Position sizing is a critical aspect of successful trading. It determines how much of your capital you should risk on each trade, based on your risk tolerance and the specifics of your trading strategy. In this blog post, we will focus on anti-martingale approaches to position sizing, fixed dollar amount (not anti-martingale), fixed percentage, and the Kelly Criterion.

Anti-Martingale Position Sizing Approaches

Anti-martingale approaches are strategies where the position size is decreased after a loss and increased after a win. This is the opposite of martingale strategies, where the risk is increased after a loss. Anti-martingale strategies are generally considered more conservative and safer for most traders. Be sure to read our blog about it if you haven’t done so yet.

- Fixed Value Amount

- Fixed Percentage

- Kelly Criterion

Fixed Dollar or Fixed Value Amount

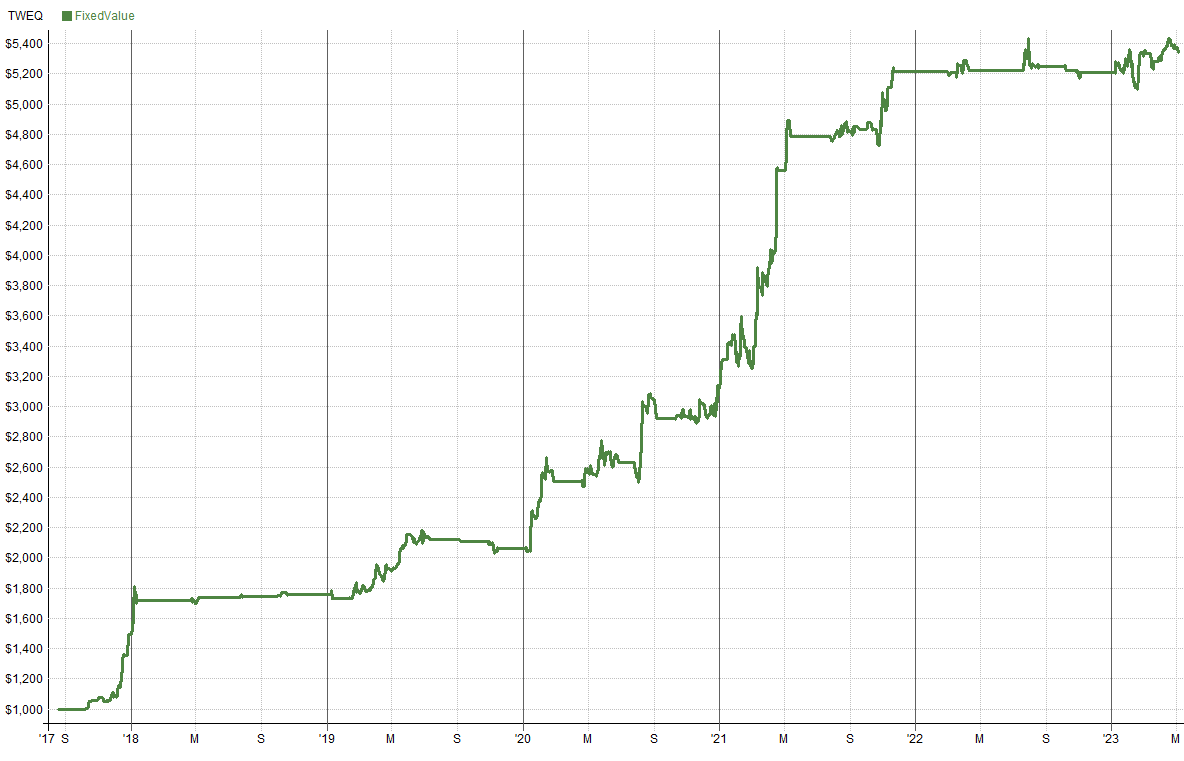

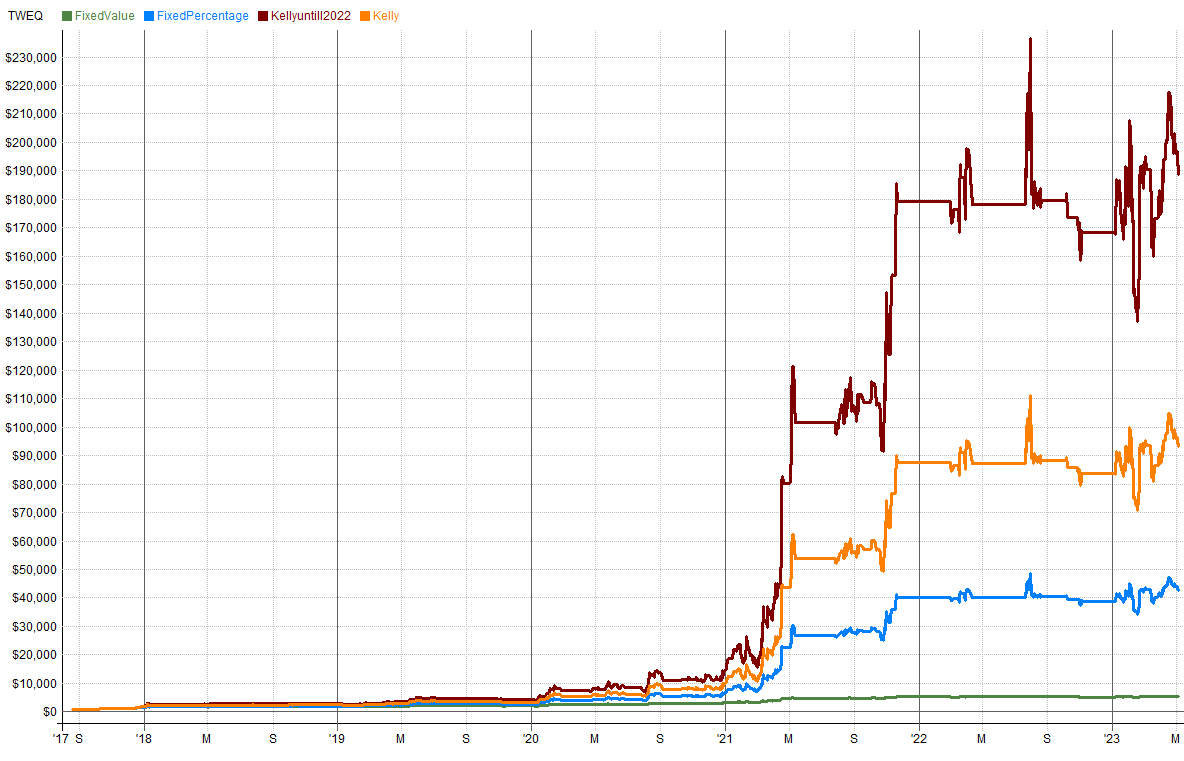

The fixed dollar amount is a position sizing method where a trader risks a fixed amount of money on every trade. This approach is simple and easy to implement, but it does not fully use the power of compounding. Let’s use a simple example of one of our breakout strategies on a portfolio level. We’ll use a maximum of 5 positions on a 1000 USD balance, so we split the budget equally into 200 USD per position

Nice looking graph, looks like a very stable curve.It seems like it made good money in the trending markets and is now having very low volatility in the equity curve because it’s only using a small part of the balance.

Looks very safe. However, it’s important to note that it is not an anti-martingale approach. If you start trading and get into a drawdown, your position sizes grow compared to your balance, hence increasing your risk at the start. If you trade the spot market you will need to add money to your wallet. On the futures market you will have to start using leverage. The reason is simple. At $1000 you open a position of $200 or 20% of your account. At $800, a $200 position is already 25% of the account.

This is the main reason why this approach is not optimal. With a drawdown, you can risk unnecessarily much on one position, and on the contrary, with a larger account growth, you limit your further potential significantly.

