Breakout systems are based on the idea that if the market makes a move from a previous price level, it is likely to continue moving in the same direction. This continuation may only last for a short period of time, but it can be enough to make a profit.

In a breakout system, you always enter a trade in the direction that the market is moving at the time. The idea is that momentum tends to precede price, so if the market is moving up, it is likely to continue moving up for a while.

Another principle of price behavior in breakout systems is that the market tends to alternate between periods of equilibrium and disequilibrium. When the market is in equilibrium, supply and demand are balanced, and prices are stable.

However, when the market is in disequilibrium, supply and demand are unbalanced, and prices are volatile. Breakout systems take advantage of this volatility by entering trades when the market breaks out of a period of equilibrium.

By understanding these principles, you can create breakout systems.

How to identify potential breakout trades

Technical analysis can be used to identify support and resistance levels, as well as other indicators that may signal a breakout is imminent. However, we in systematic/algorithmic trading are reactive to price action, as opposed to the predictive styles of the popular TA gurus on YouTube or Twitter. In the end, we look for price action that breaks through channels or levels. We can use plenty of methods to find those levels, such as a Donchian channel, Bollinger bands, Keltner channel, and many more.

Even the popular ascending triangle used by TA magicians could do a good job, but it is difficult to test it in an exact systematic way. Instead we could try to code the contraction of volatility together with a breakout out of the trading range.

The volatility contraction means the market finds it equilibrium and the breakout afterwards means people don’t agree anymore with that price level.

Let’s create a ridiculously simple long breakout strategy:

We learned that the very basics of a breakout strategy are the following: it needs to break through a level of a trading range, and we only hold it for a short time. So let’s try exactly that!

Entry: The highest high of the last 30 days.

Exit: After 3 days on the close.

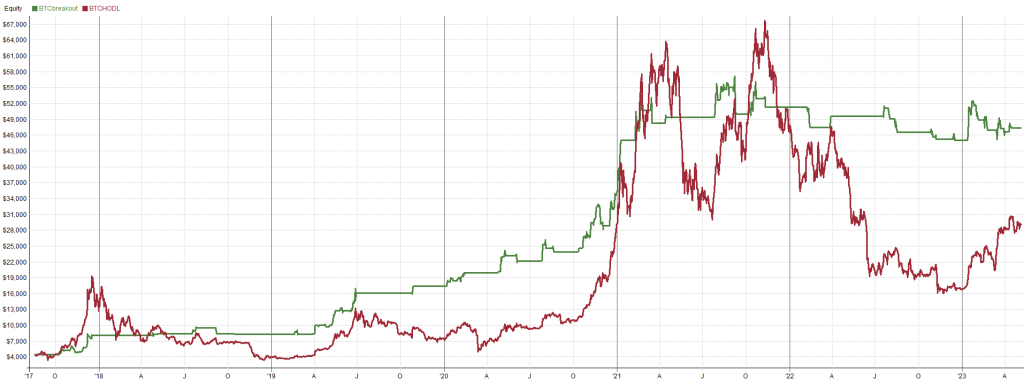

Let’s see how it performed on BTC:

Not bad! This strategy has only a 22% drawdown, compared to the 83% drawdown when HODLing, with a 60% win rate and only 17% of the time in the market.

