Compounding in investing is like a snowball rolling down a hill. Initially, it starts small, but as it rolls, it picks up more snow, growing larger with each turn. Because the ball is bigger, it can gather even more snow at a faster pace. Similarly, when you reinvest your profits, your investment grows larger, allowing it to generate even more profit. This cycle continues, making your investments grow exponentially over time.

Understanding Compounding and Its Power

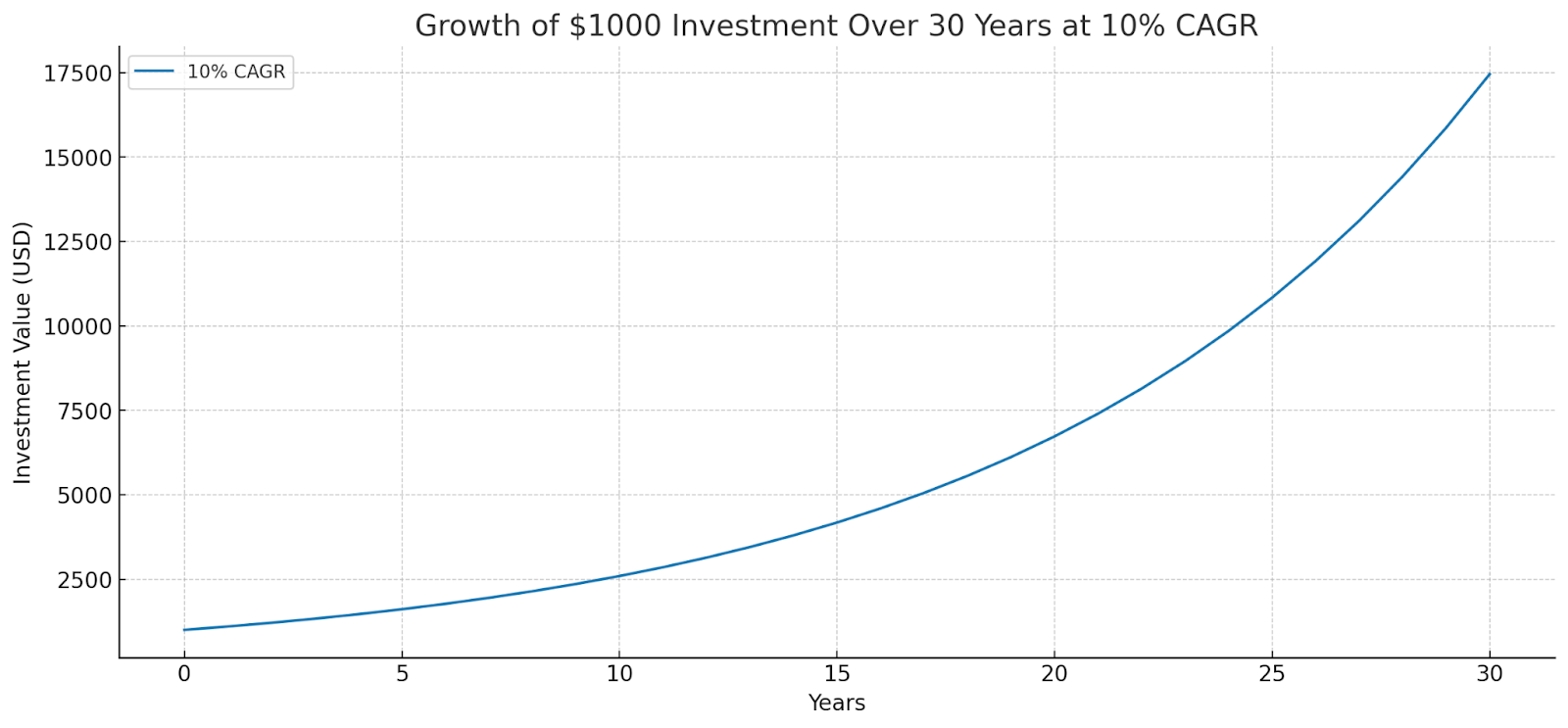

It’s a straightforward concept. Imagine you have $1,000 and make a 10% profit in your first year on your investment. That means you would have made $100. So, you might think you’d need another 9 years to get to $2,000 and double your money. But that’s not the case, as we always reinvest the profits. This means that we won’t need 10 years, but only a bit over 7 years with a compound annual growth rate (CAGR) of 10%. What’s important to know is that this growth is exponential! Let me show you a chart:

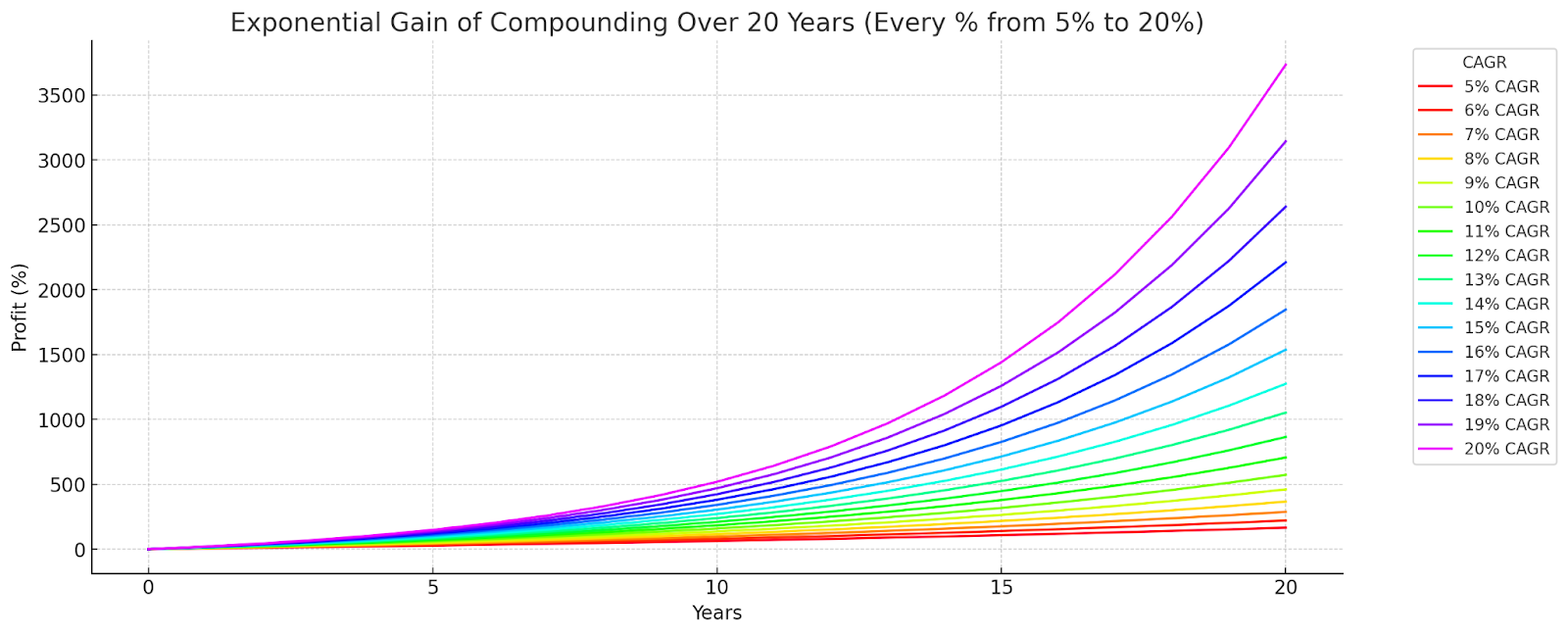

Also the higher the CAGR the faster this exponential growth.