Fixed Percentage

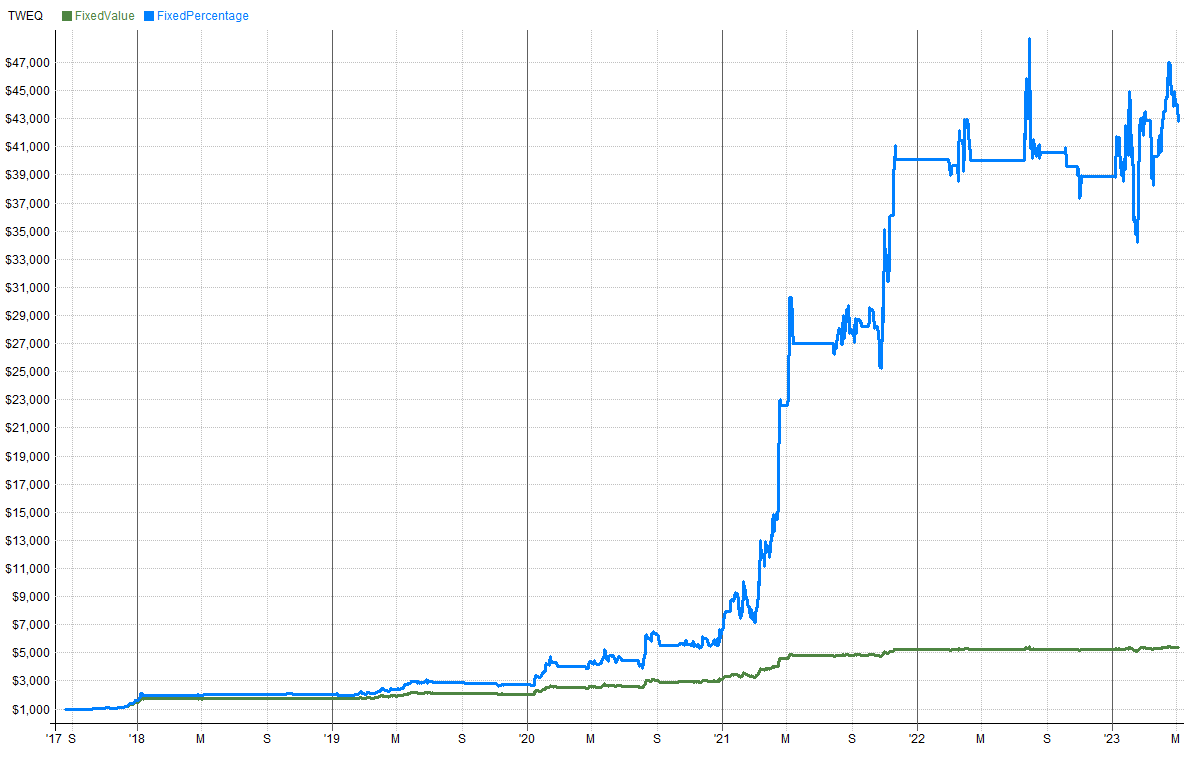

The fixed percentage is a position sizing method where you always use a fixed percentage of your account balance for your position sizing. It’s effective at lowering a trader’s risk of ruin as it adheres to the anti-martingale approach. So you get all the advantages of lowering your risk of ruin and getting compounded returns. Let’s compare the results with what we previously tested. We’ll start with a 1000 USD balance and use a maximum of 5 positions and use 20% per position, so the first trade will also be with 200 USD.

Wow! Compounding is a beast! The profit is almost 10 times the amount, showcasing the power of the compounding effect!

The biggest advantage of this approach is the fact that you set the risk you want to apply to the strategy once and keep it all the time. Why risk less with more capital or more with less? That doesn’t make sense.

Kelly Criterion

The Kelly Criterion is a position sizing method that aims to maximize the growth of capital over the long term. However, it can lead to significant drawdowns and is considered risky by many traders.

The Kelly Criterion is calculated using the following formula:

K% = W – [(1 – W) / R]

Where:

- K% is the fraction of capital to be put into a single trade.

- W is the win probability

- R is the win/loss ratio

For example, our breakout strategy has a has a win rate of 50.93% and a profit factor of 1.93, the Kelly Criterion would be calculated as follows:

K% = 0.5093 – [(1 – 0.5093) / 1.93]

This results in a K% of 25.53%. This means that, according to the Kelly Criterion, you should risk 25.53% of your trading capital on each trade.

