In trading, it’s not just about making good trades. It’s also about managing your money effectively. That’s because even if you have a great trading strategy, you can still lose money if you don’t manage your risk properly.

One of the most important aspects of money management is choosing the right approach. There are two main types of money management philosophies: Martingale and Anti-Martingale.

Martingale Money Management

The Martingale strategy is based on the gambler’s fallacy, which is the belief that if you keep doubling down on your bets, you’re eventually bound to win and recoup your losses. For example, if you lose a trade with a $100 position size, you would increase your position size to $200 on the next trade. If you lost that trade as well, you would increase your position size to $400 on the next trade, and so on.

The idea is that eventually, you’re going to win a trade and your losses will be recouped. However, this strategy is very risky. If you have a string of losses, you will end up blowing your entire account.

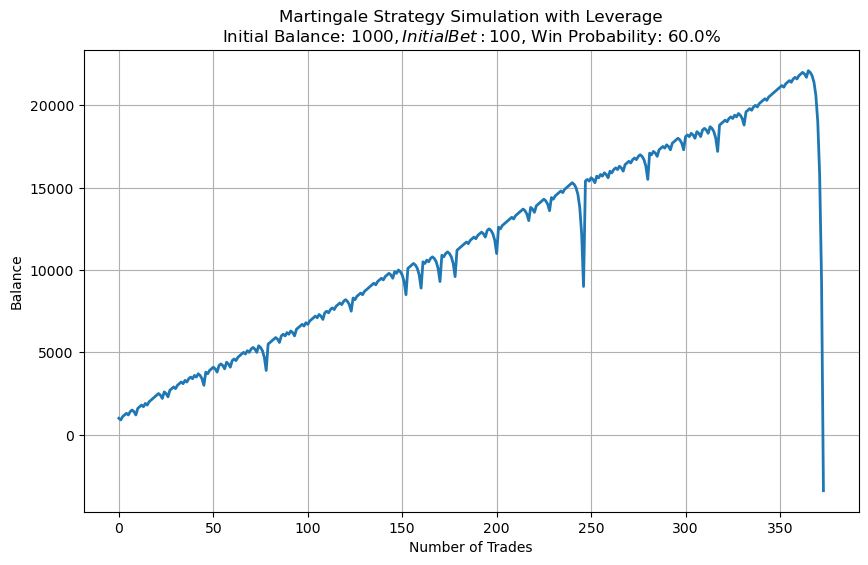

Most people get lured into using a Martingale money management because it creates such a perfect equity curve until it fails. I made an analysis on a system that has a win rate of 60%, using 100 USD as the initial position on a starting budget of 1000 USD.

Managed a really nice rally of 350+ trades until it died. Let’s do another run of the test, as we used a random distribution of wins of the strategy we will have different results every time I run it.