This is also why people are so obsessed with beating the market, even by a single percent, because that 1 percent has a significant effect in the long term.

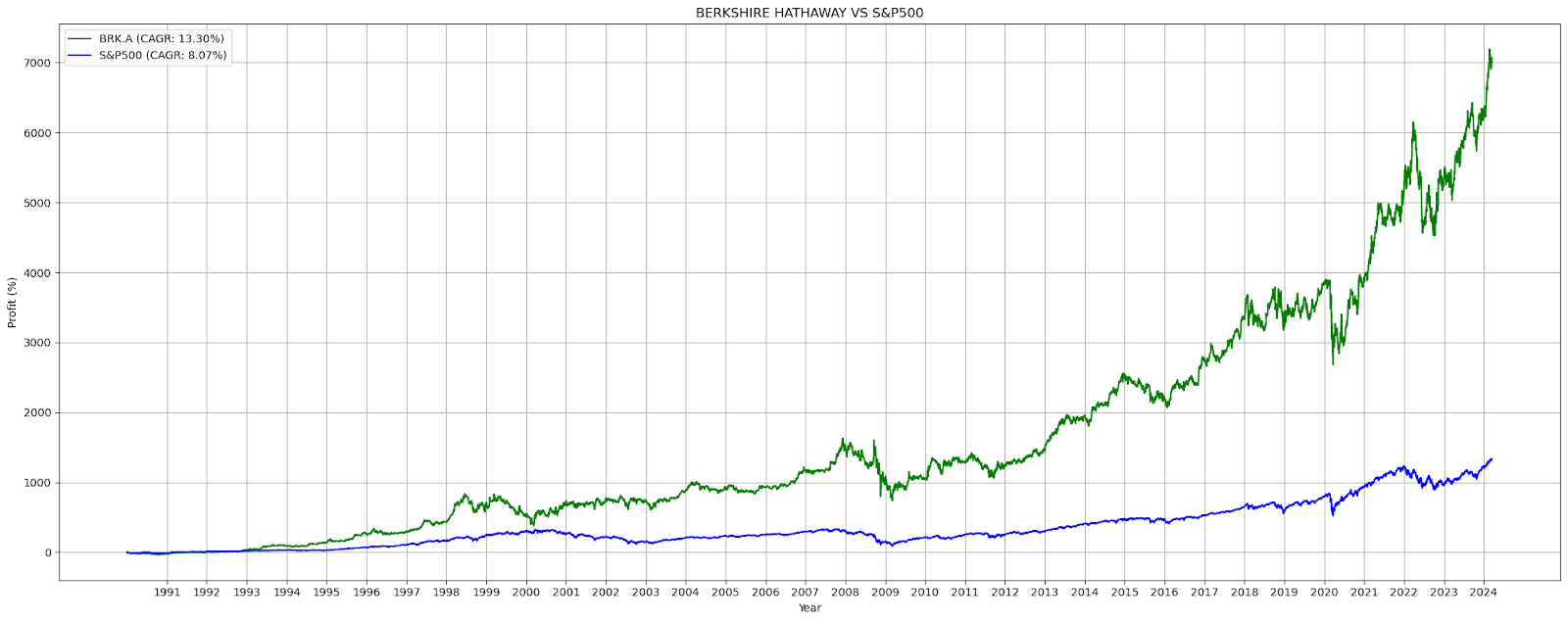

Now that we understand the power compounding has, we should look at the real-life example of Warren Buffett. Probably the most famous investor of all time. Let’s examine the effect of compounding by comparison his Berkshire Hathaway Inc. Class A shares to the S&P 500 from 1990 till today:

- BRK.A: CAGR: 13.30%, Final Profit: 7066.77%

- S&P500: CAGR: 8.07%, Final Profit: 1322.64%

The CAGR is 65 percent higher but the profit is 435% higher! Exponential difference!

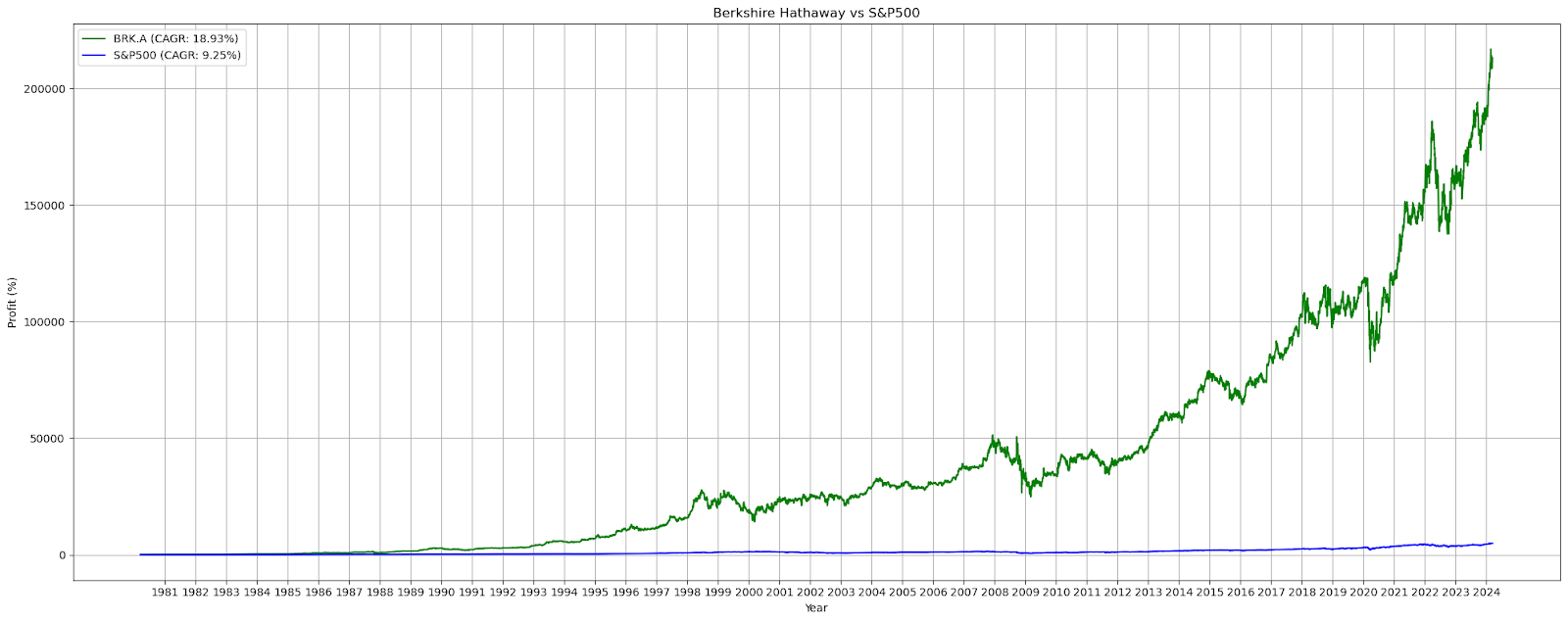

Now let’s look back from 1980:

- BRK.A: CAGR: 18.93%, Final Profit: 213049.66%

- S&P500: CAGR: 9.25%, Final Profit: 4904.00%

BRK.A’s final profit is 4,244% higher than the S&P 500’s final profit.