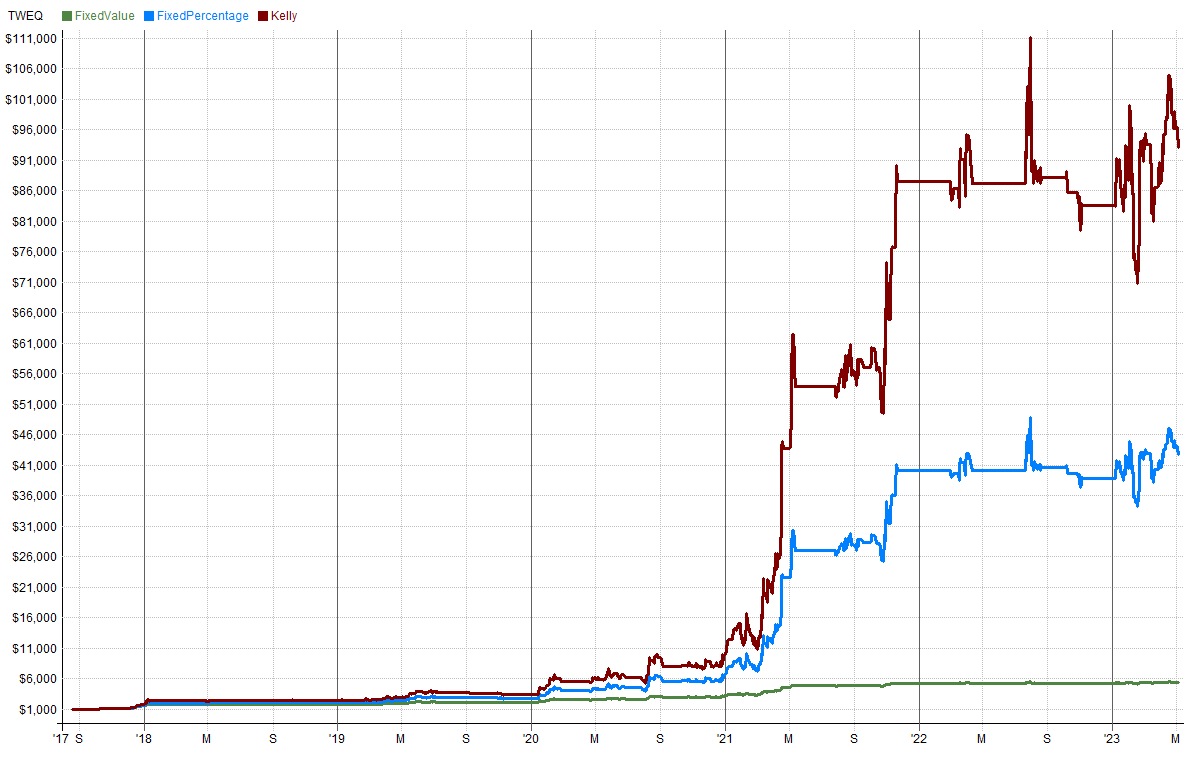

Let’s check the results!

Very impressive results, you can see that Kelly definitely aims for max capital growth..

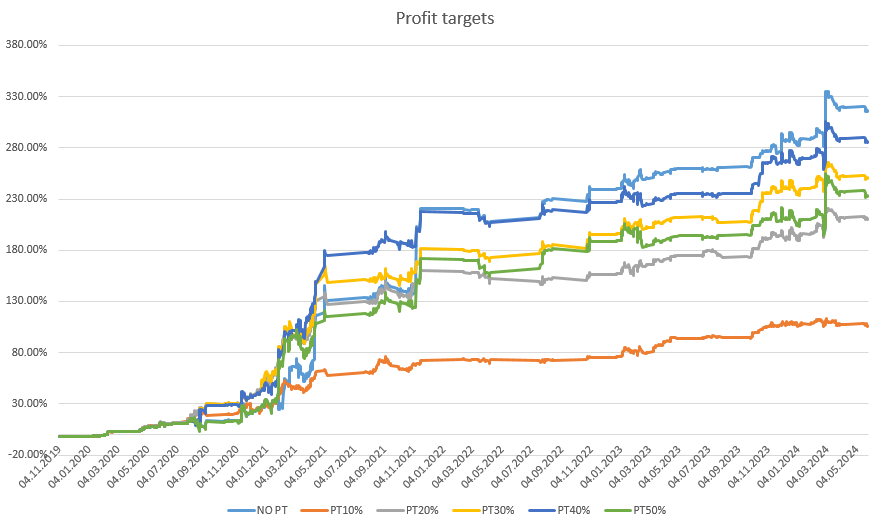

But you need to be careful with this one. As we learned in the previous blog posts about biases in trading falls Kelly Criterion definitely under curve fitting. We used historical performance to get the optimal position size.

