Mean reversion is a statistical concept that states that extreme values are not sustainable and tend to revert back to the mean over time. In other words, if something is too high, it will eventually go down, and if something is too low, it will eventually go up. Similar to the behavior of a rubber band, stretch too far out and it will snap back.

Mean reversion is also called counter trend trading because you trade against the current trend, so you could say it is the opposite of trend following where we follow the trend.

How Does Mean Reversion Work?

Mean reversion strategies involve identifying assets that are trading at extreme levels, either overbought or oversold, and taking positions in the opposite direction,

Mean reversion strategies are often counterintuitive.

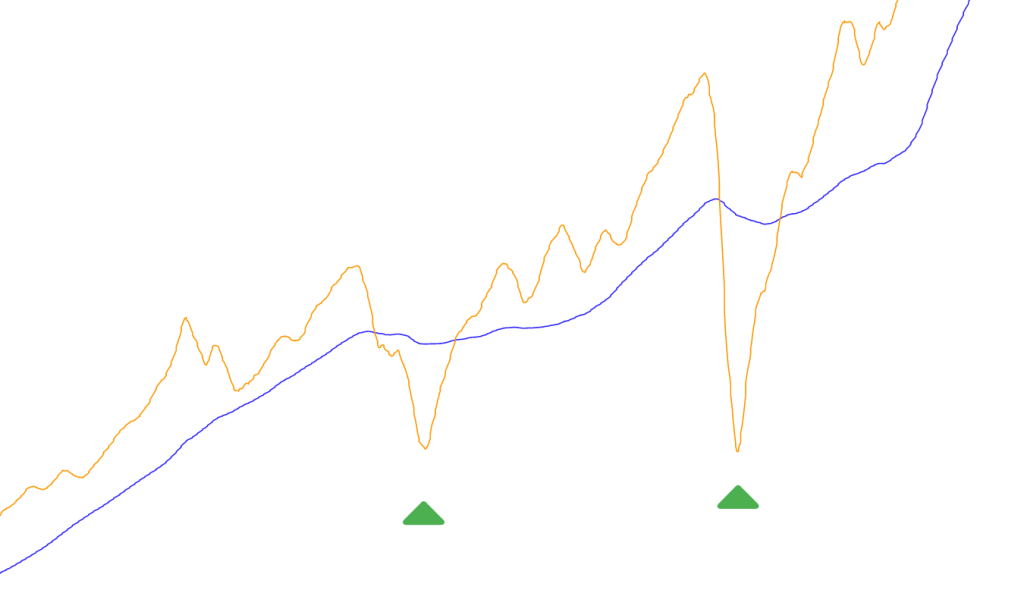

The best entries are those that are against a strong move. The longer and more intense the move, the better.

Emotions can play a big part here. Look at the huge drop after which the system entered a long position.

Could you have entered discretionary here? Imagine the strong emotions. Buying into extreme weakness may create doubts and make you question if you are making the right decision.

That’s why it is best to only trade mean reversion systematically, relying on statistics and probabilities, rather than your gut.

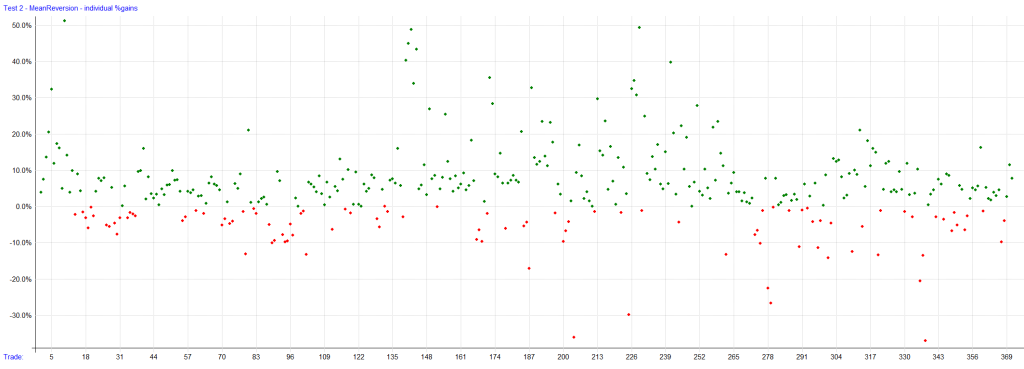

However, the reward for such entries is a relatively high probability of wins, with around 60% to 70% of all trades being successful. As shown on the scatter plot, there are significantly more green (profitable) trades.