What started as a snowball has transformed into an avalanche!

The Volatility of Cryptocurrency Markets

With crypto we have ridiculous volatility. It’s a paradise for systematic traders like us. The market moves like crazy up and down and we can make much more money than in the traditional market using the same all-weather trading system as we use for crypto.

But just a warning here for crypto investors. Yes, crypto is going up like crazy, but it is also going down like crazy. People are showing off the crazy gains they make on BTC or, for example, SOL.

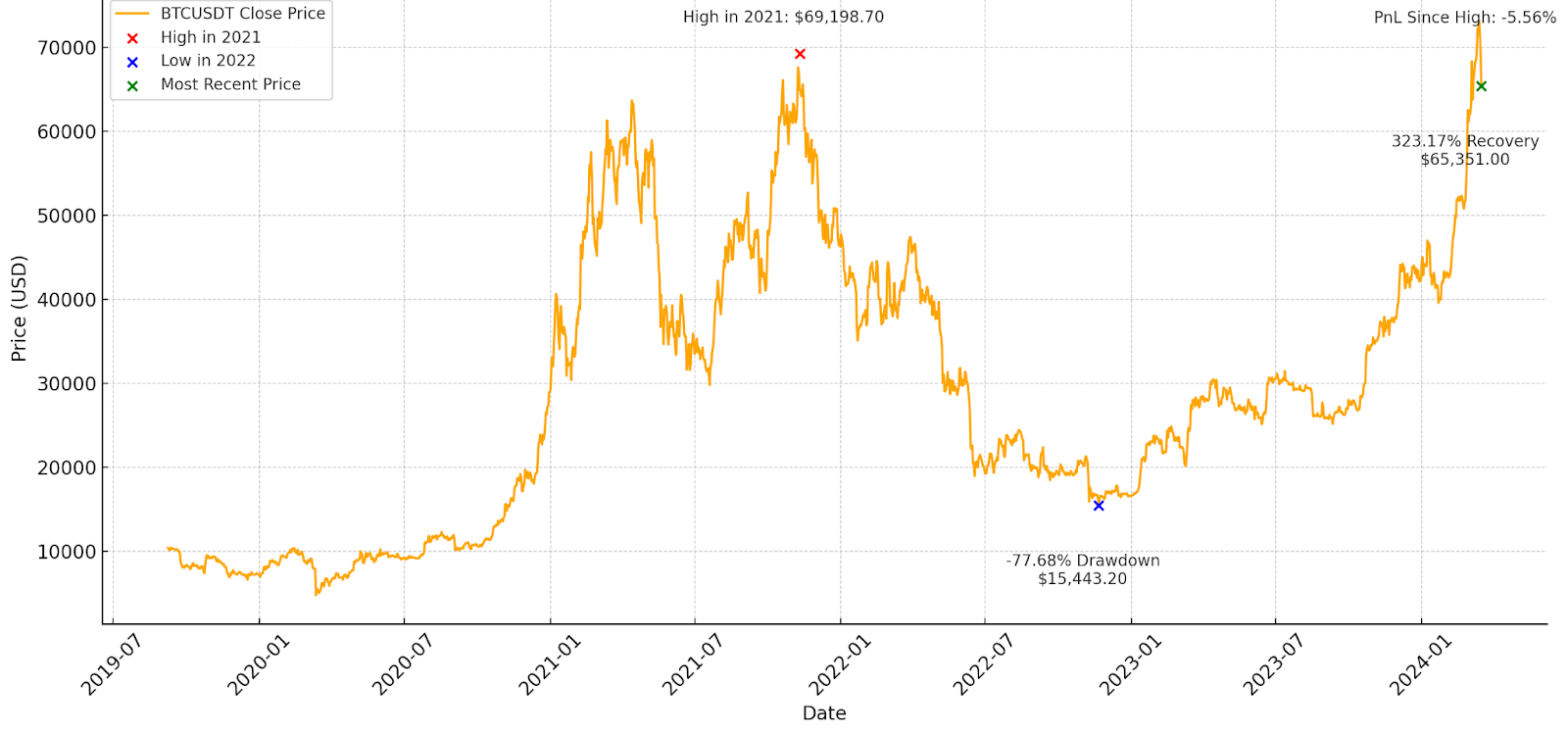

But what they didn’t show is the drawdown that happened before and that they are probably not even in profit yet. Look at the charts!

In 2021 Bitcoin made a high, then dropped almost 80% to go up 320% to end up basically at break even. But on the way there, we have incredible nice trends we can exploit very well!