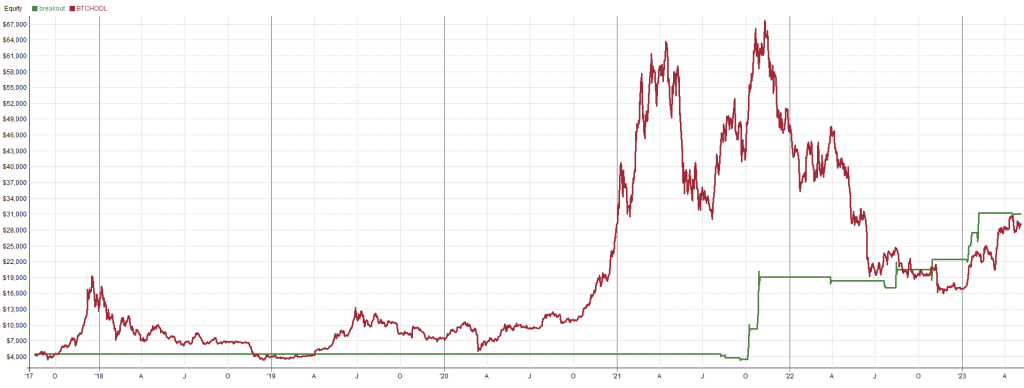

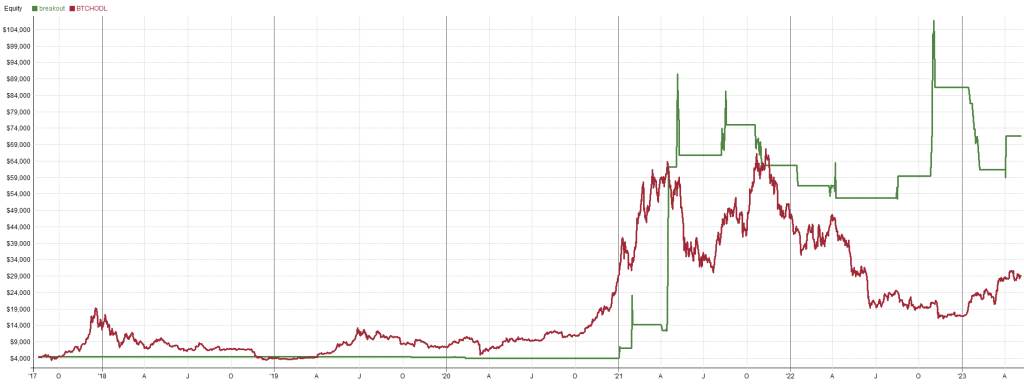

Let’s see how it does on meme coins.

Shiba was listed late on Binance, so we don’t have much data. However, it also looks promising here.

In Doge, we observe more chop, but that is to be expected with such a volatile coin.

If you want to take a look at how this strategy performs on more coins on TradingView, you can download the PineScript code here.