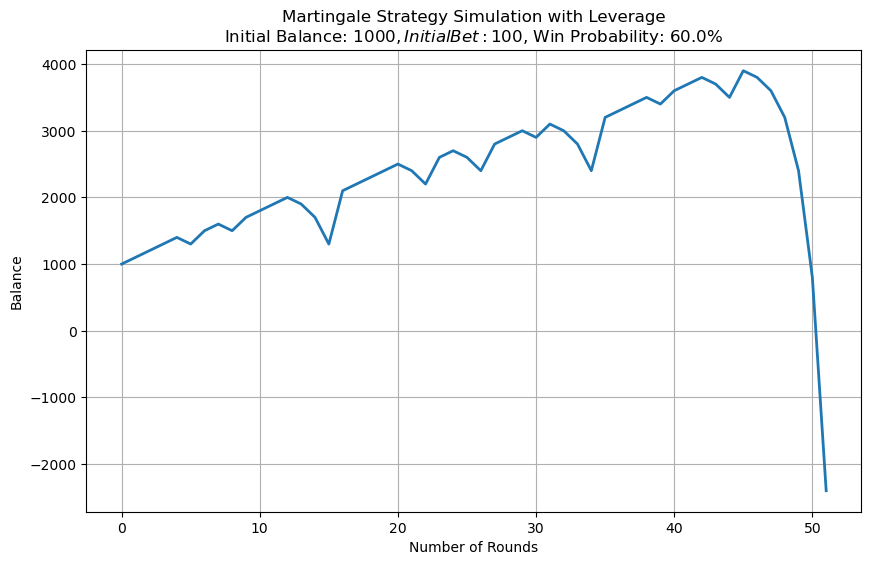

That one didn’t survive long 🙁

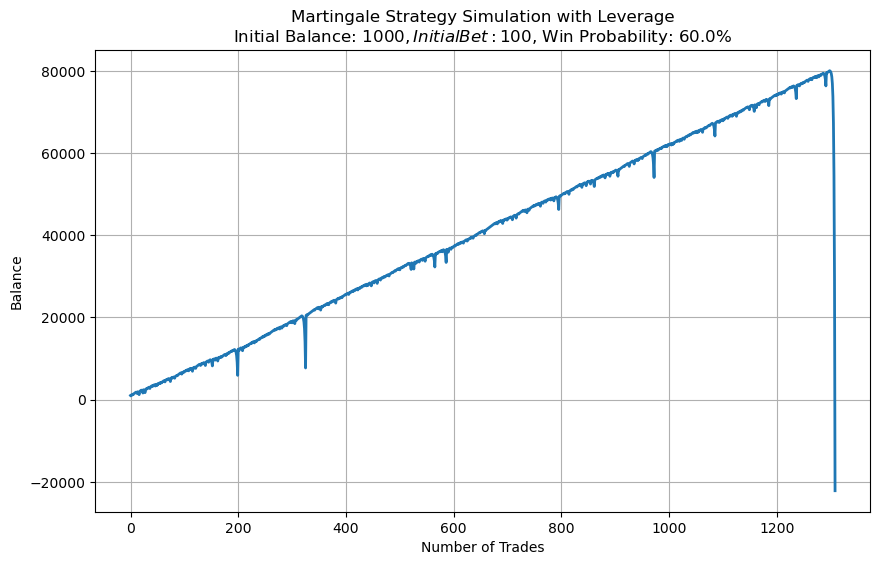

Wow! Looks like we got lucky and managed to stay in the game for almost 1300 trades.

But do we really want to rely on luck when trading? As you can see you can be as lucky as you want with a martingale strategy but you will always end up ruined!

The same can be said for highly leveraged DCA (Dollar Cost Averaging) strategies used by traders in the crypto community. Traders keep buying into a downtrend to lower their average entry price, intending to sell with a small profit afterward. However, as they continue to DCA, their position sizes become larger and larger compared to their overall account balance, which significantly increases their risk. They end up risking their entire account for only a small potential gain. Furthermore, as we have witnessed in past bear markets, many of these altcoins never bounce back and eventually die out, so does their account, mostly even faster.

Anti-Martingale Money Management

No worries! There’s a smart strategy called Anti-Martingale money management. Here’s how it works: when you lose money, it tells you to bet less next time. This way, you protect your money when things are tough. But when you’re winning, it says to bet a little more.