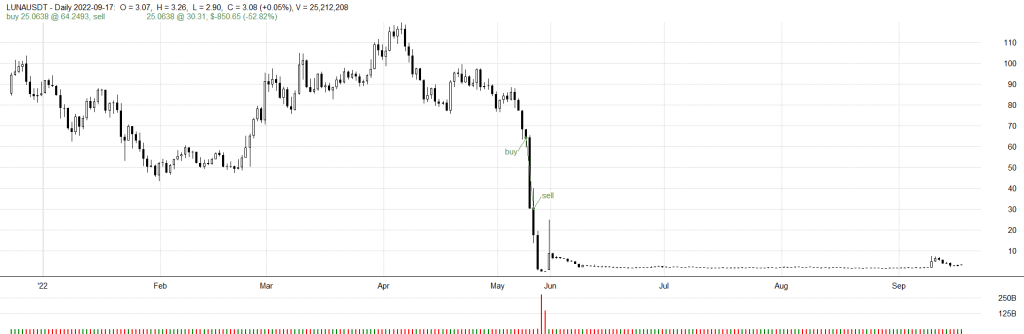

Occasionally, you may also encounter a larger losing trade, like the one on LUNA.

It resulted in a whopping 52% loss, but this loss is relatively harmless to our portfolio because other positions in our mean reversion system snapped back up.

Stop losses and mean reversion

In almost all backtests, stop-loss orders don’t work well with mean-reverting strategies. Using stop losses can harm the strategy unless you set a very wide stop loss. However, if your stop loss is very wide, then you, in reality, don’t have a stop-loss.

Shorts are an exception to this rule. You don’t want to stay in a coin that makes 5X overnight.

Factors that Affect Mean Reversion

For mean reversion to be profitable, the market needs to exhibit a tendency to revert back to the mean. In certain market conditions, mean reversion strategies may face challenges. For example, in 2022, many stocks and cryptocurrencies experienced prolonged deviations from their means, making long mean reversion strategies less profitable than usual.

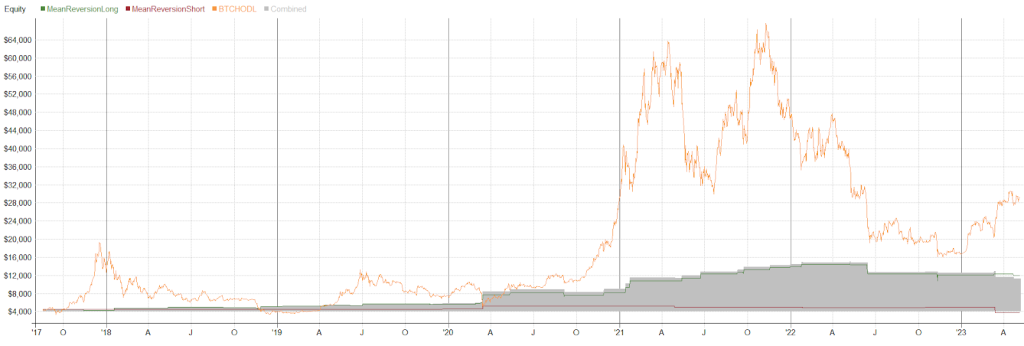

Results of systematic mean reversion trading on cryptocurrencies.