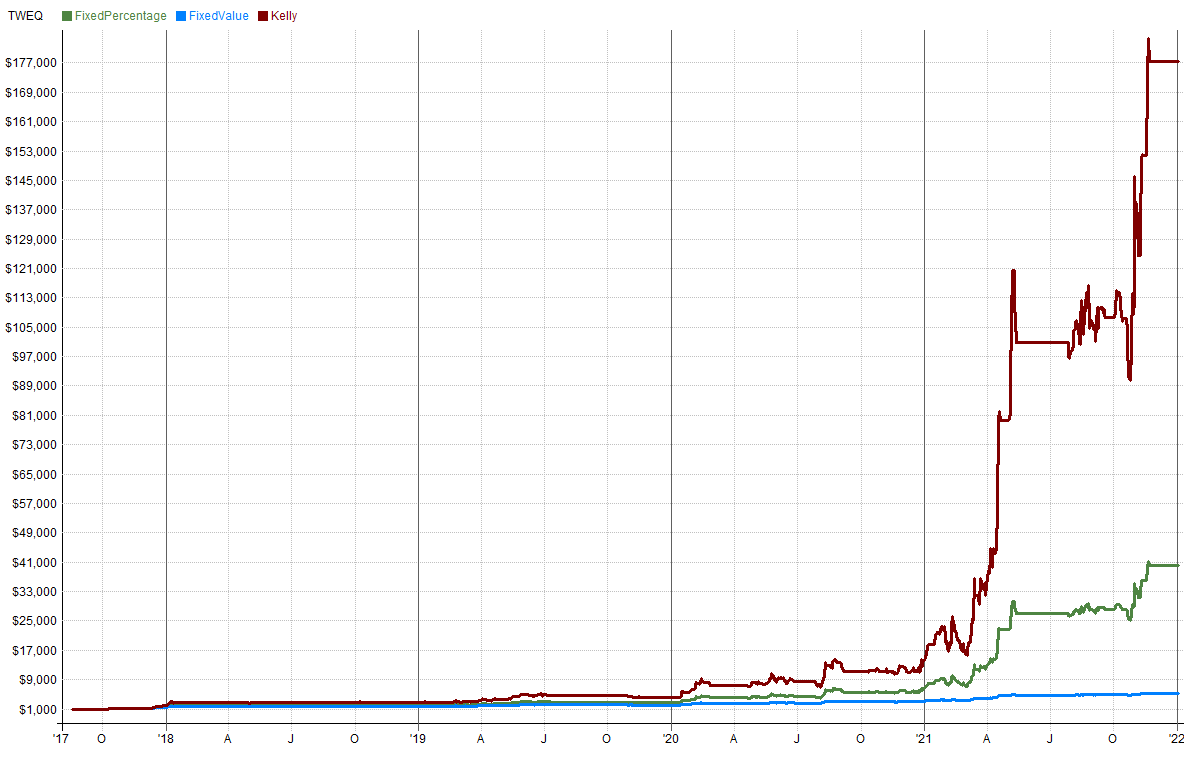

Let’s recalculate the Kelly and pretend we would start trading this strategy from the beginning of 2022, the backtest shows me a win rate of 51.83% and a profit factor of 2.19, So, according to the Kelly Criterion, you should risk approximately 29.83% of your trading capital on each trade. That’s already a big increase in the position size!

Wow, that looks impressive! Straight to the moon would the crypto boys say 🙂

Let’s see how the full historic looks like:

Just ridiculous volatility, don’t think any of us have the mental strength to trade a system like this. And if your system isn’t performing as well anymore as on your backtest, which it almost always guarantees your drawdown will just be unbearable. Therefore, the Kelly Criterion, while aiming to optimize returns, can also lead to very big losses. It is wise to use a fraction (like half, or quarter) of the suggested Kelly percentage.

