Before we delve into more specific topics, it’s important to grasp the basic concept of the “risk of ruin.” Algorithmic or systematic trading is a long-term game, where the law of large numbers comes into play. The key is to stay in the game, and the risk of ruin informs us about the likelihood of being unable to do so.

Larry Hite, a pioneer in systematic trading, sums it up simply: “I have two basic rules for winning in trading and life: 1. You have to place bets to have a chance of winning. 2. If you lose everything, you can’t continue playing.”

By understanding the concept of risk of ruin, traders prioritize capital preservation. If you lose all your capital, you’re out of the game, unable to seize future trading opportunities. Recognizing the potential for ruin allows you to approach trading rationally, reducing the likelihood of making impulsive and emotionally driven decisions that can further increase the risk of ruin.

Analyzing Risk of Ruin with a Simple Example

Imagine you’re the owner of a small-town casino with a budget of $1M, determined to keep your business thriving. Let’s explore two scenarios involving the game of roulette, with a focus on ensuring the casino’s financial stability.

In a game of roulette, the chance of correctly guessing the color depends on the specific version being played. In the American version of roulette, there are 38 total slots, including 18 red slots, 18 black slots, and 2 green slots (representing 0 and 00).

Therefore, the probability of guessing the correct color (red or black) is calculated as follows:

Number of favorable outcomes (red or black): 18

Total number of possible outcomes: 38

So, the probability of getting the correct color is:

18/38 ≈ 47%

As the casino owner, you have an edge over your customers. With a 53% probability of winning, theoretically, for every $100 your customers play, you should make $3. Sounds promising, right?

Now, let’s move on to analyzing the risk of ruin in two different scenarios where players pick a color.

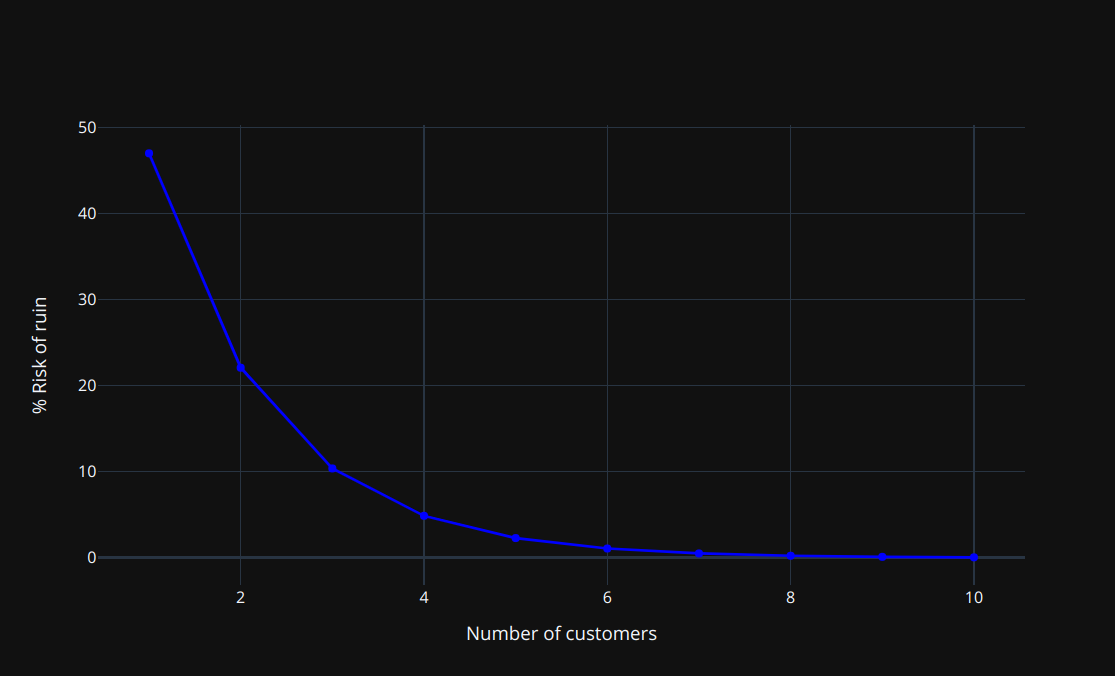

-Scenario 1: A single customer with a budget of $1M, betting all the money on a chosen color.

-Scenario 2: 10 customers with a budget of $100,000 each, playing at different tables, also betting all their money on a chosen color.

As a responsible casino owner, it’s important to assess the risks associated with different scenarios.

Should you allow scenario 1 in your casino?

In this case, the risk of ruin is quite high at 47%. This means that there is a 47% chance that you have to pay out the customer the entire one million dollars, which would ruin your casino’s budget, forcing you to file for bankruptcy. Considering this high risk, it would be wise to avoid allowing this scenario in your casino.

Instead, scenario 2 offers a more sustainable approach, safeguarding your casino’s financial well-being and minimizing the chances of significant losses. The chances of getting ruined in this case are only 0.05%.

Calculation of risk of ruin = (Probability of losing a single bet)^(Number of bets)

Calculation of risk of ruin = 0.47^10 = 0.05%

Trading consequences

Calculating the risk of ruin for roulette is simple. You know in advance the probability of winning and especially the size of the profit and loss. Trading is a bit more complex and there are several ways of doing this calculation.

