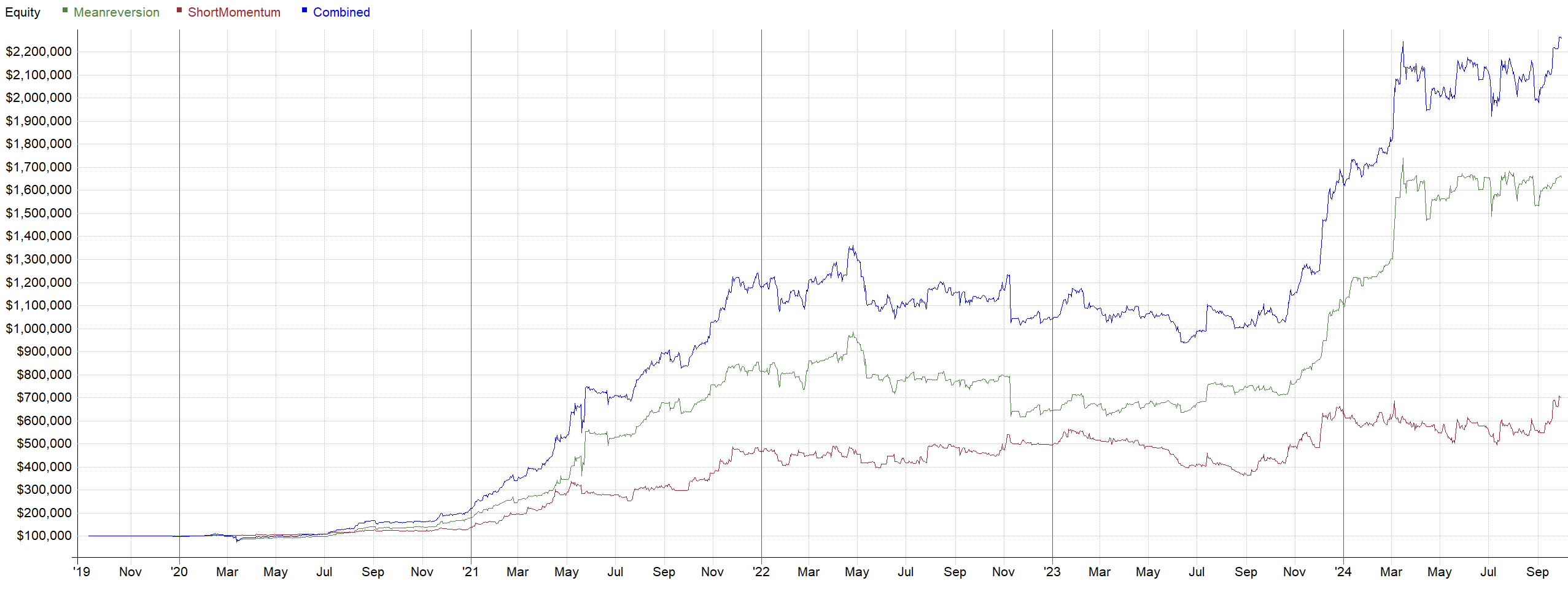

Crypto markets exhibit a clear momentum characteristic, making them suitable for momentum-based trading models, such as breakout and trend-following strategies. However, as the market matures, we may see a shift towards longer-term trend-following models combined with short-term mean-reversion strategies. At Robuxio, we aim to stay ahead by integrating momentum and mean-reversion models into an all-weather portfolio for more stable results.

For further questions or discussions, feel free to reach out.