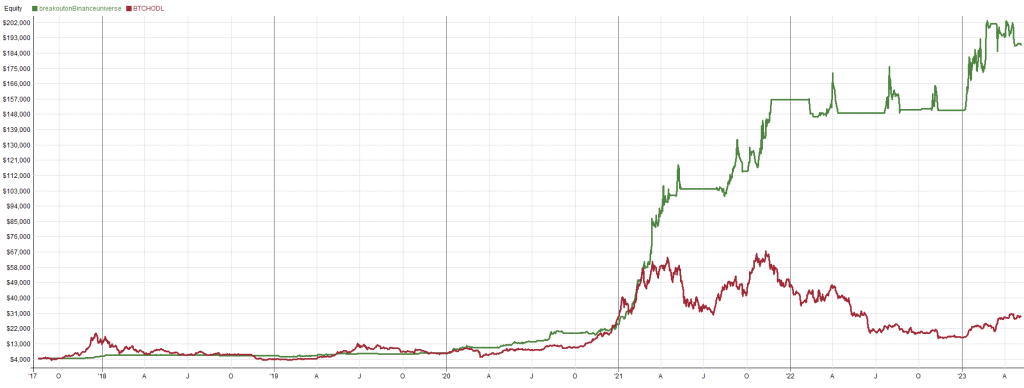

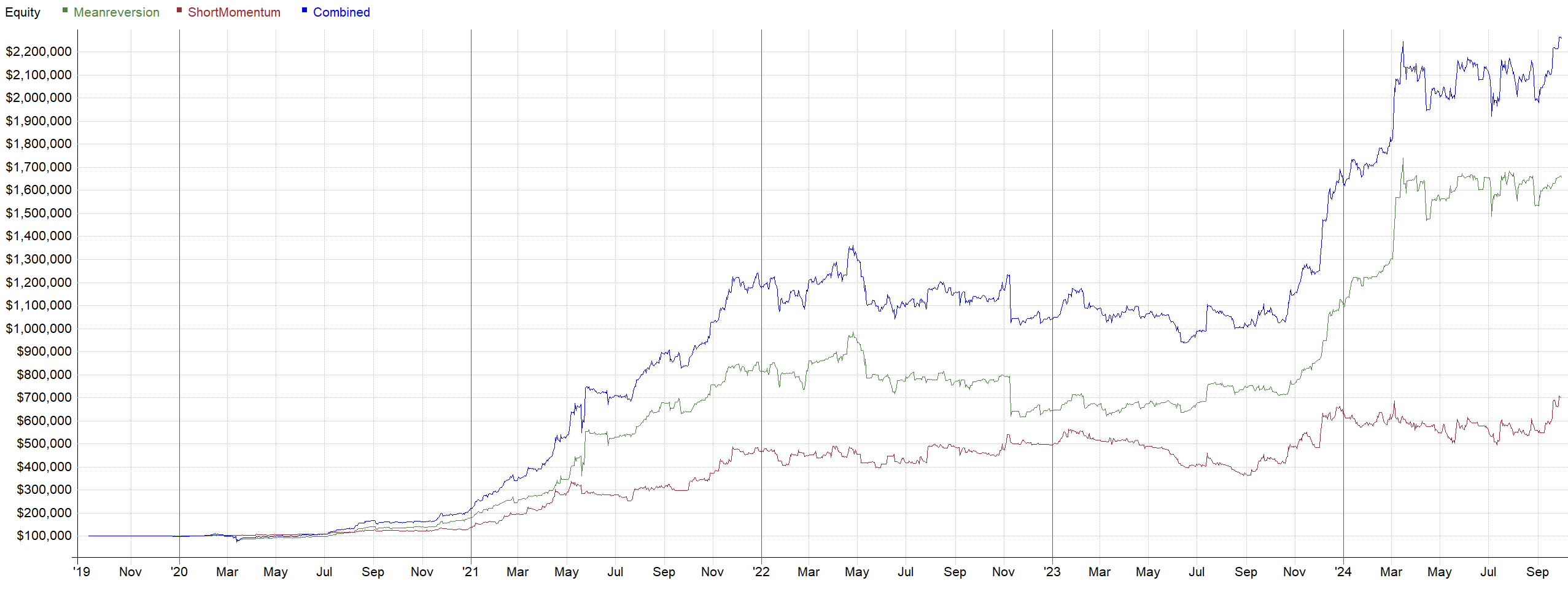

Just one last picture to demonstrate how this super simple strategy would perform when running it as a portfolio with a maximum of 10 positions on a wide universe on Binance.

Our capital is only used 18% of the time, with a drawdown of less than 20%. If you read our previous blog posts, you will know what you need to add to your portfolio to push it to the next level.