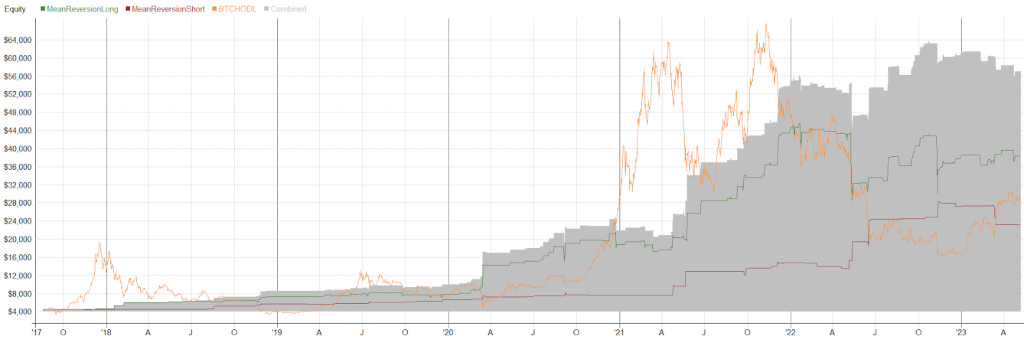

See here the results of a basic Mean Reversion long and short strategy on BTC compared to hodling BTC.

As you can see, the strategy is relatively stable but not as profitable as simply hodling BTC since late 2017. Main reason being the low number of trades. BTC alone cannot generate many trades; otherwise, we would not be trading extreme levels. The average use of the capital is below 3%.

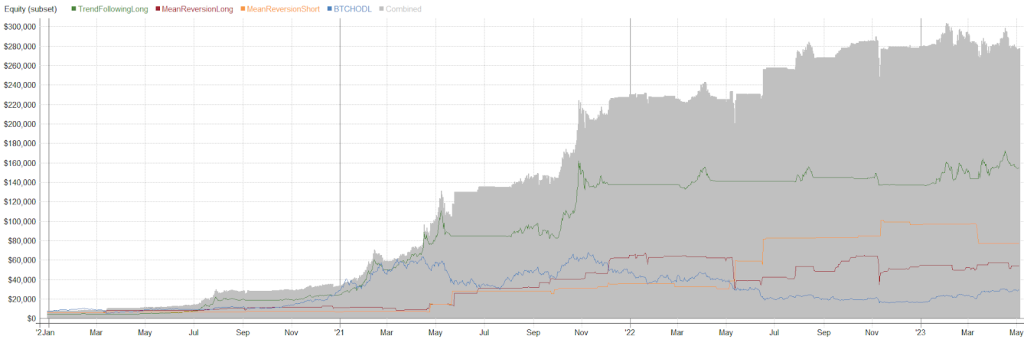

So let’s trade the liquid universe of Binance pairs to find more extreme levels.

This approach looks way better. 10 times the amount of trades, almost 10 times the amount of profit and outperforms BTC. Max drawdown was -29%, compared to the -83% drawdown on BTC our small MR portfolio did pretty good.

But still only 6.5% of the time was our capital at work. This makes it very interesting to use the same capital also for a different kind of trading approach.