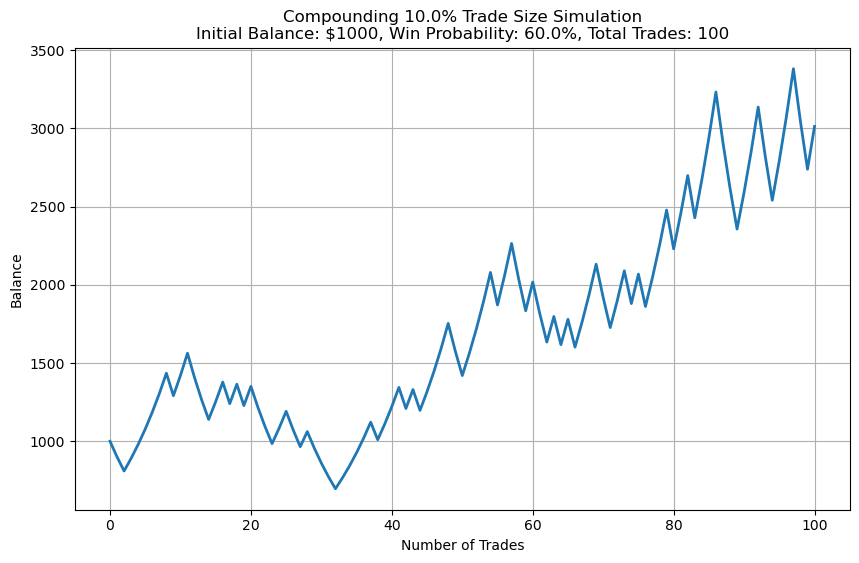

Let’s test this theory in a simple strategy:

– again 60% win rate

– 10% position sizes – if you lose, they get automatically smaller; if you win, they get bigger in USD terms – percentage remains the same, 10% of the account

– 1:1 risk reward ratio

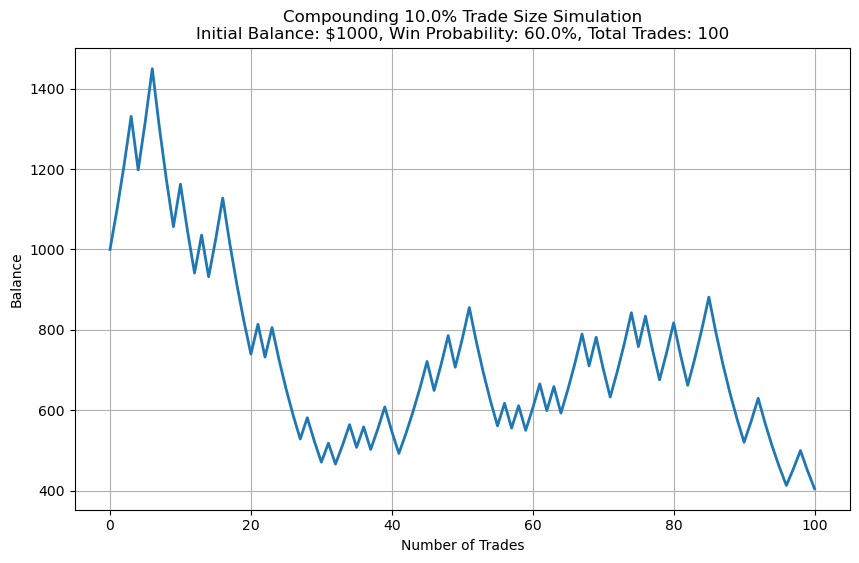

Let’s do 100 trades:

The equity curve already looks much different. We make some money, then we lose all what we made and go into a pretty deep drawdown, but in the end we end up in very good profit after 100 trades.

Probably many new traders would have given up on the strategy after 30 trades and looked for a new strategy.

Let’s do another simulation:

This one almost hurts! How is this even possible, same parameters, same probabilities?