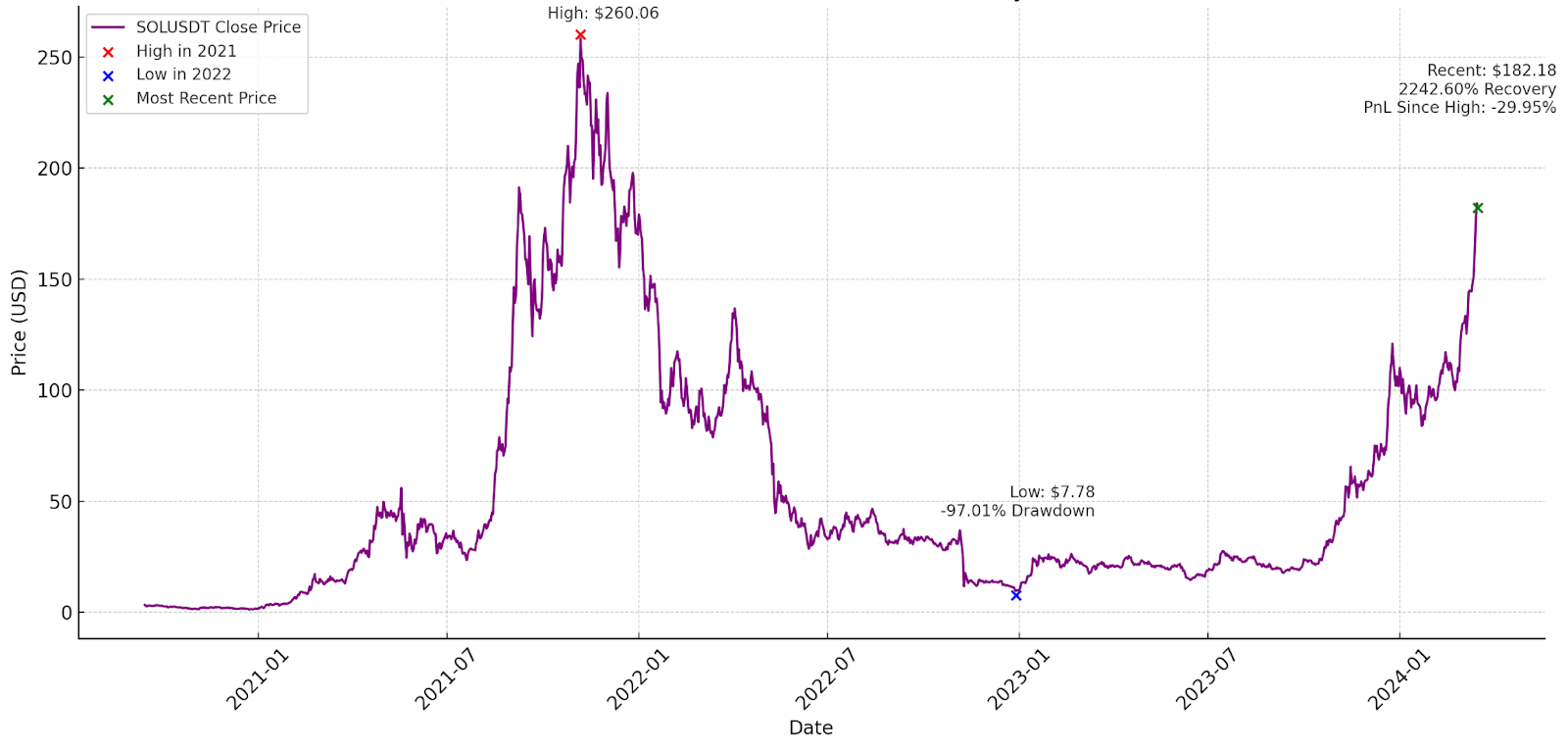

Solana, for example, is even crazier.

Just imagine being down 97% then go back up 2242% just to be still down -30%!

But look at those nice and incredible trends, look at the opportunities crypto is giving us traders. There is no other asset class that is giving us those chances to trade trends like that.

Use them wisely as they won’t be here forever. And holding on to your coins on the way up and down is not making use of that opportunity.

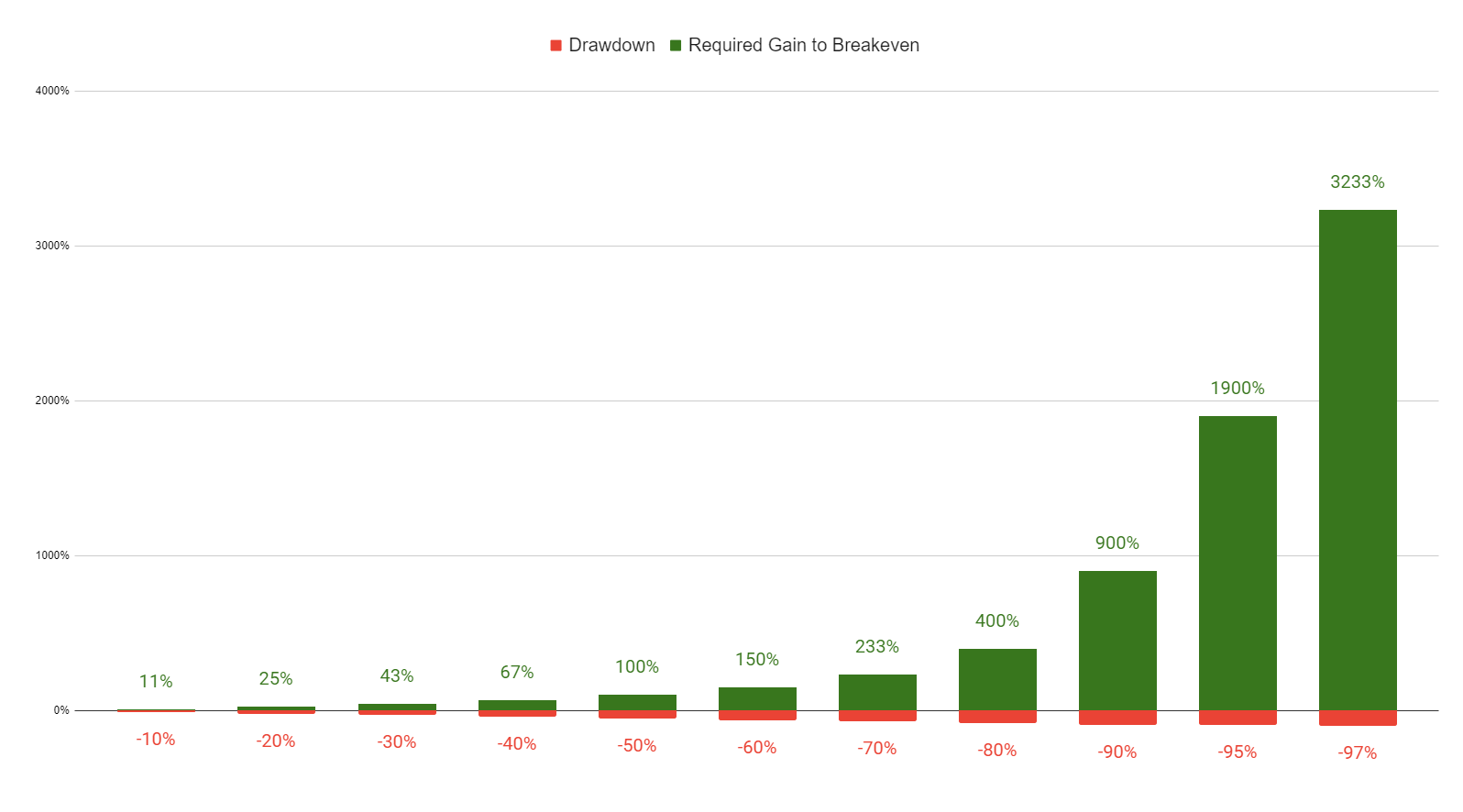

Look at the chart below, the gain required for each drawdown just to get breakeven again.

Recovering from such drawdowns like Solana requires 3000%+ gain just to break even again. That is why investing in crypto is definitely not the way to compound your capital. But the good news is that crypto has those big price movements. We just need a different approach to capitalize them.

Robuxio’s All-Weather Approach to Crypto Trading

By employing an all-weather approach, Robuxio’s system aims to profit in both bull and bear markets. Trying to keep the drawdown low and keep compounding the portfolio as much as possible.

Let’s have a look at why this all weather approach is so important to keep making some profits in all market environments, even if they are “small” compared to the profits you can make during the bull run with trend strategies.

But first, a few steps back. As we wrote about in our blog about position sizing and the martingale vs. anti-martingale, we are using fixed percentages for the trading sizes, which is an anti-martingale approach. If you haven’t read them, I would suggest reading them first, starting with the martingale money management blog before you continue with this blog.