How to Use Mean Reversion in Trading

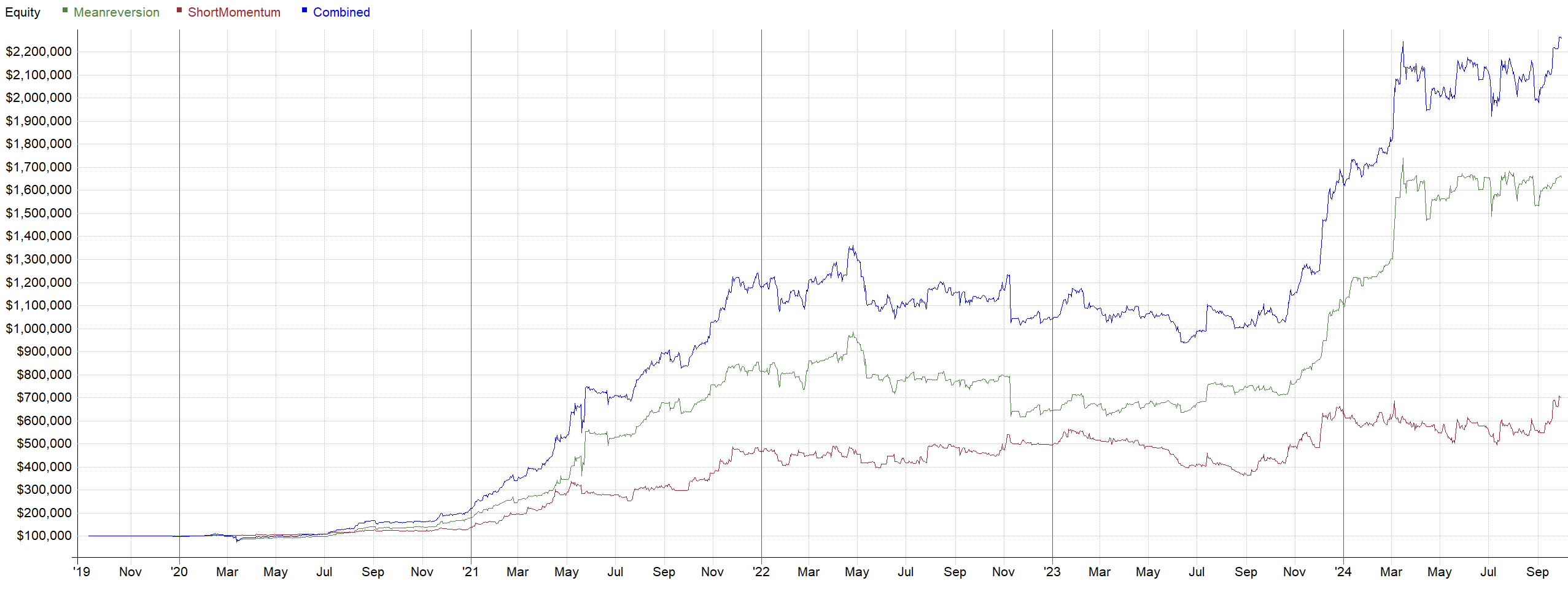

Mean reversion can be a valuable addition to a trading portfolio, especially when combined with trend following strategies. By incorporating mean reversion, the overall portfolio’s stability can be improved, as it typically exhibits a low correlation with other trading approaches. Introducing mean reversion helps smooth the volatility of the equity curve, providing a more consistent return profile as you can see on the graph below.

Profit just explodes, while volatility on the equity curve decreases. Max drawdown is now down to -20%. The trend strategy brings in the big bucks, but the mean reversion strats keep pushing the portfolio higher and higher, while reducing the volatility. Lots of capital is ready for the next big trend, thanks to our mean reversion strategies, we won’t suffer from those long dull whipsaw and drawdown periods trend trading has.

The Risks of Mean Reversion Trading

While mean reversion strategies are profitable, they are not without risks. In volatile markets, especially like the crypto market, outliers and abnormalities may not always return to normal. There is a possibility that extreme price deviations can continue to extend, leading to big losses if not managed properly. Risk management is crucial in such scenarios to mitigate potential losses.

What are the pros of Mean Reversion?

- High winning percentage

- Short holding period

- Portfolio stabilization

- Low average use of the trading capital

What are the cons of Mean Reversion?

- A lot of times, this technique is employed when the market is in a bad state. It can be hard to stick to the system and push the button to place the order.

- Prone to curve fitting (we will explain this in another blog)

- Low number of trades on a single symbol

- Needs a market that reverts back to the mean

Is Mean Reversion trading for you?

Mean reversion strategies are very important diversifiers in a broader trading portfolio.

If you use these strategies, you need to be systematic and trade real extremes where the probability of a profitable trade is quite high.

Although trend and breakout strategies make the most money in crypto, using mean reversion strategies is definitely a smart idea.