Capital protection always comes first. Kelly% looks good in the backtest. But unless you have real experience with deep drawdowns in a trading account, think carefully about using this money management technique.

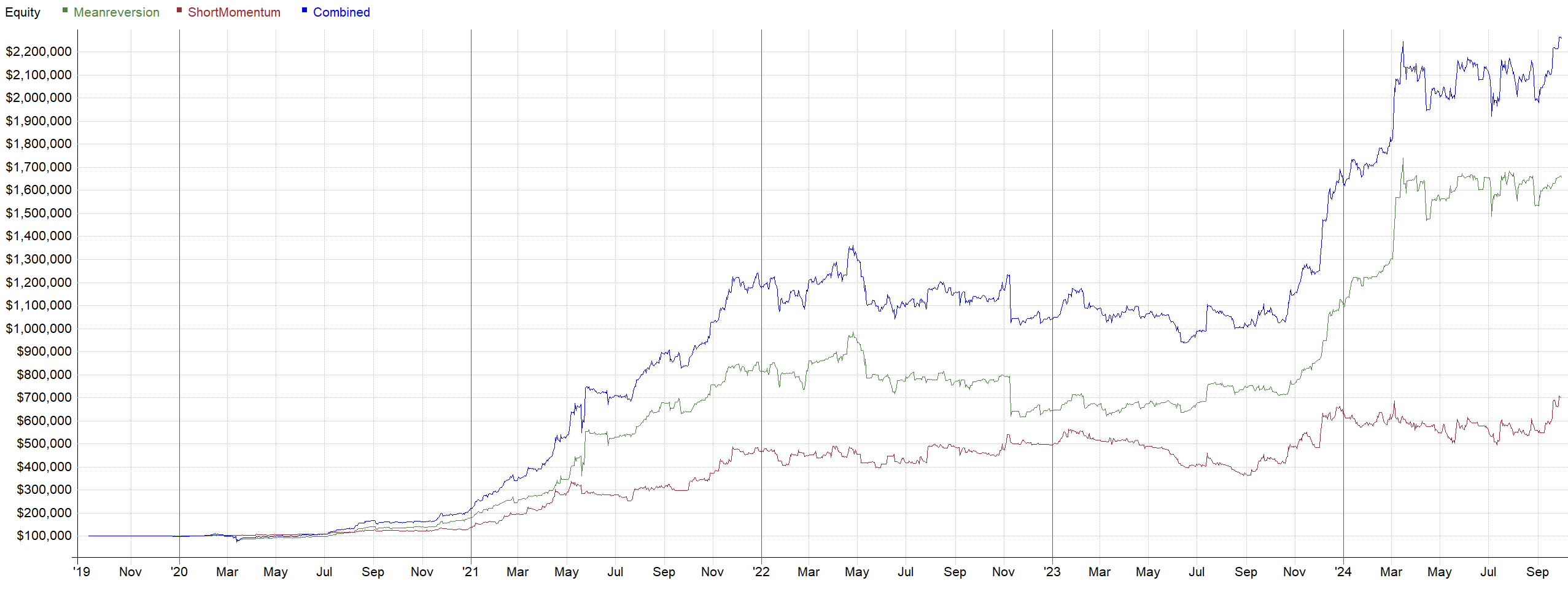

There are several other position sizing methods that share similarities with fixed dollar amount, fixed percentage, and the Kelly Criterion. These include fixed units, fixed capital, fixed ratio, percent volatility and many more. Each of these methods has its own advantages and disadvantages, and the best choice depends on the individual trader’s risk tolerance and trading strategy.

Conclusion

Position sizing is a crucial part of successful trading. If you’re new to trading, don’t aim to choose an approach that will maximize your gains. On the contrary, you should probably opt for a strategy that minimizes the volatility in your trading account. In a backtest, a 40% drawdown may not seem particularly threatening. However, in live trading, it’s a completely different story.

If you’re looking for a starting point, the fixed percentage money management approach is a safe bet. Remember, the goal is not just to generate profits, but also to manage risk and ensure the longevity of your trading career.