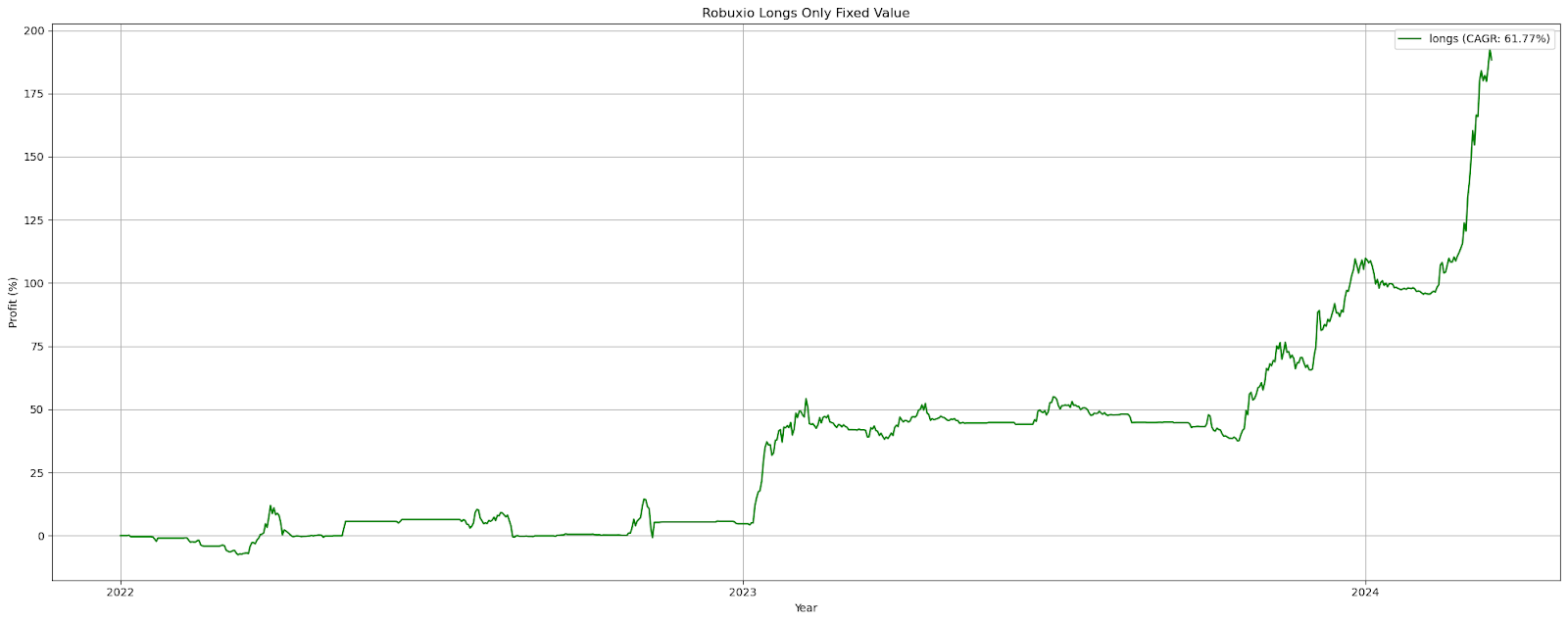

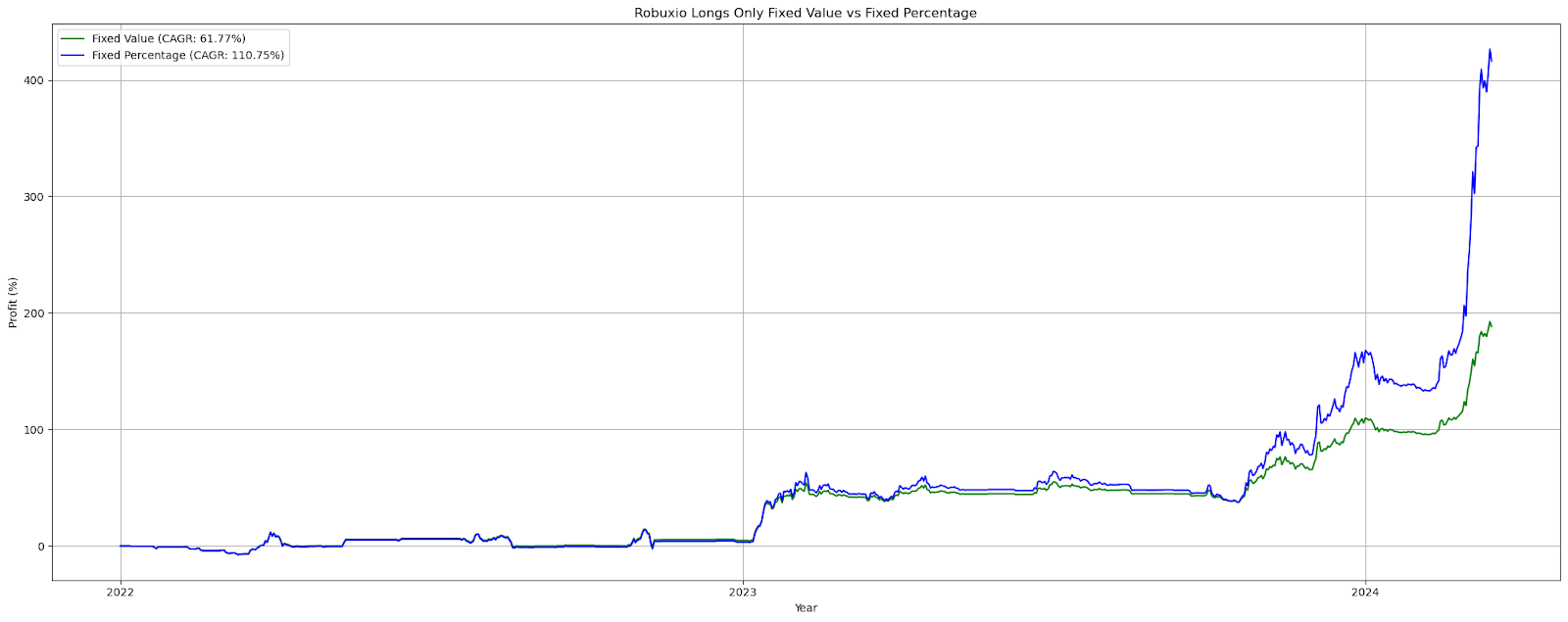

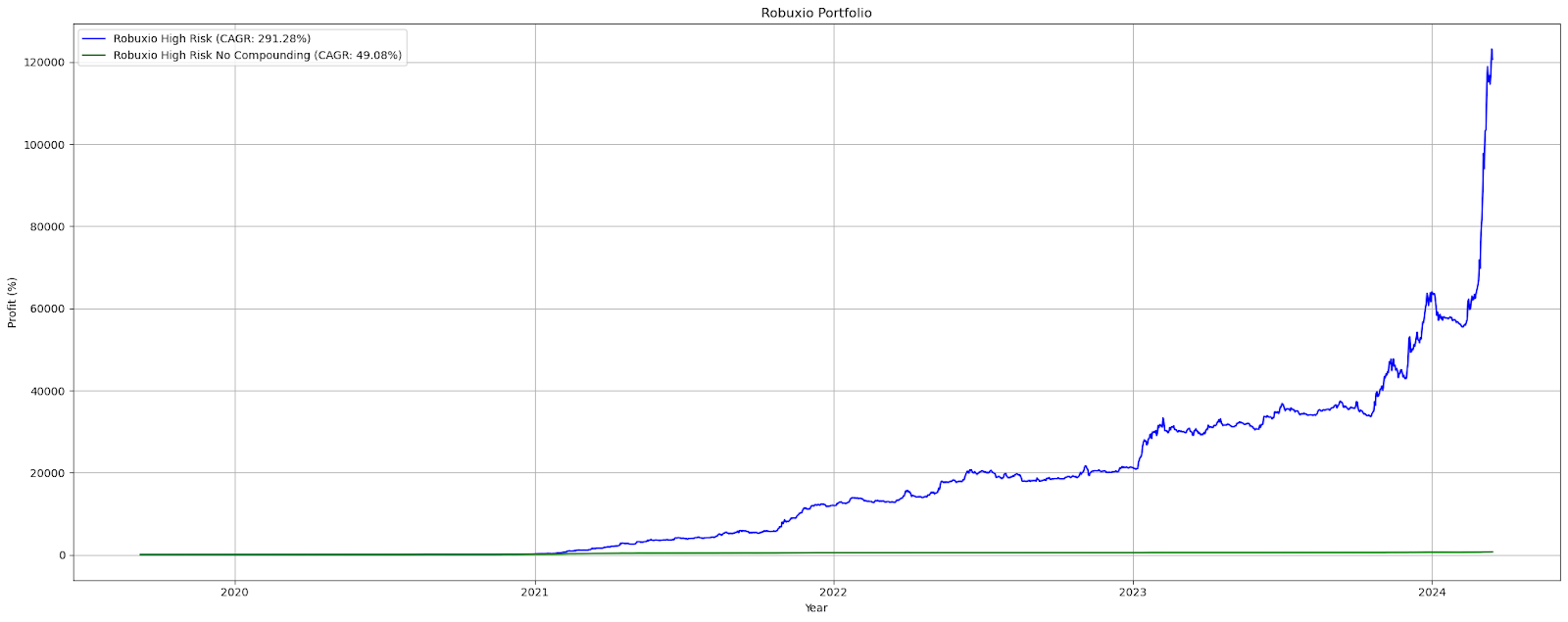

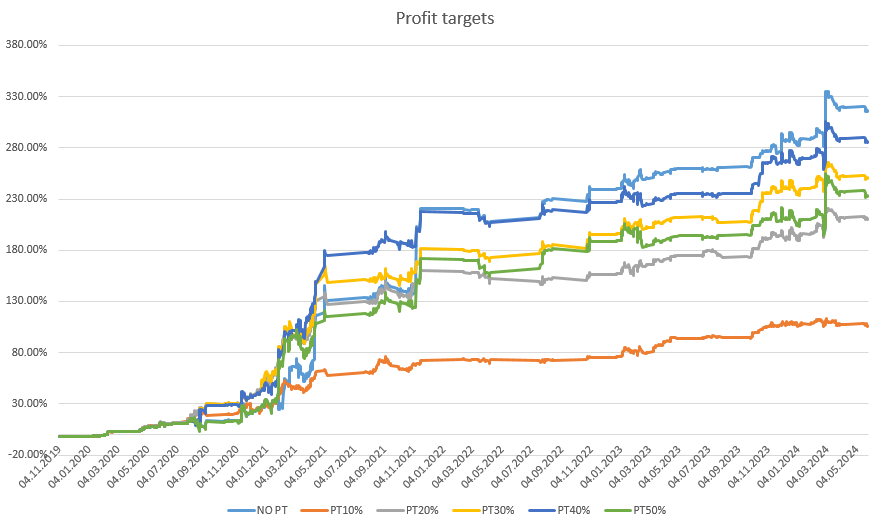

Let’s do a few tests on our portfolio, looking only at the long part of our portfolio from 2022.

First test: only the long portfolio since 2022 with fixed value position sizes. Looks not bad, but we are not compounding!

Now let’s run the same test but with fixed percentage positions sizes like we do at Robuxio. The first trades would be the same USD amount as on the test above. But now we increase the position size when we make profit and we reduce it when we make a loss. An anti martingale approach that makes you capture the upside of compounding while minimizing the risk of ruin.

Just crazy to see in crypto how fast the compound kicks in once the market starts moving. That is also the main reason to move to our performance based program to make full use of the compounding effect!

But with long strategies it’s very difficult to make money during bearish regimes. But as you can see on the chart, the more money you make the more the compounding effect kicks in.

But how does an all-weather approach help in Compounding?

