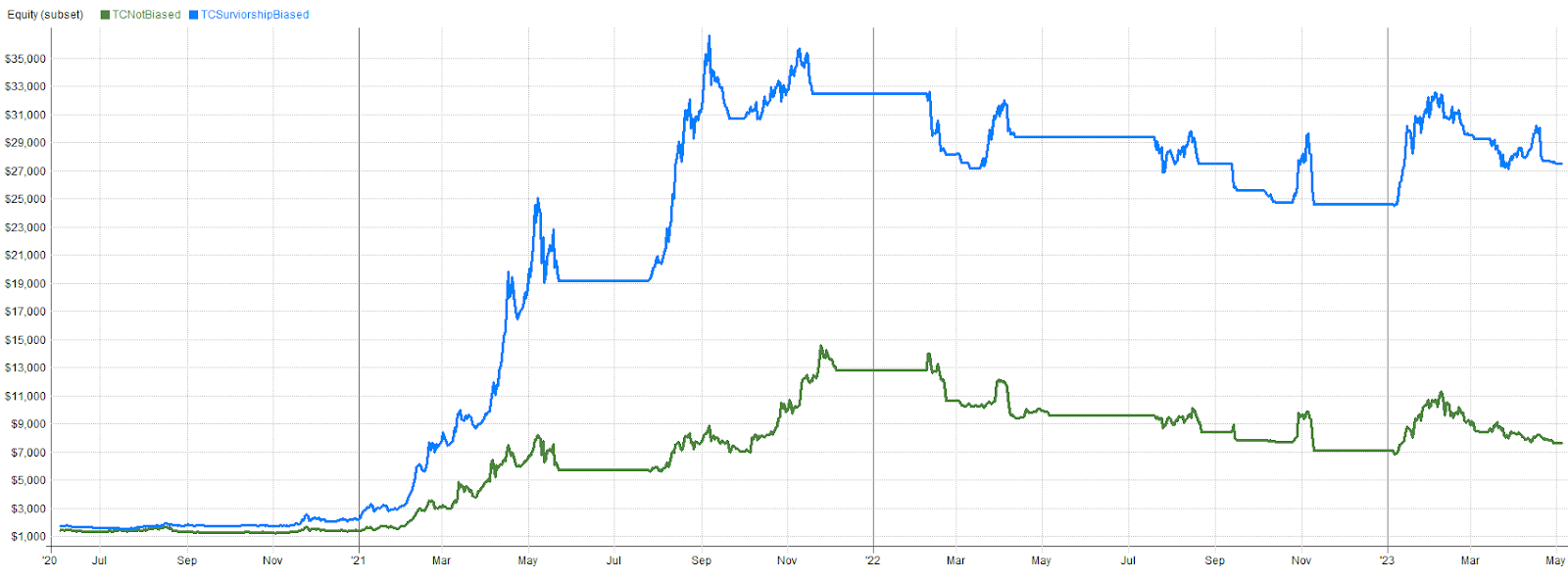

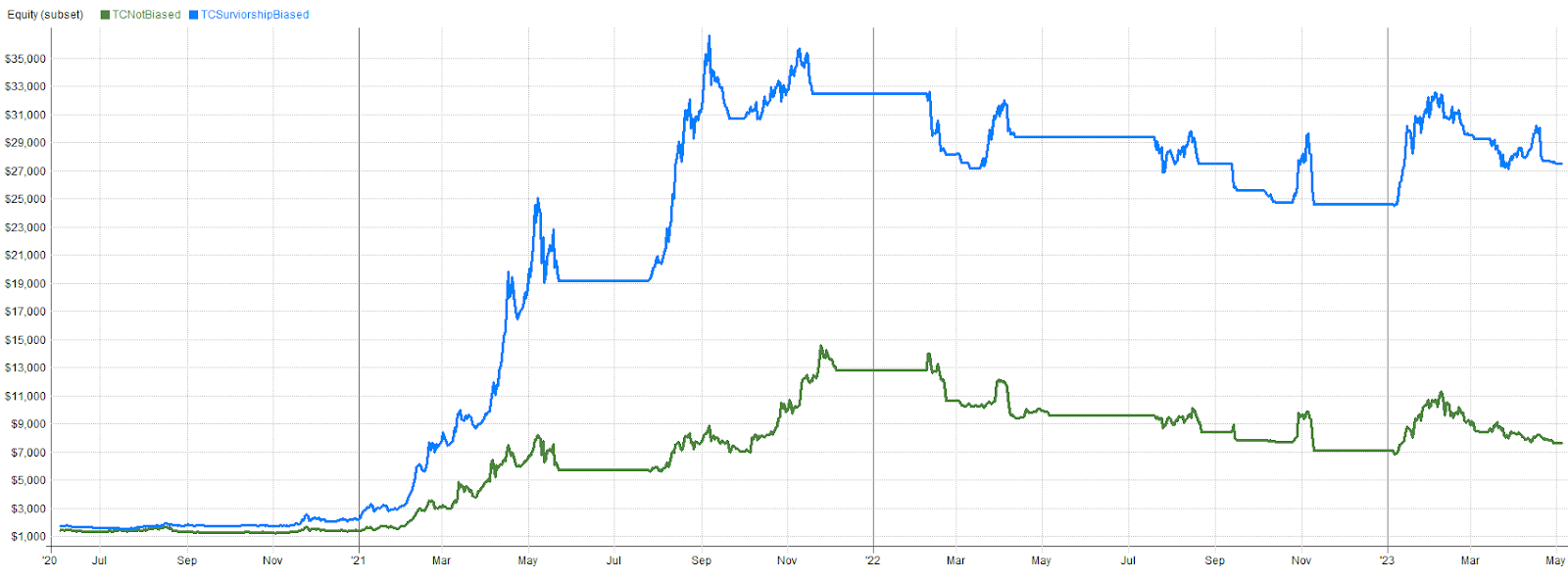

Algorithmic Crypto Trading X: Trading Biases

Navigate Survivorship, Hindsight, Sample, Selection, Look-Ahead, Recency biases, and Curve Fitting in crypto trading for sound strategies.

Navigate Survivorship, Hindsight, Sample, Selection, Look-Ahead, Recency biases, and Curve Fitting in crypto trading for sound strategies.

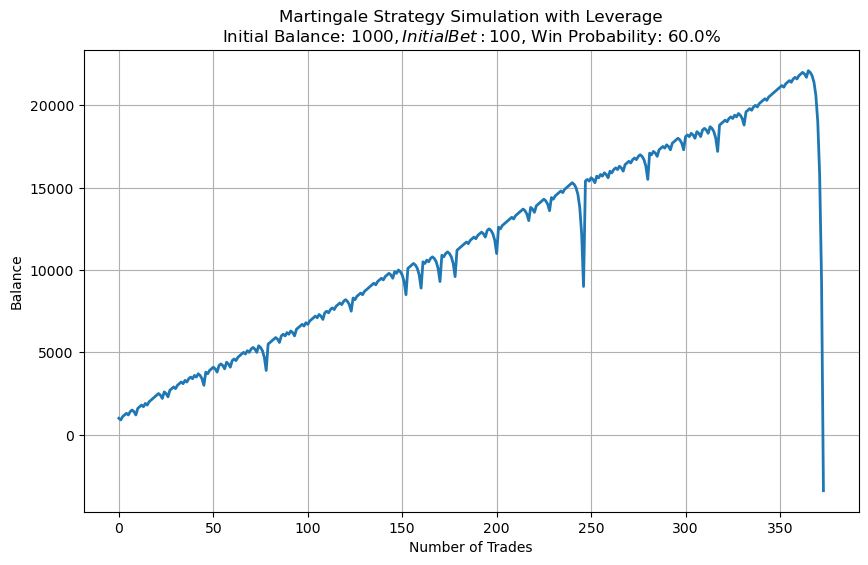

Discover the key differences between Martingale and Anti-Martingale money management strategies in trading. Learn how these approaches impact risk, profits, and account sustainability.

Before we delve into more specific topics, it’s important to grasp the basic concept of the “risk of ruin.” Algorithmic or systematic trading is a

In the previous blog posts, we discussed why trading crypto and adopting a systematic/algorithmic approach can be beneficial. In the upcoming blogs, we will delve

Breakout trading is a strategy that involves buying or selling symbols when they break out of a trading range. In this blog post, we will discuss the basics of breakout trading and how to use it to trade cryptocurrencies.