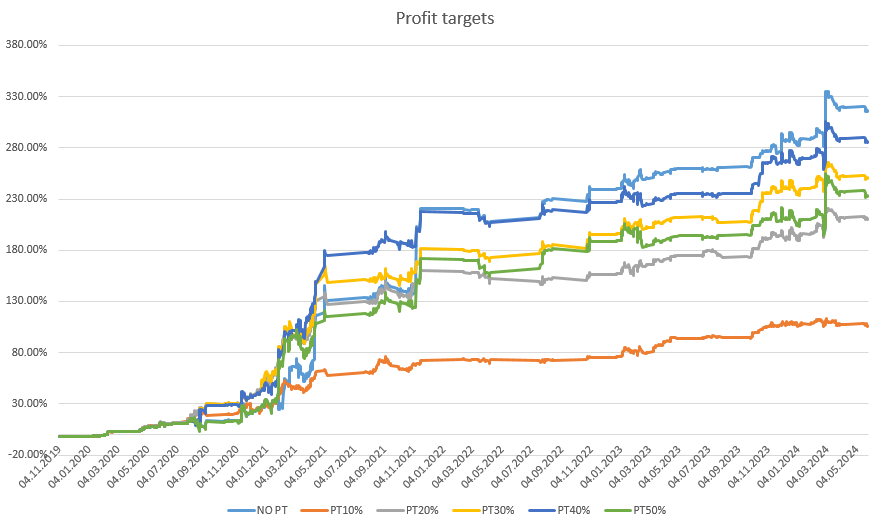

Without describing them specifically, the following rules apply for reducing the risk of ruin:

- The less capital you risk per trade, the smaller your risk of ruin.

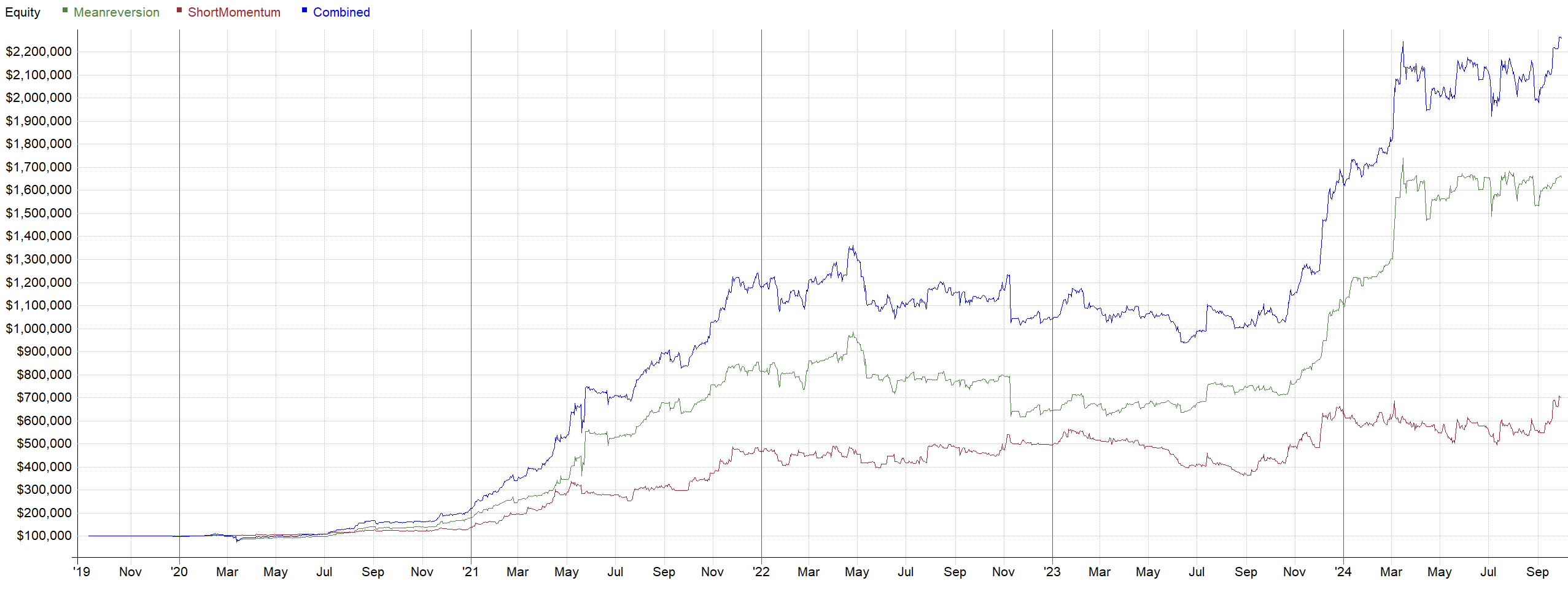

- The more coins you trade at one time within a single strategy, the lower your risk of ruin.

- The more uncorrelated strategies you have within your trading portfolio, the further you minimize your risk of ruin.

From the points above, you can see that if you want to protect your account, it is important to properly spread your portfolio across multiple uncorrelated strategies. In doing so, each strategy should have its capital split into multiple smaller positions.

In a portfolio constructed this way, the probability of risk of ruin drops to a minimum.

Conclusion

In trading, people often say that having an edge is all you need to be profitable. But as we’ve seen in this blog, that’s not the whole story. Even with an edge, there’s still a chance of ruin. That’s where risk management comes in. It’s essential for long-term trading success.

Just like a casino owner needs to consider the risk of ruin despite having an edge, traders must prioritize risk management. Without it, you could lose everything, and that’s not what we want.

In our future blog posts, we’ll explore different approaches and strategies for effective risk management in trading. We’ll show you how to protect your capital and avoid blowing up your account. Because in trading, it’s not just about having an edge—it’s about smart risk management for lasting profitability.