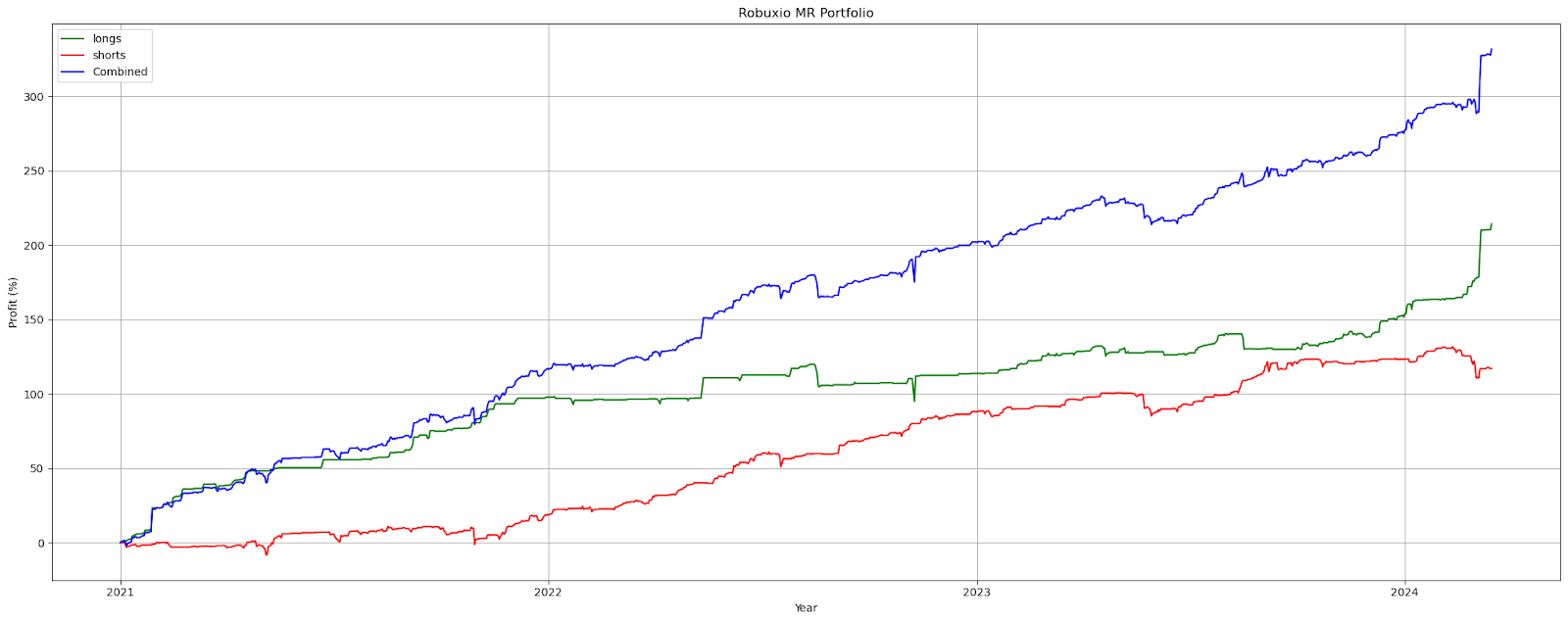

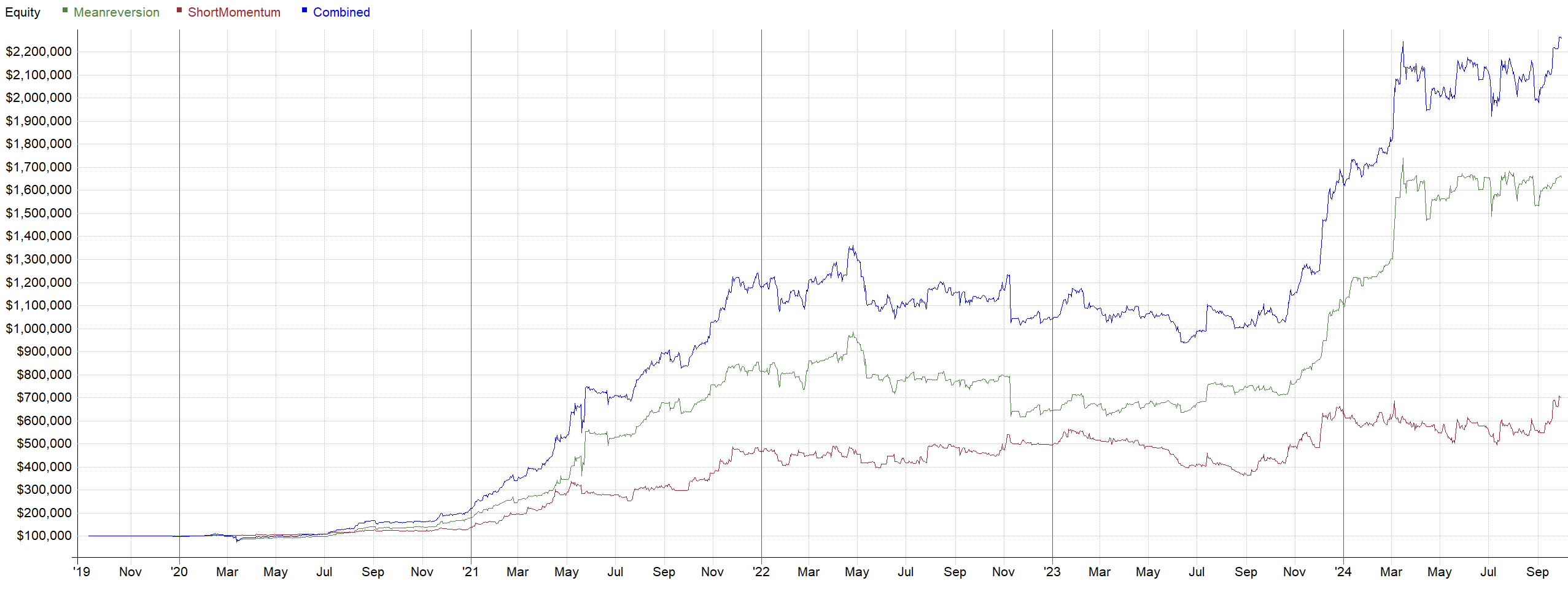

With the all weather approach we don’t have to rely on only the big up or down trends in crypto. By trading many mean reversion strategies to the long and short side we can stabilize the portfolio a lot.

These are the results of our mean reversion strategies, they are very stable but are not as profitable as our trend strategies.

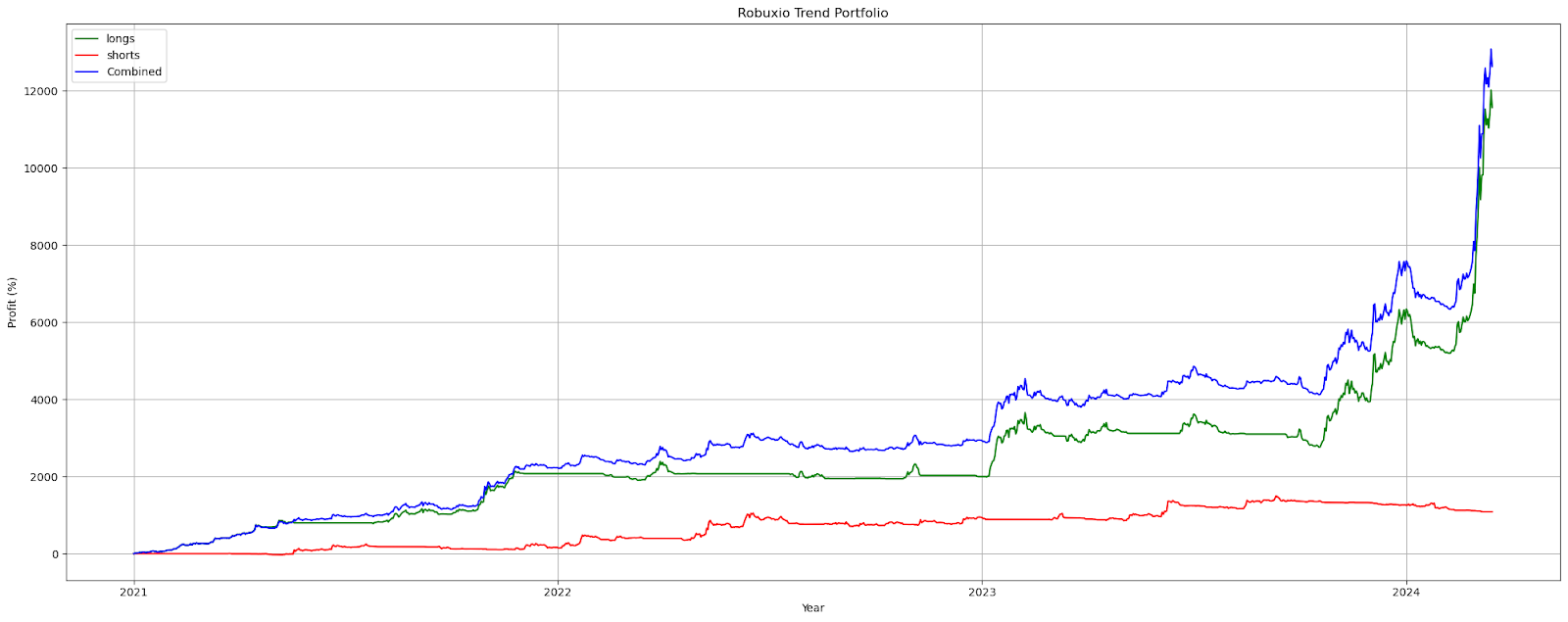

Look at our portfolio of trend strategies with the shorts included. Unlike the long trend strategies only, we can make money during bull and bear regimes.