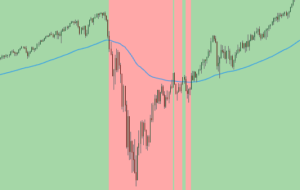

Mean reversion is a statistical concept that states that extreme values are not sustainable and tend to revert back to the mean over time. In

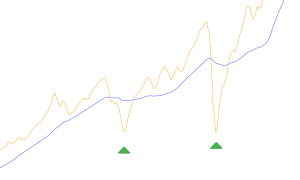

Discover the potential of trend following in systematic trading to identify and ride market trends

Read on to discover the characteristics of trend trading, mean reversion, and breakout trading, and the advantages and disadvantages of each approach.

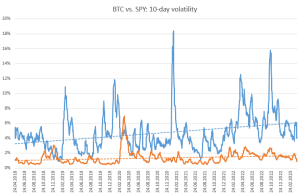

Discover the advantages of trading cryptocurrency due to its high volatility and the potential for significantly higher profits compared to traditional assets.

In this first article of the systematic trading series, we will discuss the basics of systematic trading and introduce a simple trading strategy using the example of Bitcoin and Ethereum.

With Robuxio, we bring professional approaches to crypto trading that have been proven successful in traditional assets over decades of use.

Don’t miss out on Robuxio’s latest research and newsletters. Subscribe now!

We care about your data in our privacy policy.