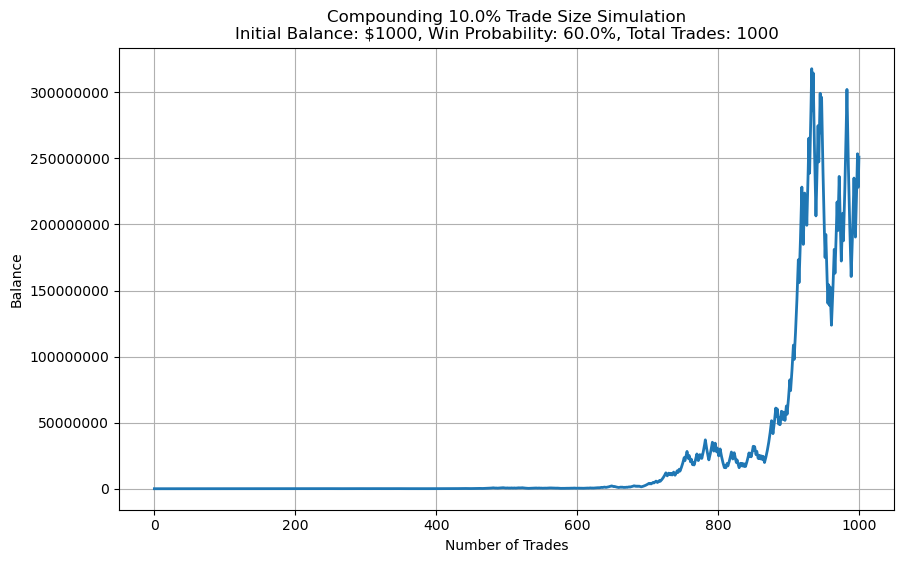

Let’s test on a bigger sample size. You should always think about the next 1000 trades

Looks like we survived some wild volatility in the portfolio, but due to the anti martingale we stayed in the game. For the sake of the experiment, we used a volatile example to demonstrate the effectiveness of the Anti-Martingale strategy.

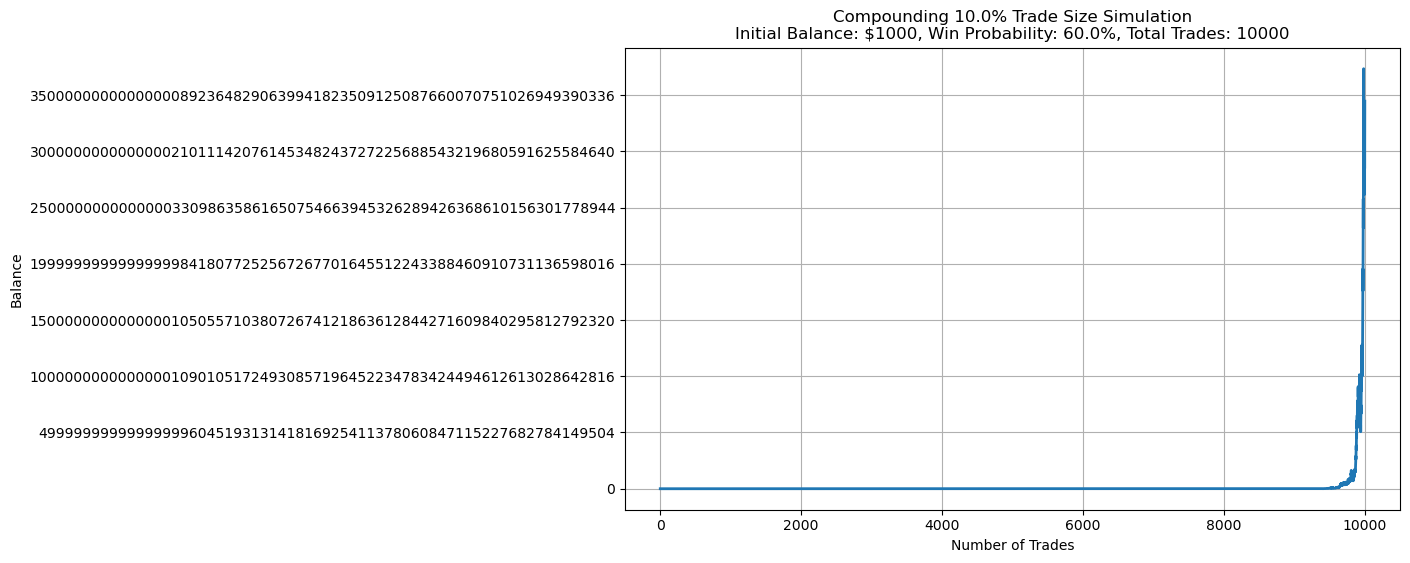

Let’s go bonkers and try 10 000 trades and see if we are still in the game!

The numbers are so big that they barely fit on the screen, but we are still in the game. No matter how many simulations I do, we stay in the game every time and witness this hockey stick.