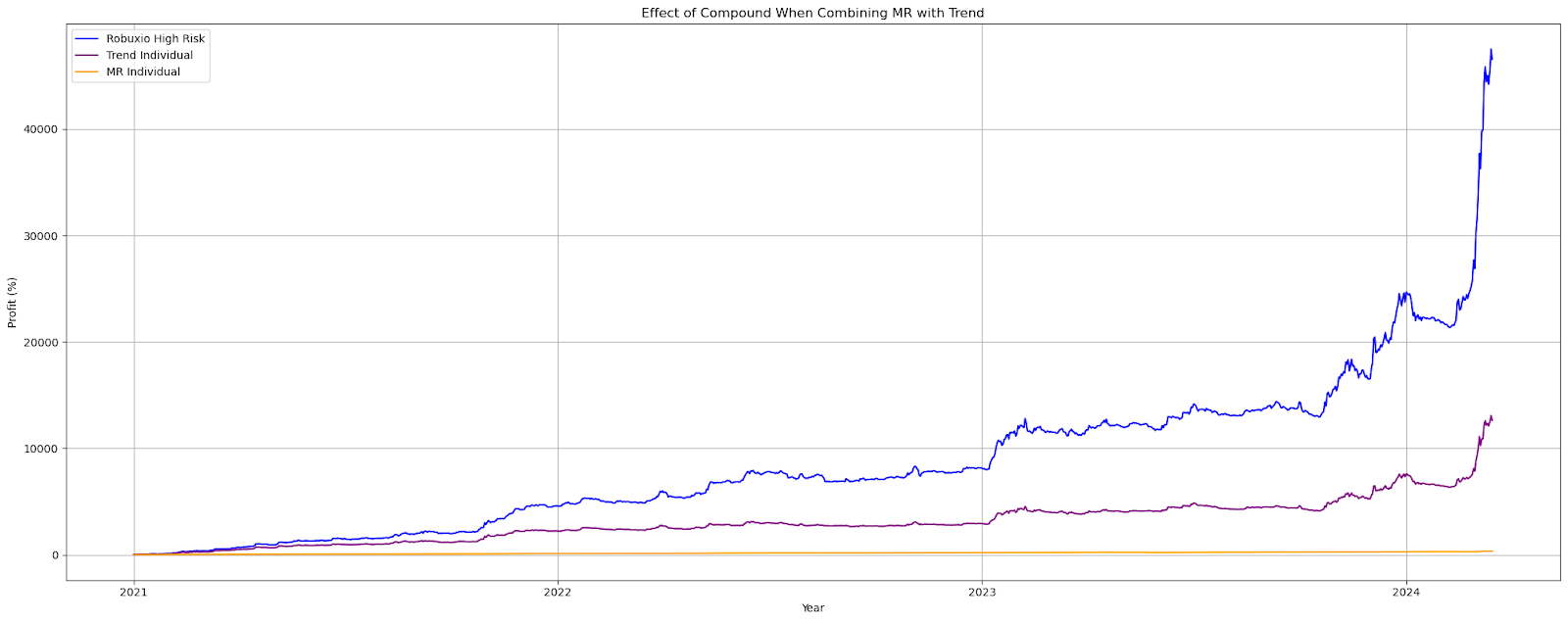

330% for MR vs 12,500% for the trend strategies. So you could think why even bother with those MR strategies?

We saw the impact of compounding over time by increasing the CAGR by a little.

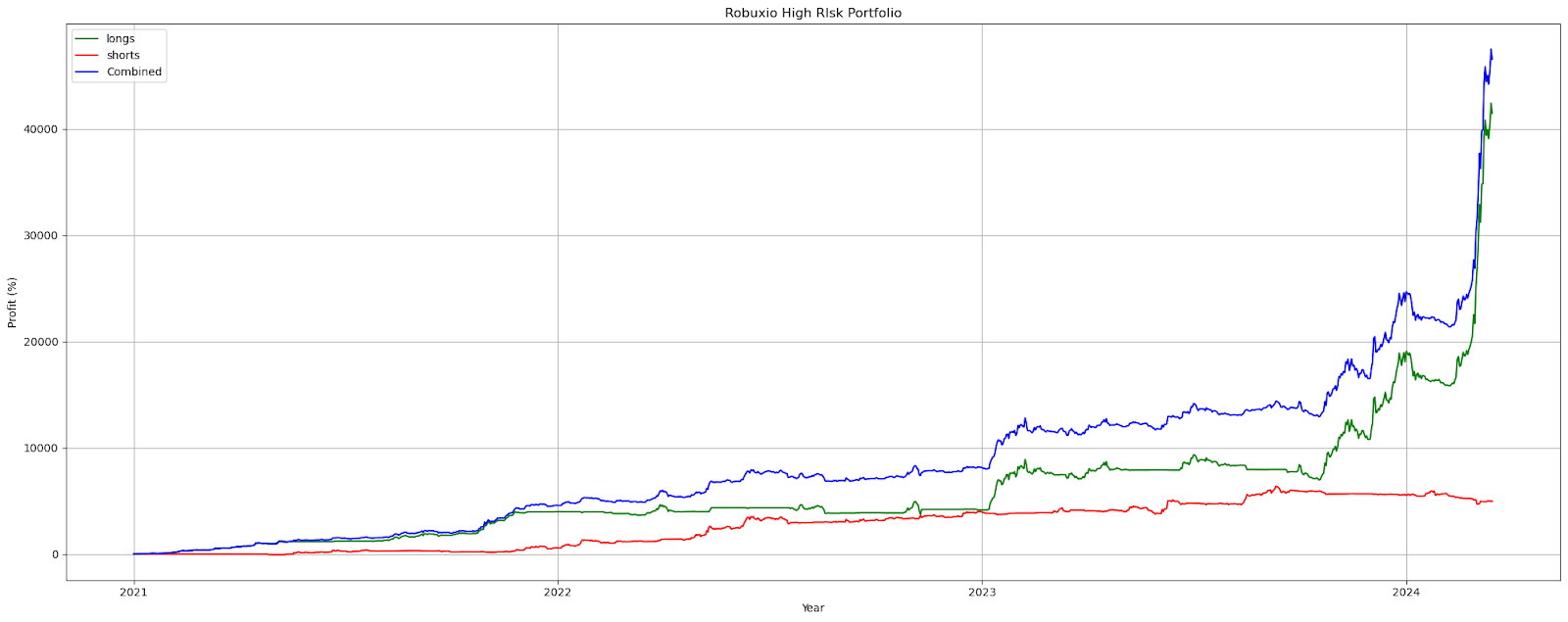

It would definitely not be a bad idea to look at what would happen if we add those 2 approaches together in a portfolio as they are very uncorrelated. Meaning that the MR strategies should be making money when the trend strategies are losing money.

The snowball keeps rolling faster and bigger! Compounding makes it possible. Those “small” profits from the MR strategies really keep pushing the compounding effect to exponential heights.

We pushed our trend portfolio from 12500% to 45000%, by adding an uncorrelated sub portfolio of MR strategies that made as a standalone portfolio 330% during that time!

Let me visualize that with a chart:

Now you understand the importance of an all weather approach in crypto. Crypto gives huge trends. But without the right approach you can be in deep drawdowns like Solana and recoveries of more than 2000% will still not make you breakeven again.

With a good approach like ours at Robuxio you can keep growing. The snowball is growing bigger and faster into a massive avalanche!

Compounding over time

With Buffett, we looked at 40+ years of data. Crypto, being a new, inefficient market full of amateurs, doesn’t have that long of a history. But that’s exactly where the opportunity lies. The edge we have now won’t stay as large for the next 30 years, but that’s also not necessary.

Look at what was possible in crypto in a few short years:

The compound annual growth rate that an all weather approach can achieve in crypto is so high that in a few years you can grow incredibly big. Will it happen again? Who knows, but we are prepared.

And we started 2024 very strong!