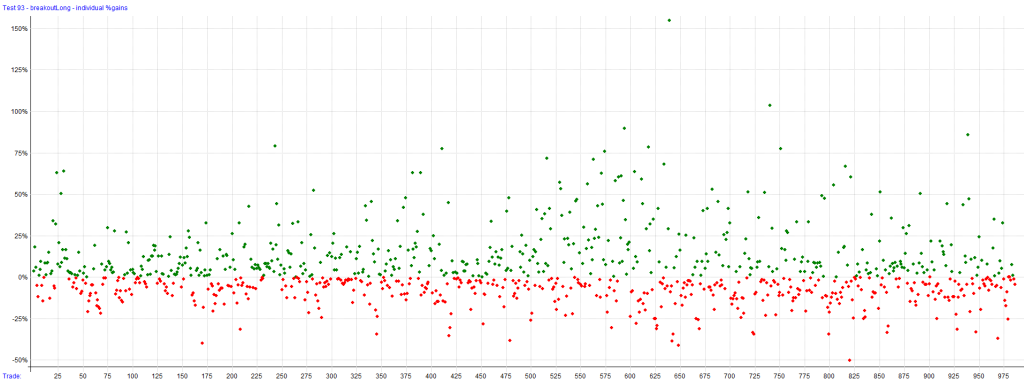

Here is the scatter plot. You can already recognize that this does not look like Trend Following or Mean Reversion. It has a moderate to high win rate with a wider range of returns on the upside and downside. You should not forget that we are buying coins that are out of equilibrium, and they tend to be very volatile.

The best breakouts will not give you retracements to enter; you are either on board or you are not. Those strong breakouts mostly turn into trends, which we can pick up and ride with our trend following systems.

The Risks of Breakout Trading

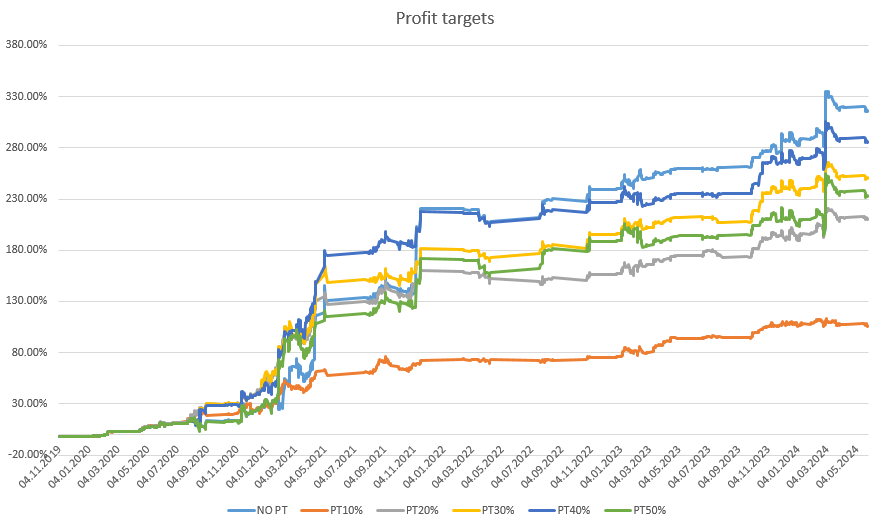

Breakout systems will perform really well during volatile bull markets, but they get whipsawed in low volatile choppy markets with many false breakouts. You will buy many times the highs or sell the lows with this kind of system.

Risk management is crucial with breakout strategies, definitely in Crypto. Everyone knows that those coins can go to the moon and back in a matter of days. Diversify and keep the position sizing reasonable, otherwise your account will get chopped to zero pretty fast.

What are the pros of Breakout strategies?

– Very profitable in volatile or bull markets.

– Very active strategy on multiple markets. (Pro when you are automated)

What are the cons of Breakout strategies?

– Struggles in choppy, less volatile markets.

– Slippage risk. Fast market conditions or thin orderbooks can cause bad fills.

– Very active strategy on multiple markets. (Con when you are not automated)

Is Breakout trading for you?

If you want to make money in crypto algorithmic trading breakout strategies should be at least a part of your portfolio.

Crypto is well-suited for them due to its volatility. Moreover, unlike trend strategies, breakout strategies have a higher probability of profitable trades. This also makes them less psychologically challenging to trade. We like to combine them in broader portfolios, for example with mean reversion strategies.

As with all the other approaches we mentioned in this series, you need to have absolute confidence in the statistics and robustness of your strategy to keep pushing the buttons day after day.

PineScript of the described breakout strategy:

If you want to test the strategy further and see how it performs in different market phases, click here.