Compounding in anti martingale money management allows traders to grow their profits exponentially over time. This is because the profits from each trade are compounded on the profits from previous trades.

On the other hand, anti-martingale protects you in drawdowns. Instead of trading larger positions and trying to recover the loss, you trade smaller positions. This effectively reduces drawdowns in dollar terms.

Conclusion

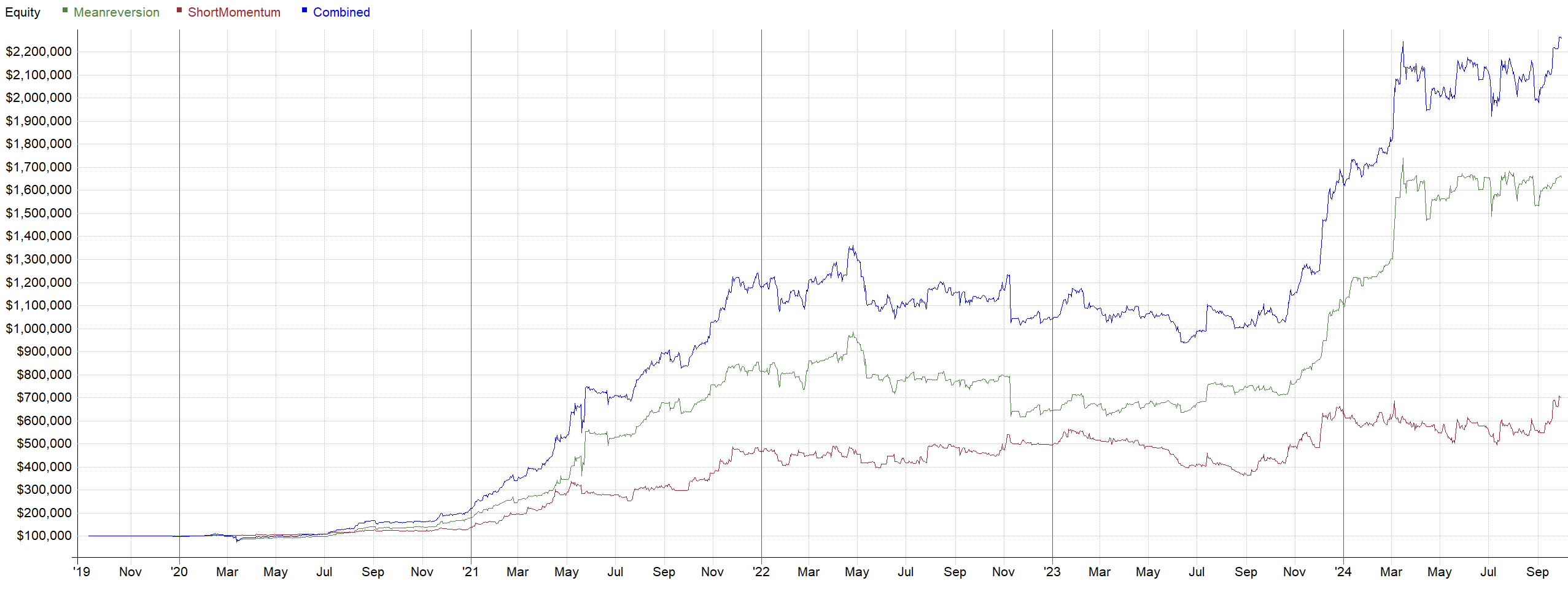

The comparison between Martingale and Anti-Martingale money management clearly shows the advantages of the latter. While Martingale may initially create the illusion of a perfect equity curve, it is highly risky and can lead to account ruin.

On the other hand, Anti-Martingale’s smart approach of adjusting bet sizes based on wins and losses allows traders to manage risk effectively, withstand market volatility, and compound profits over time.

Martingale is the fastest most guaranteed way of ruin

Doing the opposite makes you capture the upside of compounding while minimizing the risk of ruin